- United States

- /

- Software

- /

- NasdaqCM:AEYE

AudioEye, Inc.'s (NASDAQ:AEYE) 34% Cheaper Price Remains In Tune With Revenues

AudioEye, Inc. (NASDAQ:AEYE) shareholders that were waiting for something to happen have been dealt a blow with a 34% share price drop in the last month. Still, a bad month hasn't completely ruined the past year with the stock gaining 26%, which is great even in a bull market.

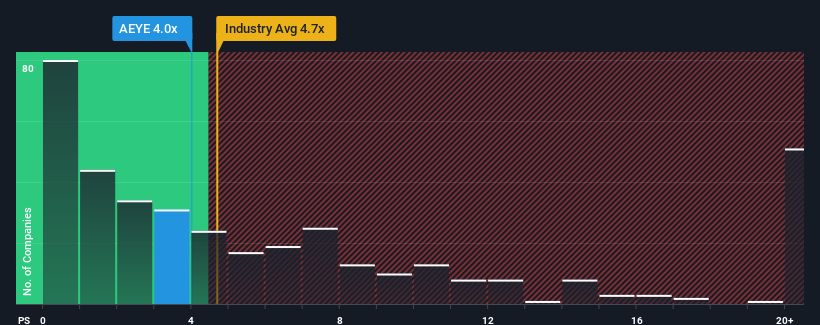

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about AudioEye's P/S ratio of 4x, since the median price-to-sales (or "P/S") ratio for the Software industry in the United States is also close to 4.7x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for AudioEye

How Has AudioEye Performed Recently?

With revenue growth that's inferior to most other companies of late, AudioEye has been relatively sluggish. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on AudioEye.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like AudioEye's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 12%. This was backed up an excellent period prior to see revenue up by 44% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 18% over the next year. Meanwhile, the rest of the industry is forecast to expand by 19%, which is not materially different.

In light of this, it's understandable that AudioEye's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

Following AudioEye's share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

A AudioEye's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Software industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

A lot of potential risks can sit within a company's balance sheet. Our free balance sheet analysis for AudioEye with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AEYE

AudioEye

Provides Internet content publication and distribution software and related services to Internet and other media to people regardless of their device, location, or disabilities in the United States and Europe.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success