- United States

- /

- Software

- /

- NasdaqGS:ADBE

Is Adobe’s (ADBE) AI Alliance With Google Cloud Reshaping Its Creative Ecosystem Strategy?

Reviewed by Sasha Jovanovic

- At the recent Adobe MAX 2025 conference, Adobe and its partners, including Google Cloud and YouTube, announced a series of major AI-powered innovations and collaborations designed to expand creative possibilities across its Creative Cloud suite, Firefly, and GenStudio platforms.

- These developments bring together industry-leading AI models within Adobe’s trusted applications, aiming to empower creators and enterprises with streamlined content production, increased customization, and deeper integrations with leading advertising and social media platforms.

- We’ll explore how the expanded partnership with Google Cloud signals a shift in Adobe’s investment narrative toward an open, multi-model creative ecosystem.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Adobe Investment Narrative Recap

To be a shareholder in Adobe today, you need to believe the company can translate its rapid pace of AI-driven product innovation, including recent Google Cloud and YouTube partnerships, into stronger revenue growth and durable market share. While these announcements reinforce Adobe's focus on ecosystem leadership, their immediate impact on key short-term catalysts like subscription growth or margin improvements may be limited, especially as competitors quickly enhance their own creative AI tools. The biggest risk remains Adobe’s ability to execute complex integrations and maintain its technology edge amid intensifying competition.

Among the many announcements at Adobe MAX 2025, the expanded integration of Google’s advanced AI models into core Creative Cloud apps stands out. This partnership is especially relevant as it extends Adobe’s partner model, giving both individual and enterprise users the flexibility to work with leading AI technologies directly within their trusted workflows. For investors, this development strengthens one of Adobe’s central growth stories: expansion of a multi-model AI creative ecosystem that could support new upsell and retention opportunities.

Yet even as excitement builds around these advancements, investors should also be alert to a different risk…

Read the full narrative on Adobe (it's free!)

Adobe's outlook anticipates $29.3 billion in revenue and $8.7 billion in earnings by 2028. This is based on analysts forecasting 9.0% annual revenue growth and a $1.8 billion increase in earnings from current earnings of $6.9 billion.

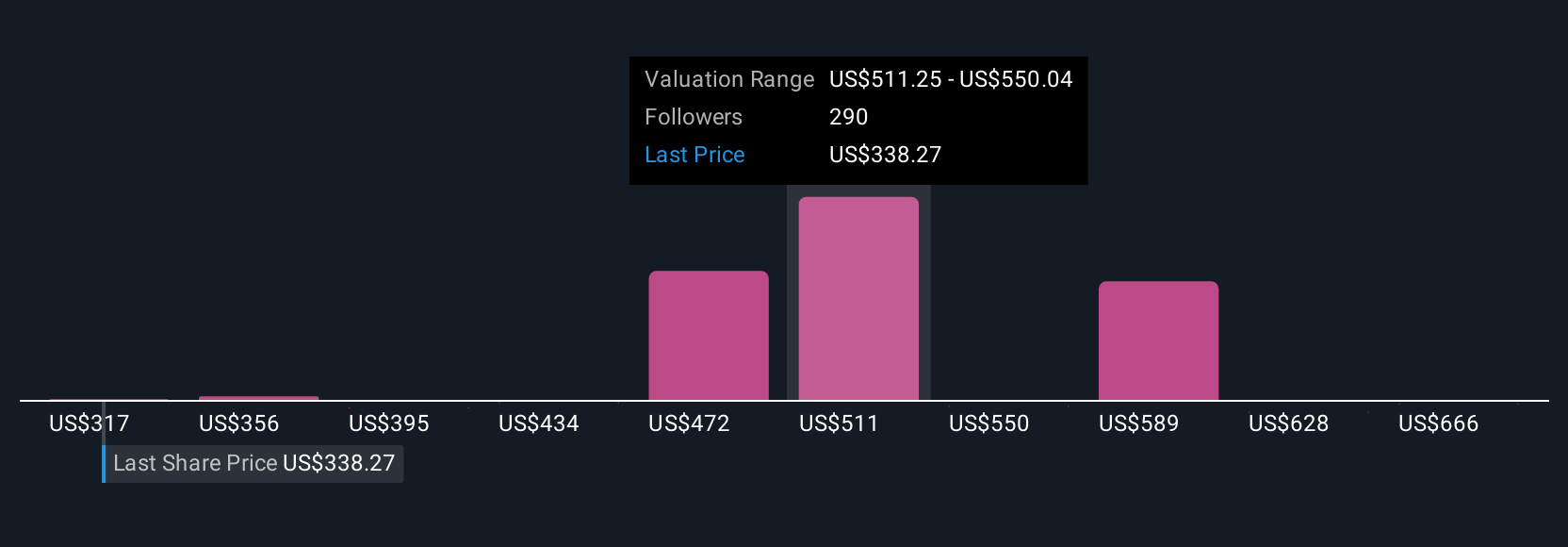

Uncover how Adobe's forecasts yield a $456.18 fair value, a 34% upside to its current price.

Exploring Other Perspectives

Some of the lowest analyst forecasts, which recently saw Adobe’s 2028 revenue at just US$27 billion and expect shrinking profit margins, highlight concerns about whether new AI-driven tools like Firefly tiers will attract and monetize users as projected. While news like the recent partnerships may shift expectations, it is important to recognize that forecasts from even a small group of pessimistic analysts suggest much lower earnings and share price potential. It is smart to compare all perspectives before deciding what you believe is likely for Adobe’s future.

Explore 86 other fair value estimates on Adobe - why the stock might be worth just $380.00!

Build Your Own Adobe Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Adobe research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Adobe research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Adobe's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives