- United States

- /

- IT

- /

- NasdaqGS:APLD

Applied Digital (APLD): Is There Still Value After a 227% One-Year Return?

Reviewed by Simply Wall St

Applied Digital (APLD) has seen a wave of interest after a period of sharp swings in its stock price. Investors are watching closely to see what is behind this volatility and where the company could be heading next.

See our latest analysis for Applied Digital.

Despite a turbulent month, Applied Digital’s share price has soared 203% year-to-date and delivered a staggering 227% total shareholder return over the past year. This signals that momentum, while volatile, remains strong as investors weigh up its growth story and shifting risk outlook.

If these dramatic moves have you wondering what else is out there, now is a great time to broaden your investing perspective and explore fast growing stocks with high insider ownership

With such impressive gains and high volatility, the question on everyone’s mind is whether Applied Digital still offers hidden value or if the market has already factored in all the optimism about its future growth.

Most Popular Narrative: 45.9% Undervalued

Applied Digital's widely followed narrative assigns a fair value far above its last close price, highlighting an unusually optimistic outlook compared to recent trading levels.

The company's focus on locating campuses in the Dakotas enables access to abundant, low-cost, and renewable power, with optimized liquid cooling and energy efficient designs (projected PUE of 1.18 and near-zero water consumption). This significantly lowers operating costs per megawatt and provides a long-term net margin advantage in a market that increasingly prioritizes sustainability.

Want to know what fuels this sky-high valuation? This narrative banks on bold revenue, earnings, and profit margin leaps that could turn sector expectations upside down. Curious how these forecasting leaps drive the price target? Discover which forward-looking financial assumptions push this fair value to the next level.

Result: Fair Value of $43.70 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty remains if Applied Digital does not secure new hyperscale clients or if crypto market volatility affects its long-term revenue stability.

Find out about the key risks to this Applied Digital narrative.

Another View: Market-Based Valuation

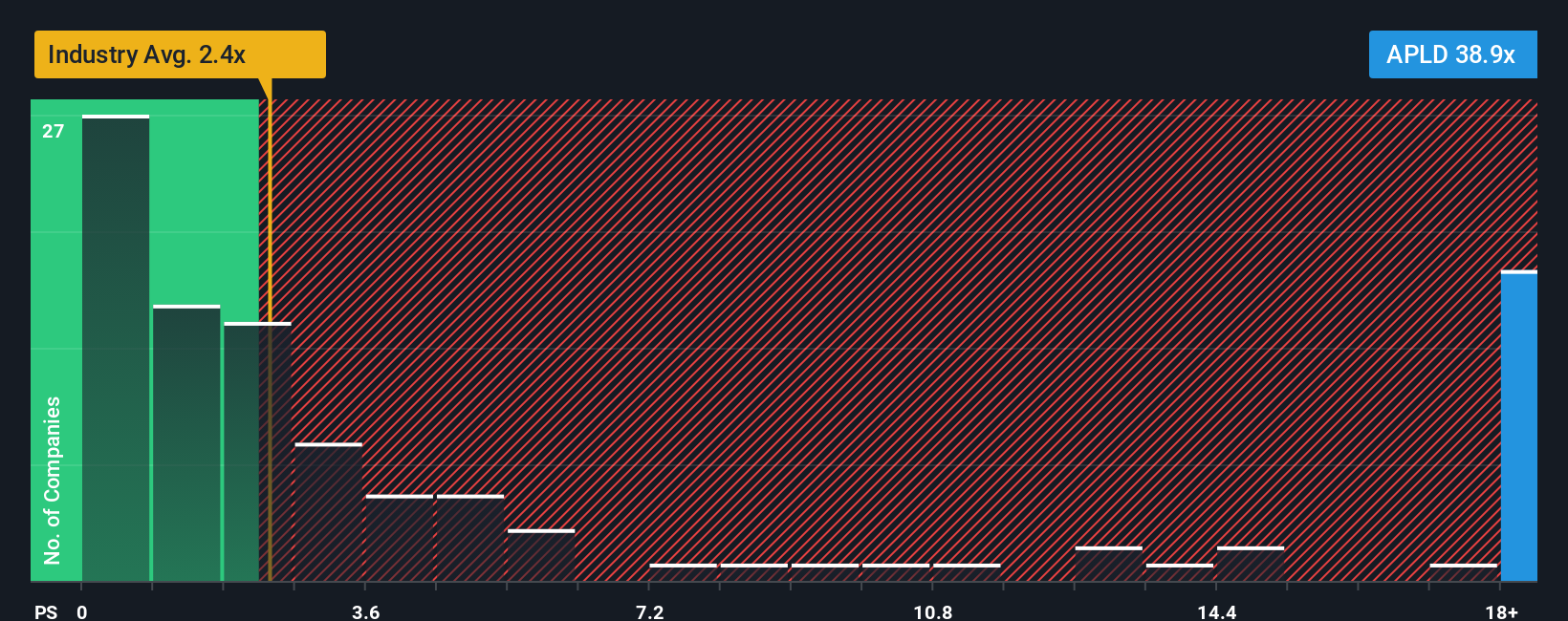

While the first approach paints Applied Digital as a bargain, a look at the price-to-sales ratio tells a different story. The company’s ratio stands at 38.9x, which is far higher than the industry average of 2.4x and even the fair ratio estimate of 19.6x. This gap could signal valuation risk if hype fades. Are investors overpaying for future potential?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Applied Digital Narrative

If you see the story differently or want to draw your own conclusions, dive into the data yourself, test your views, and craft your own perspective in just a few minutes, Do it your way

A great starting point for your Applied Digital research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Missing out on fresh opportunities could cost you. Give yourself the edge by checking proven strategies that top investors are using right now with Simply Wall Street’s powerful screeners.

- Uncover game-changing startups by scanning these 3593 penny stocks with strong financials, which have solid financials and are positioned for potential explosive growth.

- Boost your income with these 16 dividend stocks with yields > 3%, offering high yields from companies known for rewarding their shareholders generously.

- Empower your portfolio with innovation by targeting these 31 healthcare AI stocks, focused on the companies advancing healthcare with AI-driven breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:APLD

Applied Digital

Designs, develops, and operates digital infrastructure solutions to high-performance computing (HPC) and artificial intelligence industries in North America.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives