- United States

- /

- Software

- /

- NasdaqGS:AGYS

Does Agilysys Justify Its Premium Valuation After a 218% Five Year Surge?

- Wondering if Agilysys at around $126 a share is a hidden opportunity or just fully priced in already? You are not alone, as this stock has been quietly attracting valuation minded investors.

- Over the very short term it has been a bit choppy, up 2.5% in the last week but roughly flat over 30 days, while still sitting on a 106.9% gain over 3 years and 217.7% over 5 years, even though it is down 2.8% year to date and 5.7% over the last year.

- Recent attention has centered on Agilysys as a niche software provider in hospitality and gaming technology, as investors debate how durable its growth runway is. Coverage has highlighted expanding demand for cloud based property management and point of sale platforms across hotels, casinos and resorts, reinforcing the idea that this is a quality growth story rather than a short term trading play.

- Despite that backdrop, our current valuation framework gives Agilysys a value score of 0/6, meaning it does not screen as undervalued on any of our six checks. Next we will unpack what each valuation lens is telling us and, at the end of the article, explore a more holistic way to judge whether the stock deserves its current price tag.

Agilysys scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Agilysys Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it could generate in the future and then discounting those cash flows back to the present. For Agilysys, this means looking at how much cash the company can return to shareholders over time in $.

Agilysys currently generates around $51.2 million in free cash flow, and analyst forecasts, combined with Simply Wall St extrapolations, suggest this could rise to about $142.7 million in 10 years. Those projections step up through the late 2020s, with forecast free cash flow of roughly $75.8 million by FY 2027 as the business scales.

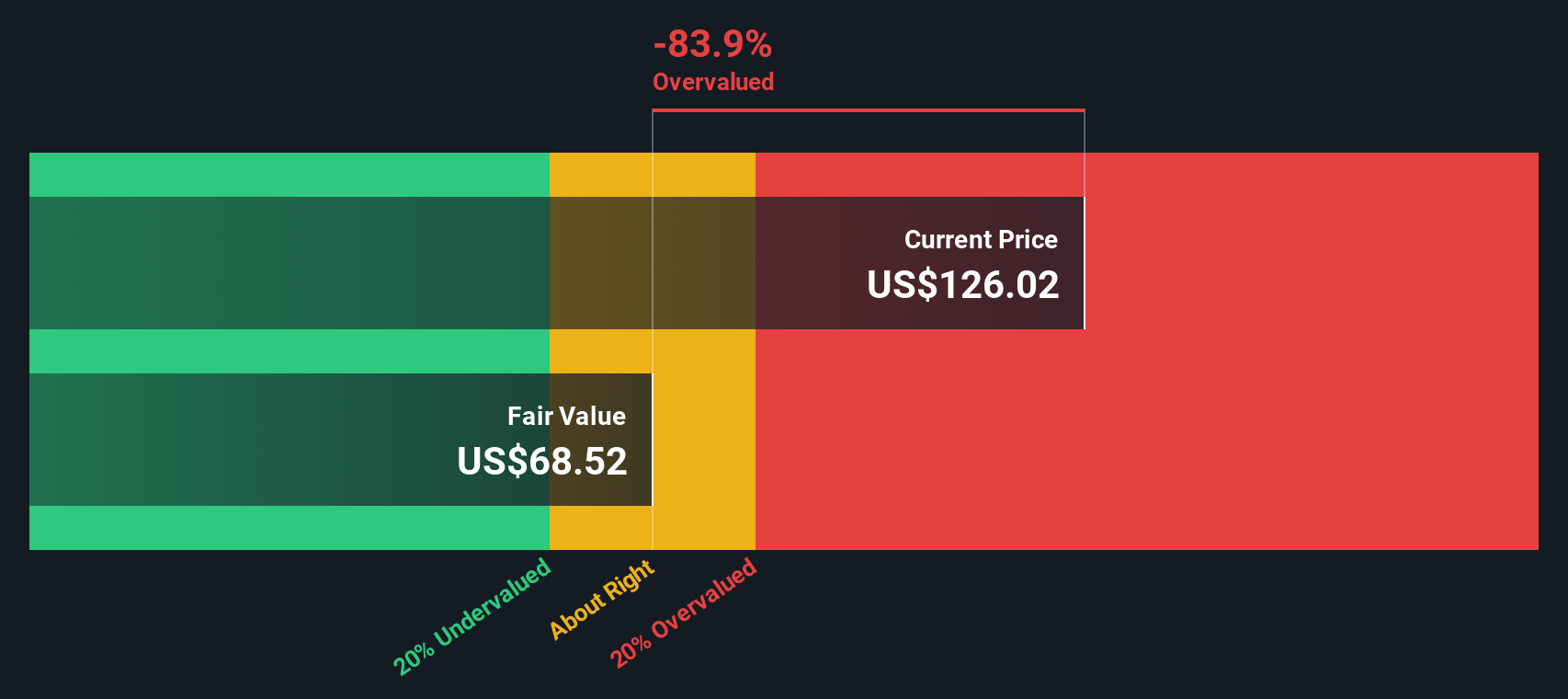

When all those future cash flows are discounted using a 2 Stage Free Cash Flow to Equity model, the resulting intrinsic value is about $68.55 per share. Against a market price near $126, the model implies Agilysys is roughly 83.8% overvalued on a pure cash flow basis, suggesting expectations baked into the stock are very demanding.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Agilysys may be overvalued by 83.8%. Discover 906 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Agilysys Price vs Earnings

For profitable software businesses like Agilysys, the price to earnings, or PE, ratio is a useful shorthand for how much investors are willing to pay for each dollar of current earnings. Higher growth and lower perceived risk usually justify a higher PE, while slower or more uncertain growth should command a lower multiple.

