- United States

- /

- Software

- /

- NasdaqGS:ALTR

Altair Engineering Inc. (NASDAQ:ALTR) Just Reported And Analysts Have Been Lifting Their Price Targets

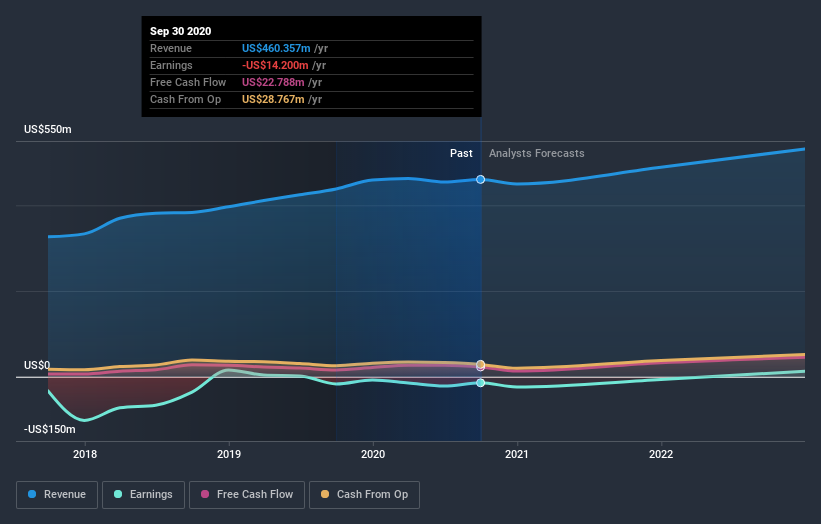

Altair Engineering Inc. (NASDAQ:ALTR) just released its latest third-quarter results and things are looking bullish. Revenues and losses per share were both better than expected, with revenues of US$106m leading estimates by 7.7%. Statutory losses were smaller than the analystsexpected, coming in at US$0.12 per share. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. We've gathered the most recent statutory forecasts to see whether the analysts have changed their earnings models, following these results.

Check out our latest analysis for Altair Engineering

Taking into account the latest results, the consensus forecast from Altair Engineering's eight analysts is for revenues of US$488.5m in 2021, which would reflect a modest 6.1% improvement in sales compared to the last 12 months. The loss per share is expected to greatly reduce in the near future, narrowing 35% to US$0.12. Yet prior to the latest earnings, the analysts had been forecasting revenues of US$490.1m and losses of US$0.16 per share in 2021. Although the revenue estimates have not really changed Altair Engineering'sfuture looks a little different to the past, with a the loss per share forecasts in particular.

These new estimates led to the consensus price target rising 8.5% to US$49.00, with lower forecast losses suggesting things could be looking up for Altair Engineering. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. There are some variant perceptions on Altair Engineering, with the most bullish analyst valuing it at US$53.00 and the most bearish at US$37.00 per share. There are definitely some different views on the stock, but the range of estimates is not wide enough as to imply that the situation is unforecastable, in our view.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Altair Engineering's past performance and to peers in the same industry. It's pretty clear that there is an expectation that Altair Engineering's revenue growth will slow down substantially, with revenues next year expected to grow 6.1%, compared to a historical growth rate of 11% over the past five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 13% per year. Factoring in the forecast slowdown in growth, it seems obvious that Altair Engineering is also expected to grow slower than other industry participants.

The Bottom Line

The most obvious conclusion is that the analysts made no changes to their forecasts for a loss next year. On the plus side, there were no major changes to revenue estimates; although forecasts imply revenues will perform worse than the wider industry. We note an upgrade to the price target, suggesting that the analysts believes the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have forecasts for Altair Engineering going out to 2022, and you can see them free on our platform here.

However, before you get too enthused, we've discovered 2 warning signs for Altair Engineering that you should be aware of.

If you’re looking to trade Altair Engineering, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGS:ALTR

Altair Engineering

Provides software and cloud solutions in the areas of simulation, high-performance computing, data analytics, and artificial intelligence in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026