- United States

- /

- Software

- /

- NasdaqGS:AGYS

Why Investors Shouldn't Be Surprised By Agilysys, Inc.'s (NASDAQ:AGYS) P/S

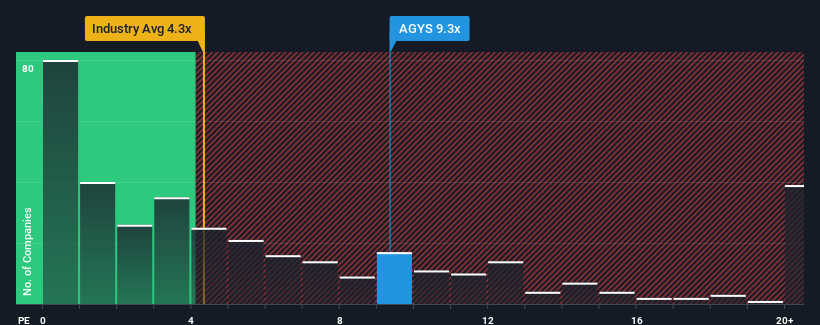

With a price-to-sales (or "P/S") ratio of 9.3x Agilysys, Inc. (NASDAQ:AGYS) may be sending very bearish signals at the moment, given that almost half of all the Software companies in the United States have P/S ratios under 4.3x and even P/S lower than 1.6x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Agilysys

How Has Agilysys Performed Recently?

Agilysys certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Agilysys.How Is Agilysys' Revenue Growth Trending?

In order to justify its P/S ratio, Agilysys would need to produce outstanding growth that's well in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. The strong recent performance means it was also able to grow revenue by 62% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 22% per year during the coming three years according to the five analysts following the company. That's shaping up to be materially higher than the 15% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why Agilysys' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Agilysys' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

Plus, you should also learn about these 3 warning signs we've spotted with Agilysys (including 2 which are potentially serious).

If these risks are making you reconsider your opinion on Agilysys, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:AGYS

Agilysys

Operates as a developer and marketer of software-enabled solutions and services to the hospitality industry in North America, Europe, the Asia-Pacific, and India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives