- United States

- /

- Software

- /

- NasdaqGM:AISP

Airship AI Holdings, Inc. (NASDAQ:AISP) Stocks Shoot Up 33% But Its P/S Still Looks Reasonable

Despite an already strong run, Airship AI Holdings, Inc. (NASDAQ:AISP) shares have been powering on, with a gain of 33% in the last thirty days. The annual gain comes to 280% following the latest surge, making investors sit up and take notice.

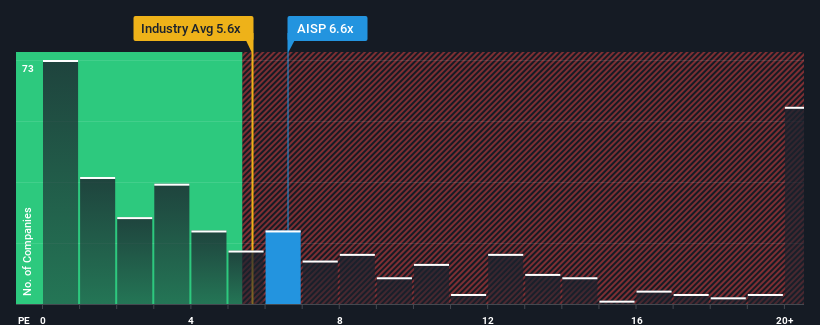

In spite of the firm bounce in price, it's still not a stretch to say that Airship AI Holdings' price-to-sales (or "P/S") ratio of 6.6x right now seems quite "middle-of-the-road" compared to the Software industry in the United States, where the median P/S ratio is around 5.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Airship AI Holdings

How Airship AI Holdings Has Been Performing

Airship AI Holdings certainly has been doing a good job lately as it's been growing revenue more than most other companies. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on Airship AI Holdings will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Airship AI Holdings would need to produce growth that's similar to the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 148%. The strong recent performance means it was also able to grow revenue by 84% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 24% during the coming year according to the two analysts following the company. That's shaping up to be similar to the 25% growth forecast for the broader industry.

With this in mind, it makes sense that Airship AI Holdings' P/S is closely matching its industry peers. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On Airship AI Holdings' P/S

Airship AI Holdings appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

A Airship AI Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Software industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

There are also other vital risk factors to consider and we've discovered 6 warning signs for Airship AI Holdings (4 make us uncomfortable!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:AISP

Airship AI Holdings

Provides artificial intelligence (AI)-driven data management surveillance platforms in the United States.

Moderate risk with worrying balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success