- United States

- /

- Software

- /

- NasdaqGS:ADBE

A Fresh Look at Adobe (ADBE) Valuation Following the Launch of Acrobat Studio and Its AI Innovation

Reviewed by Simply Wall St

Adobe (ADBE) just launched Acrobat Studio, bringing together its core document and creative products with sophisticated AI assistants. This is more than another feature update. It is a bold step that puts Adobe front and center in the race to reshape what productivity and document-centric AI can do. Transforming the humble PDF into a conversational knowledge hub could change how business professionals, students, and even travelers handle, analyze, and create with their documents. This move may attract investors looking for true innovation in the AI space.

This launch comes at a time when Adobe’s stock has needed a catalyst. Over the past year, the shares have dropped by nearly 38%, with momentum still lagging even as annual revenue and net income show modest growth. Smaller wins, such as recent product presentations at the Gartner Digital Workplace Summit or expansions to e-signature tools, have not been enough to reverse this trend. Short-term sentiment remains cautious, but longer-term investors are left wondering if product breakthroughs like Acrobat Studio can reignite excitement around the stock.

With so much change in the air, is this innovation a real buying opportunity for Adobe, or is the market already pricing in all the promised growth from AI-driven productivity?

Most Popular Narrative: 12% Overvalued

According to analysis from Goran_Damchevski, Adobe is currently trading above what is considered its fair value, using a discount rate of 6.9%. The research suggests the market's optimism may exceed the company’s longer-term business fundamentals.

Adobe is now playing defense against new browser-based startups such as Canva, Figma and smaller clones that may take market share. Given the nature of software and the rapid advancements in creative media software capabilities, I believe Adobe's existing moat of switching costs and brand power will not hold the same weight they used to, and users will not need to use Adobe as the "industry standard".

Ever wondered what assumptions drive this "overvalued" call? This narrative focuses on future margin realities, head-to-head competition, and questions about Adobe’s once ironclad market position. Which financial model is used and shifts the story? The details behind these verdicts might surprise you.

Result: Fair Value of $317.27 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a successful Figma acquisition or a shakeout among smaller competitors during an economic downturn could rapidly change Adobe's competitive landscape.

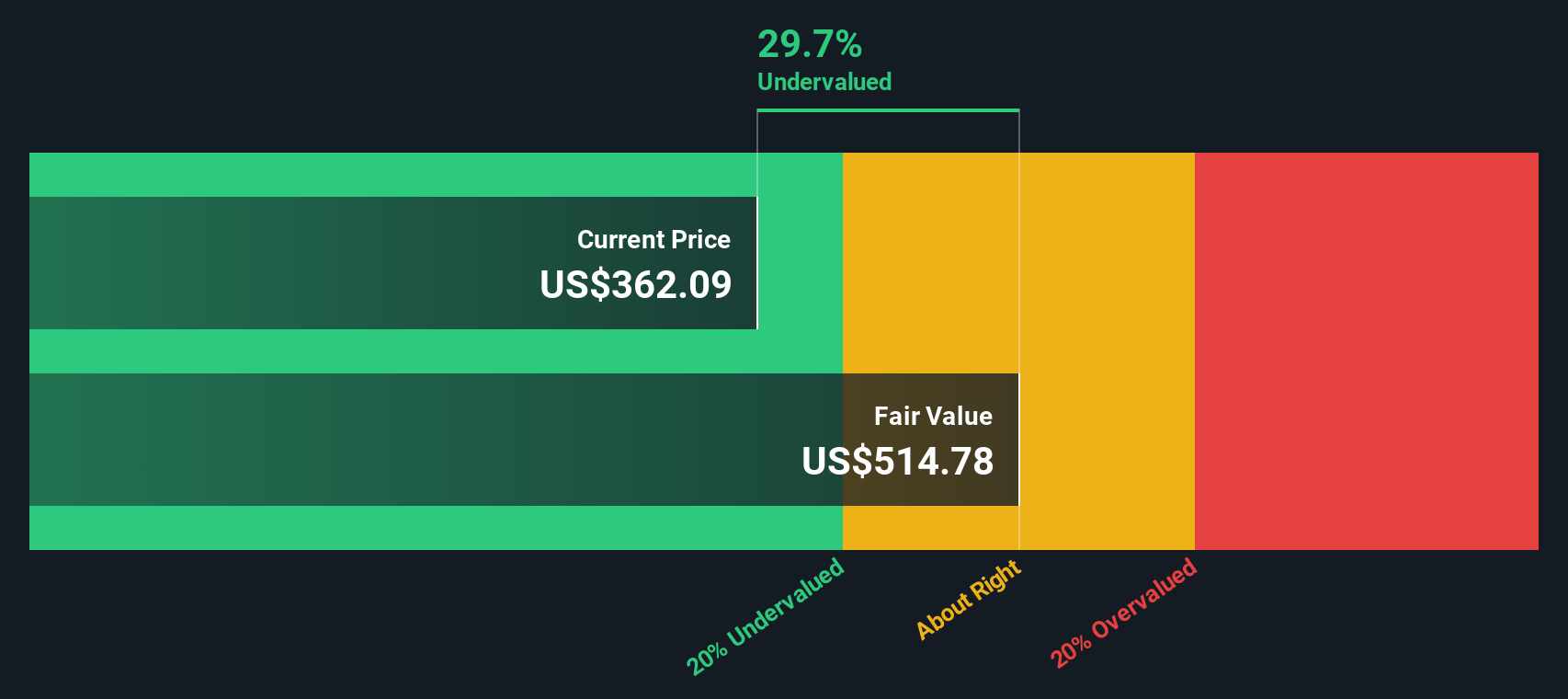

Find out about the key risks to this Adobe narrative.Another View: SWS DCF Model Says Undervalued

While the previous approach suggests Adobe is overvalued, our SWS DCF model offers a different perspective. This method currently sees the shares as trading below intrinsic value. Which method gets closer to reality, and why?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Adobe Narrative

If you have a different view or want to dive into the numbers personally, you can easily create your own narrative from scratch in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Adobe.

Looking for More Smart Ways to Invest?

Why settle for ideas everyone already knows? Set yourself up for smarter wins by using the Simply Wall Street Screener. Right now is the perfect moment to spot those hidden opportunities many investors overlook. If you want to stay a step ahead, don't miss out on these powerful avenues:

- Capture rare value opportunities with stocks trading far below what their fundamentals suggest by getting the inside track through undervalued stocks based on cash flows.

- Take advantage of advancements in artificial intelligence by exploring tomorrow's leaders in automation and next-generation innovation with AI penny stocks.

- Increase your passive income by focusing on companies with robust, above-average yields when you check out dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:ADBE

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives