- United States

- /

- Software

- /

- NasdaqCM:AEYE

AudioEye, Inc.'s (NASDAQ:AEYE) 25% Price Boost Is Out Of Tune With Revenues

The AudioEye, Inc. (NASDAQ:AEYE) share price has done very well over the last month, posting an excellent gain of 25%. The last 30 days were the cherry on top of the stock's 504% gain in the last year, which is nothing short of spectacular.

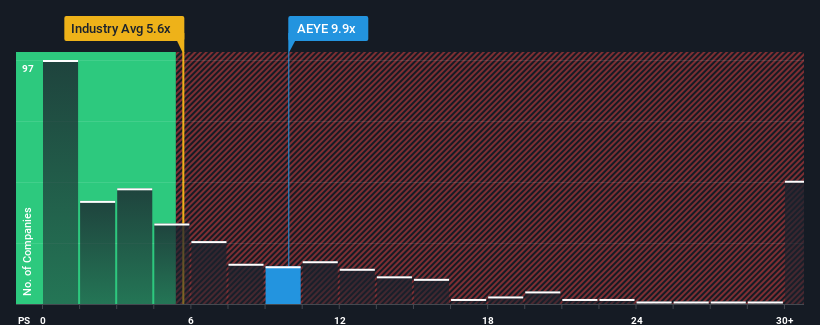

Following the firm bounce in price, AudioEye may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 9.9x, since almost half of all companies in the Software industry in the United States have P/S ratios under 5.8x and even P/S lower than 2x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for AudioEye

How Has AudioEye Performed Recently?

Recent times haven't been great for AudioEye as its revenue has been rising slower than most other companies. Perhaps the market is expecting future revenue performance to undergo a reversal of fortunes, which has elevated the P/S ratio. If not, then existing shareholders may be very nervous about the viability of the share price.

Keen to find out how analysts think AudioEye's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For AudioEye?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like AudioEye's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 6.9%. Pleasingly, revenue has also lifted 41% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 23% over the next year. With the industry predicted to deliver 27% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that AudioEye is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What We Can Learn From AudioEye's P/S?

Shares in AudioEye have seen a strong upwards swing lately, which has really helped boost its P/S figure. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've concluded that AudioEye currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

You always need to take note of risks, for example - AudioEye has 3 warning signs we think you should be aware of.

If these risks are making you reconsider your opinion on AudioEye, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:AEYE

AudioEye

Provides Internet content publication and distribution software and related services to Internet and other media to people regardless of their device, location, or disabilities in the United States and Europe.

Undervalued with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026