- United States

- /

- Semiconductors

- /

- NYSE:VLN

Subdued Growth No Barrier To Valens Semiconductor Ltd. (NYSE:VLN) With Shares Advancing 30%

Valens Semiconductor Ltd. (NYSE:VLN) shares have continued their recent momentum with a 30% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 36%.

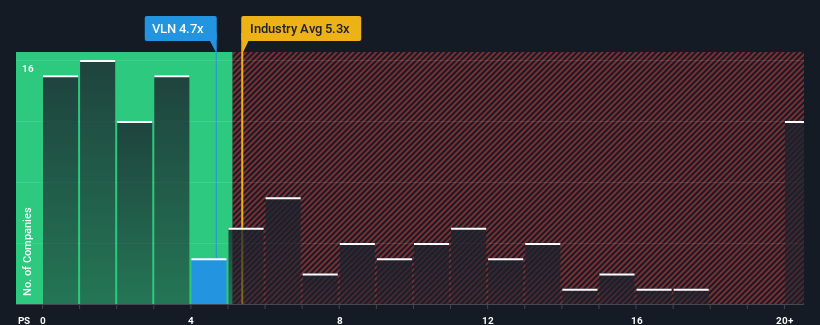

Even after such a large jump in price, there still wouldn't be many who think Valens Semiconductor's price-to-sales (or "P/S") ratio of 4.7x is worth a mention when the median P/S in the United States' Semiconductor industry is similar at about 5.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Valens Semiconductor

What Does Valens Semiconductor's Recent Performance Look Like?

Valens Semiconductor hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting its poor revenue performance to improve, keeping the P/S from dropping. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Valens Semiconductor.Do Revenue Forecasts Match The P/S Ratio?

Valens Semiconductor's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 23%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 30% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Turning to the outlook, the next year should bring diminished returns, with revenue decreasing 16% as estimated by the three analysts watching the company. That's not great when the rest of the industry is expected to grow by 40%.

With this information, we find it concerning that Valens Semiconductor is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Valens Semiconductor's P/S Mean For Investors?

Its shares have lifted substantially and now Valens Semiconductor's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

While Valens Semiconductor's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Valens Semiconductor, and understanding these should be part of your investment process.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:VLN

Valens Semiconductor

Provides semiconductor products for the audio-video and automotive industries in Israel, China, Hong Kong, Portugal, the United States, Japan, Germany, Hungary, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success