- United States

- /

- IT

- /

- NasdaqGS:APLD

Applied Digital (NasdaqGS:APLD) Partners With ABB To Enhance AI Data Center Efficiency

Reviewed by Simply Wall St

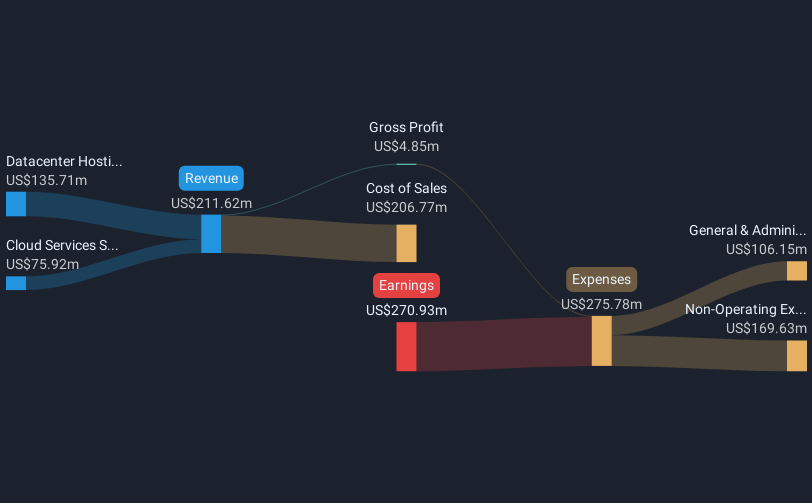

Applied Digital (NasdaqGS:APLD) recently announced a significant infrastructure partnership with ABB, aiming to enhance the energy efficiency and power density of AI data centers. This development appears to align with the company's impressive share price growth of 127% over the past month. The partnership may have contributed to this surge by boosting investor confidence in the company's forward-looking AI initiatives. Amidst this, broader market indices like the S&P 500 and Nasdaq have experienced smaller, steady gains, suggesting that Applied Digital's specific developments provided additional momentum beyond overall market trends.

Find companies with promising cash flow potential yet trading below their fair value.

The recent partnership between Applied Digital and ABB represents a significant development that could bolster the company's AI data center initiatives. This collaboration aligns with Applied Digital's efforts to improve energy efficiency and power density, key considerations for future revenue growth and net margin improvement. By addressing these areas, Applied Digital could better position itself to handle anticipated developments, such as the transition to a data center REIT structure and ongoing strategic options for its Cloud Services Business.

Over the past five years, Applied Digital's total shareholder return, encompassing both share price appreciation and dividends, has increased by a very large percentage, specifically 13289.04%. This growth contrasts starkly with the broader market, where over the past year, the company's shares have surpassed the US Market's 11.2% return and the US IT industry's 40.1% return. Such performance highlights investor optimism surrounding the company's strategic shifts and business potential.

The recently announced partnership and shift in business strategy are expected to significantly influence Applied Digital's revenue and earnings forecasts. The strategic moves are anticipated to be crucial in increasing future revenue, especially with the projected $5 billion investment influx from collaborations like Macquarie Asset Management. Despite the current challenges, analysts suggest that substantial revenue and earnings growth is expected, although profitability remains a few years away. With a current share price of US$4.48 and an analyst price target of US$9.94, the shares trade at a notable discount, indicating potential upside amidst these strategic developments. As the company continues to execute its business plans, monitoring how these predictions unfold in the coming months will be essential for stakeholders.

Gain insights into Applied Digital's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion