- United States

- /

- Software

- /

- NasdaqCM:AMPL

Is Amplitude’s Share Price Fair After Recent Market Volatility and New Product Launches?

Reviewed by Bailey Pemberton

- If you have ever wondered whether Amplitude is priced right for its potential, you are far from alone. This stock tends to spark big debates about what it is truly worth.

- While Amplitude’s stock is up 7.0% over the last year, it has seen some recent turbulence, with a 1.1% dip in the past week and a 2.1% slip over the last month.

- Some of these moves can be traced to industry-wide shifts and broader market volatility, as investors weigh the promise of digital analytics software against macroeconomic headwinds. Recent news stories have highlighted both increased competition and new product launches, adding to the mix of optimism and caution among Amplitude followers.

- On our valuation scorecard, Amplitude checks the box for being undervalued in 4 out of 6 areas, giving it a valuation score of 4. Next, we will dig into what that actually means and why even traditional valuation methods sometimes miss the bigger picture. Be sure to stick around until the end for a deeper perspective.

Find out why Amplitude's 7.0% return over the last year is lagging behind its peers.

Approach 1: Amplitude Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow, or DCF, model estimates a company’s intrinsic value by projecting its future free cash flows and then discounting them back to today’s value. This approach helps investors gauge what a stock could be worth based on its cash generation potential over time rather than its current profits or asset values alone.

For Amplitude, the latest reported Free Cash Flow stands at $15.8 million. Analysts see this growing to $20.2 million in 2026 and $22.7 million in 2027. Notably, DCF models also extrapolate beyond analyst estimates using assumptions about growth, in this case projecting Amplitude’s Free Cash Flow all the way out to $199 million by 2035. All projections and currency figures are in US dollars.

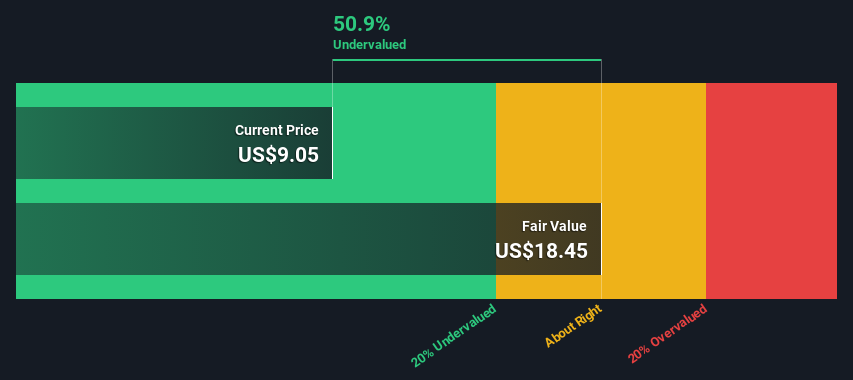

Bringing these numbers back to today’s terms, the DCF model calculates an intrinsic value of $18.56 per share. Given the current share price, this represents a 46.5% discount, which may indicate that Amplitude is undervalued based on the cash flow outlook.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Amplitude is undervalued by 46.5%. Track this in your watchlist or portfolio, or discover 843 more undervalued stocks based on cash flows.

Approach 2: Amplitude Price vs Sales

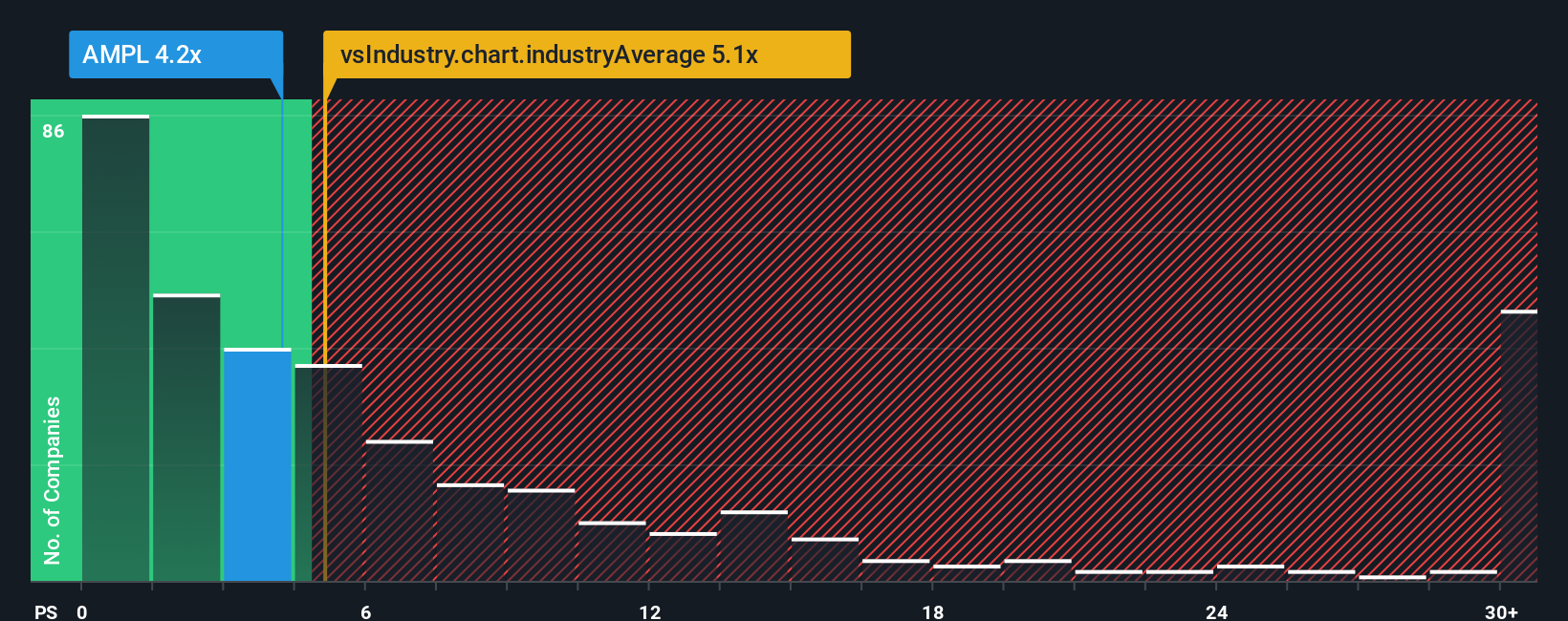

The Price-to-Sales (P/S) ratio is a well-regarded valuation metric, especially for software businesses like Amplitude that are still scaling up but may not be consistently profitable. In cases where companies are investing heavily for growth and reinvesting most earnings, the P/S ratio gives a clearer sense of how investors value each dollar of revenue generated, rather than focusing solely on profits.

What investors are willing to pay for every $1 of sales often depends on how quickly a company is growing as well as the risks attached to that growth. A higher growth rate or a differentiated product can justify a higher P/S multiple, while more competition and volatility may call for a discount. The “right” P/S ratio, therefore, is not just about comparisons but also about underlying business quality and future potential.

Currently, Amplitude trades at a P/S ratio of 4.16x. This is slightly above the average of similar peers at 3.92x, but below the broader software industry average of 5.25x. Simply Wall St’s proprietary Fair Ratio for Amplitude comes in at 4.10x, which factors in its individual growth potential, profitability outlook, market cap, and industry and risk considerations. This Fair Ratio is designed to be more nuanced than a simple peer or industry average, providing a tailored benchmark for whether the stock looks fairly valued based on its unique characteristics.

With Amplitude’s actual P/S ratio just a hair above its Fair Ratio by 0.06, the stock appears to trade right in line with what would be considered “fair value” given its profile and prospects.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Amplitude Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personalized “story behind the numbers.” It connects your view of Amplitude’s business drivers, growth potential, and risks directly to the numbers you expect for future revenue, earnings, and fair value.

Instead of relying solely on fixed ratios or generic analyst targets, Narratives let you map out how major trends, product launches, or risks could alter Amplitude’s future, incorporating your expectations into a dynamic financial forecast. This approach bridges the gap between what is happening with the business and what it could mean for the stock price, giving you a more meaningful perspective than traditional spreadsheets or ratios alone.

Best of all, Narratives are easy to create and explore within the Simply Wall St Community page. It is a tool millions of investors already use, letting you mix your own assumptions with expert inputs and see, at a glance, whether the current price is above or below your estimated fair value. If market news, earnings, or new product launches change the story, Narratives update automatically so your view stays current.

For instance, using the latest Community Narratives: one investor expects aggressive enterprise adoption and AI-driven upsell to fuel a fair value north of $18, while another, more cautious Narrative factors in competition and margins, landing closer to $13. This empowers every investor to decide for themselves whether Amplitude is a buy or a wait-and-see.

Do you think there's more to the story for Amplitude? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:AMPL

Amplitude

Provides a digital analytics platform that analyzes customer behavior in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives