- United States

- /

- Software

- /

- NasdaqGM:AISP

Market Might Still Lack Some Conviction On Airship AI Holdings, Inc. (NASDAQ:AISP) Even After 31% Share Price Boost

Airship AI Holdings, Inc. (NASDAQ:AISP) shareholders are no doubt pleased to see that the share price has bounced 31% in the last month, although it is still struggling to make up recently lost ground. But the last month did very little to improve the 73% share price decline over the last year.

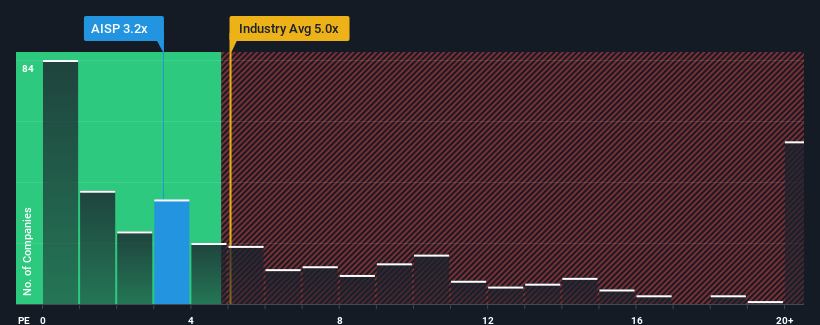

In spite of the firm bounce in price, Airship AI Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 3.2x, considering almost half of all companies in the Software industry in the United States have P/S ratios greater than 5x and even P/S higher than 12x aren't out of the ordinary. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Airship AI Holdings

How Airship AI Holdings Has Been Performing

Airship AI Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Airship AI Holdings.How Is Airship AI Holdings' Revenue Growth Trending?

In order to justify its P/S ratio, Airship AI Holdings would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered an exceptional 148% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 84% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 32% during the coming year according to the one analyst following the company. Meanwhile, the rest of the industry is forecast to only expand by 25%, which is noticeably less attractive.

With this in consideration, we find it intriguing that Airship AI Holdings' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Key Takeaway

Airship AI Holdings' stock price has surged recently, but its but its P/S still remains modest. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

A look at Airship AI Holdings' revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. It appears the market could be anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Before you take the next step, you should know about the 5 warning signs for Airship AI Holdings (3 are potentially serious!) that we have uncovered.

If you're unsure about the strength of Airship AI Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AISP

Airship AI Holdings

Provides artificial intelligence (AI)-driven data management surveillance platforms in the United States.

Moderate risk with worrying balance sheet.

Market Insights

Community Narratives