- United States

- /

- Semiconductors

- /

- NYSE:TSM

TSMC (NYSE:TSM): Examining Valuation After Consistent Share Price Gains

Reviewed by Simply Wall St

Taiwan Semiconductor Manufacturing (NYSE:TSM) has captured investors’ attention thanks to another month of steady gains. With shares climbing nearly 3% over the past month, many are taking a fresh look at what is driving sentiment.

See our latest analysis for Taiwan Semiconductor Manufacturing.

Momentum is clearly building for Taiwan Semiconductor Manufacturing, with its latest share price of $300.43 reflecting a steady upward trend. After a robust run so far this year, its year-to-date share price return stands at an impressive 49.04%. Long-term holders have benefited from a 57.41% one-year total shareholder return and a remarkable 399.94% gain over three years. Recent price moves suggest investors are increasingly focused on this stock’s growth trajectory and shifting risk perceptions in the semiconductor space.

If this surge in chipmaker momentum has you curious, now is the perfect moment to broaden your investing horizons and discover See the full list for free.

With TSMC’s stellar gains, robust fundamentals, and a share price approaching analyst targets, the big question is whether investors are overpaying for future growth or if there is still genuine value left to unlock.

Price-to-Earnings of 24.7x: Is it justified?

Shares of Taiwan Semiconductor Manufacturing are priced at a price-to-earnings (P/E) ratio of 24.7x based on the latest close. This positions the stock well below its peers but above its estimated fair value according to our DCF model.

The price-to-earnings ratio measures what investors are willing to pay today for a dollar of earnings. In the semiconductor sector, this is a common way to gauge whether growth and profitability are being over- or underpriced by the market.

Taiwan Semiconductor's P/E ratio is considerably below the US semiconductor industry average of 36.1x. This suggests the market is not overpricing its expected earnings. Furthermore, compared to the estimated Fair P/E ratio of 46.9x, the current valuation may still have room to expand as sentiment strengthens and earnings continue on their impressive growth trajectory.

Explore the SWS fair ratio for Taiwan Semiconductor Manufacturing

Result: Price-to-Earnings of 24.7x (UNDERVALUED)

However, Taiwan Semiconductor still faces risks from shifting global chip demand and potential regulatory changes, both of which could temper its current momentum.

Find out about the key risks to this Taiwan Semiconductor Manufacturing narrative.

Another View: What Does the SWS DCF Model Suggest?

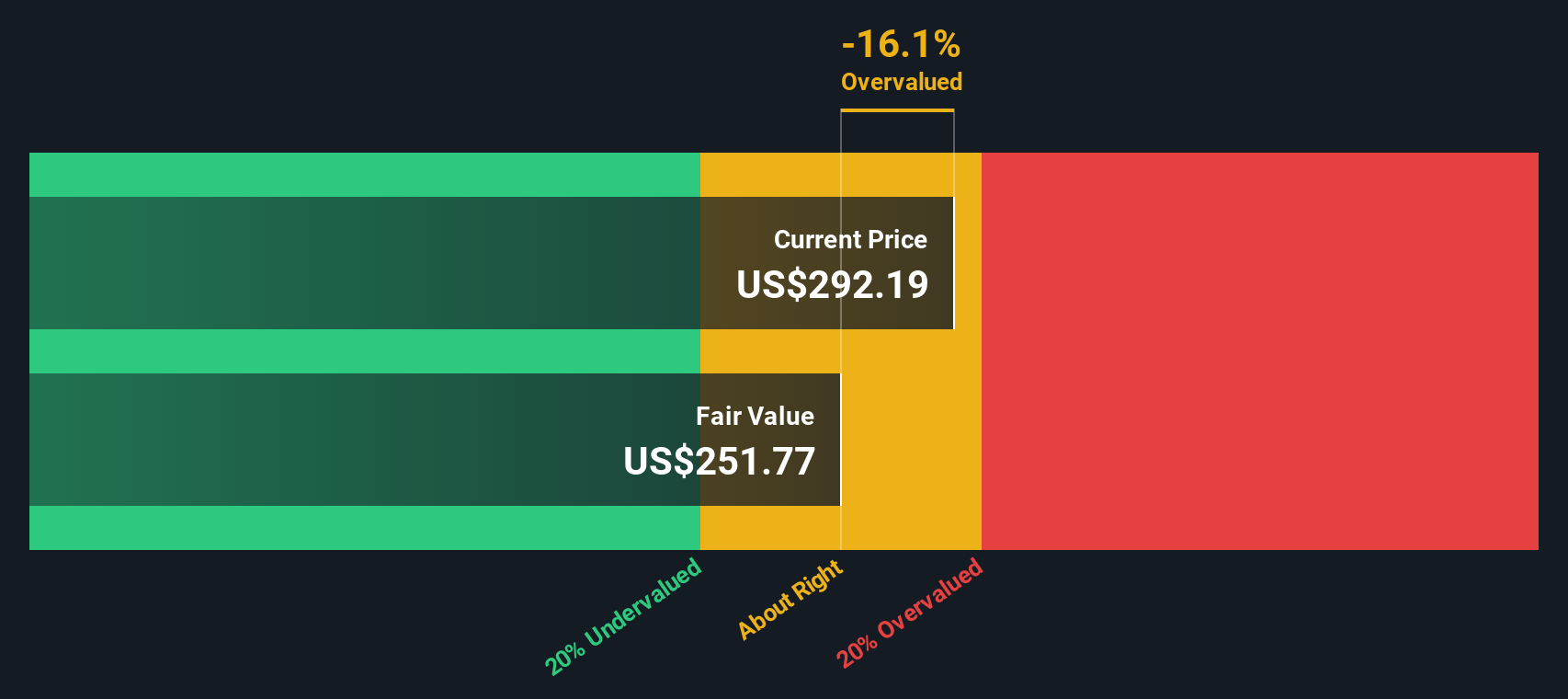

While the price-to-earnings ratio paints Taiwan Semiconductor as undervalued compared to peers, our DCF model tells a different story. According to the SWS DCF model, TSM’s current share price sits above its estimated fair value. This suggests that some future growth may already be priced in. Is the market now pricing in too much optimism, or are multiples sending a clearer signal?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Taiwan Semiconductor Manufacturing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 839 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Taiwan Semiconductor Manufacturing Narrative

If you see things differently or want to put your own spin on the analysis, you can easily build your own story around the numbers in just a few minutes: Do it your way.

A great starting point for your Taiwan Semiconductor Manufacturing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Winning Stock Ideas?

Don’t let opportunity pass you by. Power up your investing strategy right now by checking out handpicked stock ideas that could be tomorrow’s strongest performers, all waiting in the Simply Wall Street platform.

- Unlock high potential by finding these 839 undervalued stocks based on cash flows that trade below their cash flow value and might be gems the market is overlooking today.

- Spot unstoppable trends with these 26 AI penny stocks as artificial intelligence transforms industries and creates new leaders in tech innovation.

- Secure a steady income stream by reviewing these 22 dividend stocks with yields > 3% with yields over 3%, designed for those who want their money to work harder.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSM

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives