- United States

- /

- Semiconductors

- /

- NYSE:TSM

Is TSMC Fairly Priced After 52% Surge and Advanced Chip Technology Headlines in 2025?

Reviewed by Bailey Pemberton

- Ever wondered if Taiwan Semiconductor Manufacturing is trading at a bargain or if all the buzz is already priced in? This article dives straight into what really drives the stock's value.

- The share price has skyrocketed, delivering a massive 51.9% gain over the last year and an outstanding 370.2% return over three years. At the same time, it has shown a slight dip of 2.5% in the past week.

- Recent headlines have spotlighted the company's leadership in advanced chip technology and expanding global partnerships, helping drive momentum in the stock. Investors are also closely tracking moves around international supply agreements, providing further context for recent price swings.

- The company scores 3 out of 6 possible undervaluation checks. This gives us plenty to unpack ahead. We will take a closer look at the valuation approaches most investors use, and at the end of this article, reveal an even smarter way to understand what the stock is really worth.

Approach 1: Taiwan Semiconductor Manufacturing Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used approach that estimates the value of a company by projecting its future cash flows and discounting them back to today's value. In this case, the analysis starts with Taiwan Semiconductor Manufacturing's latest twelve months free cash flow, which stands at NT$804,759.6 Million (just over NT$800 Billion). Analysts provide detailed forecasts for the next five years, projecting a steady increase with free cash flow expected to reach NT$2,774,812.8 Million (about NT$2.8 Trillion) by 2029. Beyond that, further cash flow growth is extrapolated using reasonable growth assumptions.

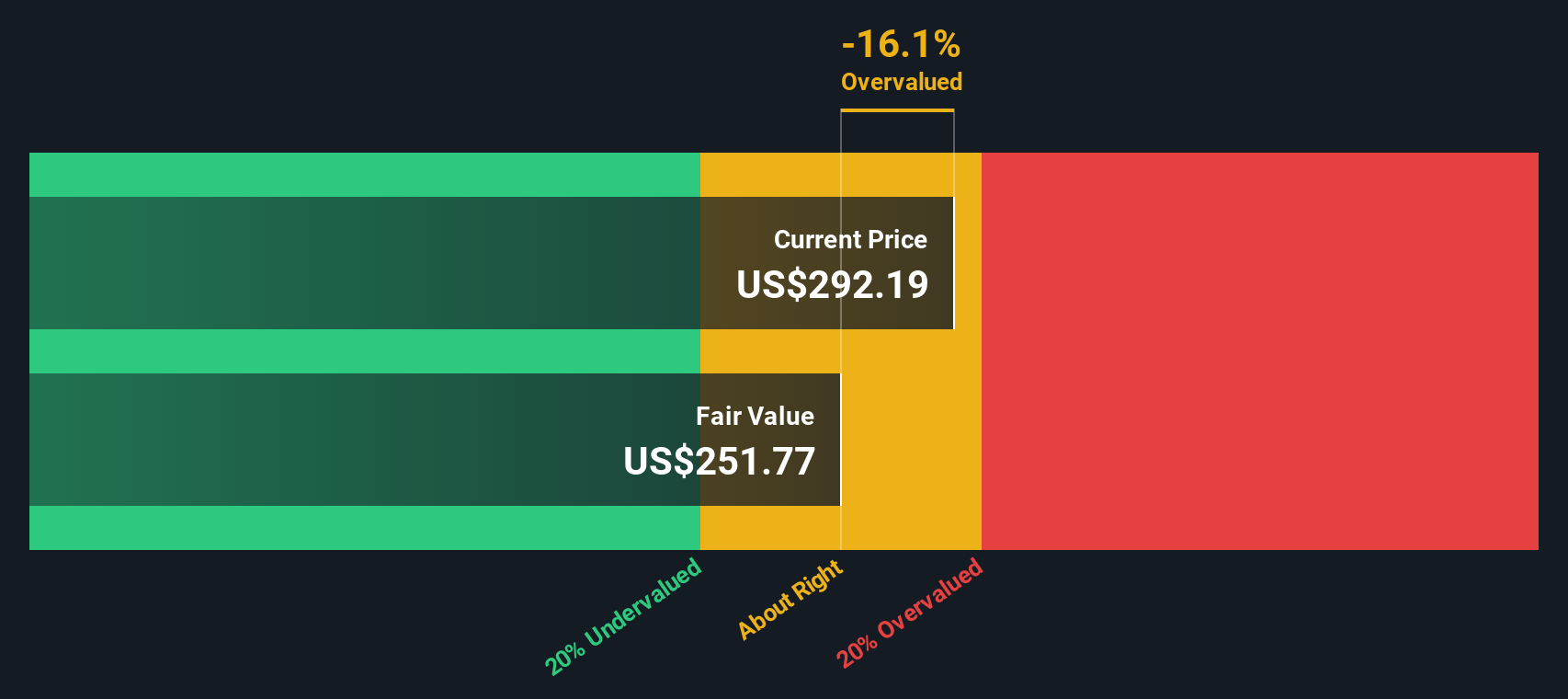

This two-stage DCF model aggregates these projected figures and discounts them using suitable rates to determine the present value of the business. The resulting estimated intrinsic value per share lands at $246.72. When compared to the recent market price, this DCF model suggests the stock is currently 19.2% overvalued.

