- United States

- /

- Software

- /

- NasdaqGS:ADEA

Why Investors Shouldn't Be Surprised By Adeia Inc.'s (NASDAQ:ADEA) 26% Share Price Surge

Adeia Inc. (NASDAQ:ADEA) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

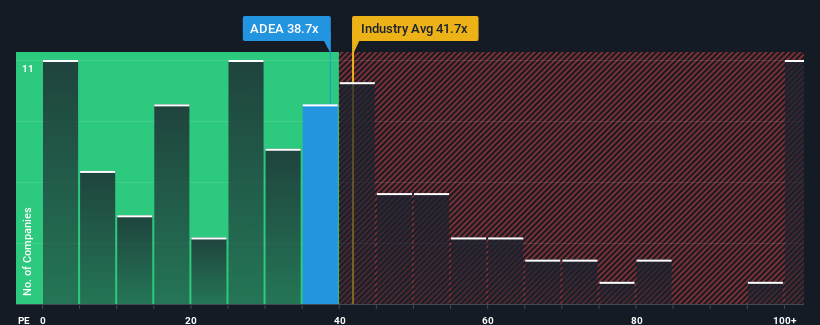

Since its price has surged higher, Adeia may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 38.7x, since almost half of all companies in the United States have P/E ratios under 19x and even P/E's lower than 11x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

While the market has experienced earnings growth lately, Adeia's earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Check out our latest analysis for Adeia

How Is Adeia's Growth Trending?

In order to justify its P/E ratio, Adeia would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 68% decrease to the company's bottom line. The last three years don't look nice either as the company has shrunk EPS by 71% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Turning to the outlook, the next year should generate growth of 139% as estimated by the three analysts watching the company. That's shaping up to be materially higher than the 15% growth forecast for the broader market.

With this information, we can see why Adeia is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Adeia's P/E

Shares in Adeia have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Adeia's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Adeia (of which 1 is a bit unpleasant!) you should know about.

If you're unsure about the strength of Adeia's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ADEA

Adeia

Operates as a media and semiconductor intellectual property licensing company in the United States, Asia, Canada, Europe, the Middle East, and internationally.

Undervalued with proven track record.

Similar Companies

Market Insights

Community Narratives