Agilysys currently trades on a PE of about 144.3x, which is far richer than both the broader Software industry average of roughly 31.5x and the 38.4x average of its peers. To go a step further than these blunt comparisons, Simply Wall St uses a proprietary “Fair Ratio” framework that estimates what PE a company should trade on after accounting for factors like expected earnings growth, profitability, industry, market cap and specific risks.

For Agilysys, this Fair Ratio comes out at around 37.7x, suggesting that even after allowing for its attractive growth profile, the current 144.3x looks stretched. On this lens, the shares appear priced for very strong execution with little margin for error.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1442 companies where insiders are betting big on explosive growth.

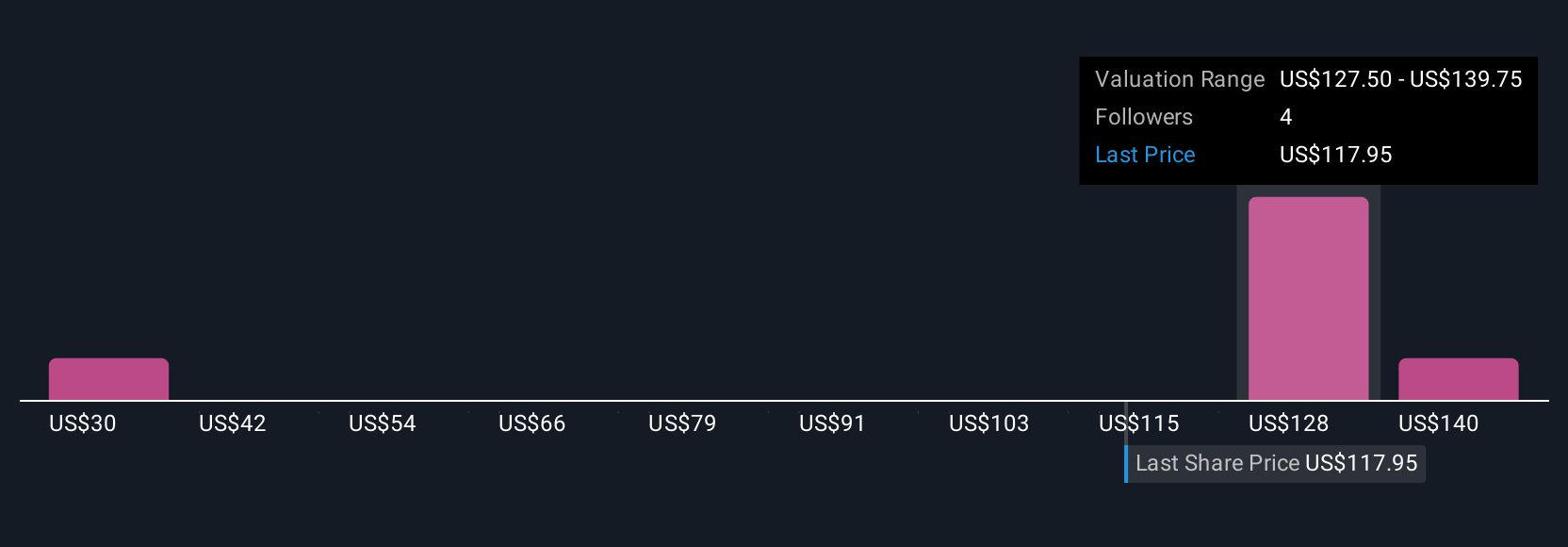

Upgrade Your Decision Making: Choose your Agilysys Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you spell out your story for a company, link that story to a concrete forecast for revenue, earnings and margins, and then translate it into a fair value you can compare to today’s share price to help inform a decision to buy, hold or sell. The Narrative automatically updates as new news or earnings arrive. For Agilysys, one investor might believe its SaaS transition and AI features will drive strong global growth and assign a fair value near $152. A more cautious investor, worried about competition and margin pressure, might see fair value closer to $120. This shows how different but clearly defined perspectives can coexist and be weighed against the actual market price.

Do you think there's more to the story for Agilysys? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AGYS

Agilysys

Operates as a developer and marketer of software-enabled solutions and services to the hospitality industry in North America, Europe, the Asia-Pacific, and India.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Rare Pure High Grade Silver with 35% Insider (Near Producer)

Swedens Constellation Software

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.