The bottom line for investors, based strictly on the DCF approach, is clear: while Taiwan Semiconductor Manufacturing shows robust cash flow growth, the current share price expects even more, making it appear a little too expensive at the moment.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Taiwan Semiconductor Manufacturing may be overvalued by 19.2%. Discover 841 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Taiwan Semiconductor Manufacturing Price vs Earnings

For profitable companies like Taiwan Semiconductor Manufacturing, the Price-to-Earnings (PE) ratio remains one of the most informative ways to gauge value. This metric tells investors how much they are paying for each dollar of current earnings, making it easy to compare profitability and valuation across companies in the same industry.

What counts as a “normal” or “fair” PE ratio is influenced by the market’s expectations for future growth and the perceived risks of a company. Higher growth prospects or lower risks generally justify a higher PE, while more uncertainty or slower growth translate to lower ratios.

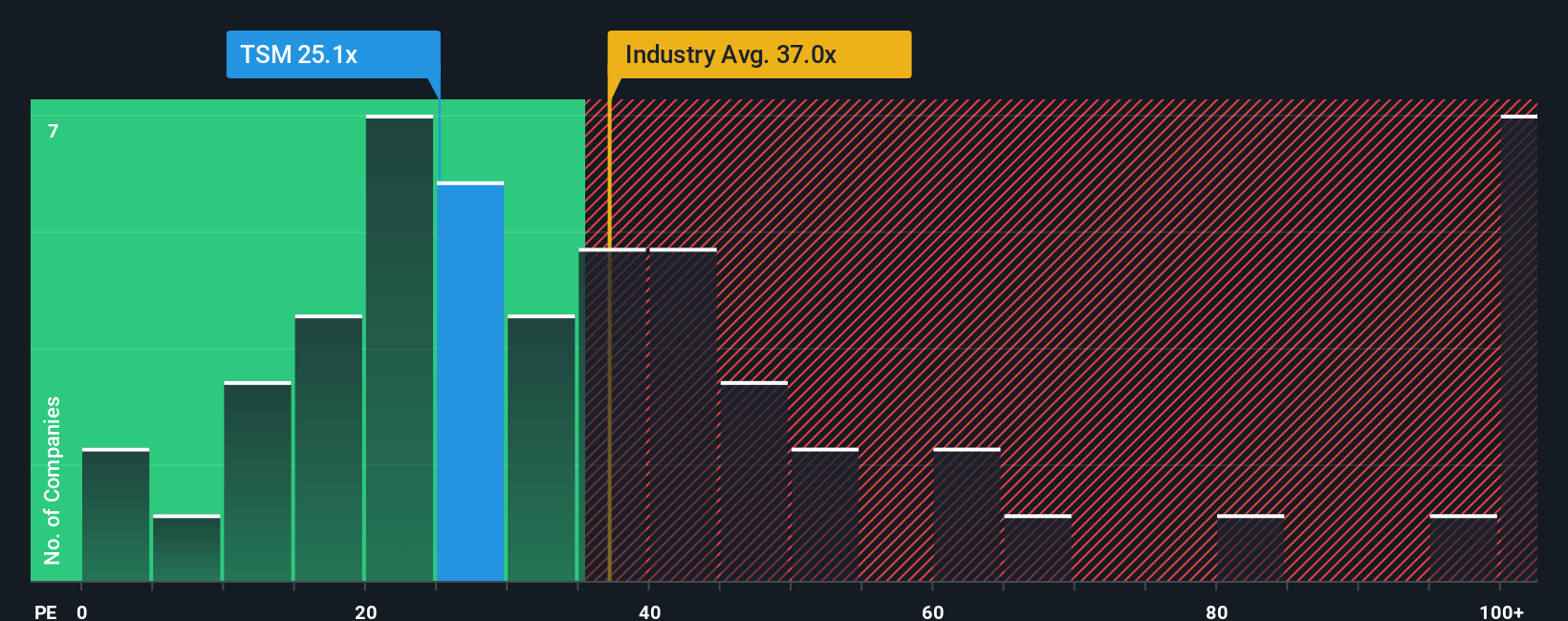

Right now, Taiwan Semiconductor Manufacturing is trading at a PE ratio of 24.8x. For context, the average PE for the Semiconductor industry sits at 35.8x, while the company’s peers average an even higher 70.4x. However, benchmarks like these do not account for the unique strengths and risks of a business.

This is where Simply Wall St’s proprietary “Fair Ratio” comes in. It estimates a reasonable multiple of 46.9x in this case by factoring in not just industry standards, but also Taiwan Semiconductor Manufacturing’s growth outlook, profit margins, size, and risk profile. By adjusting for these elements, the Fair Ratio provides a more tailored and typically reliable picture of valuation than the industry average or peer group alone.

Comparing the current PE of 24.8x with the Fair Ratio of 46.9x, the stock appears to be trading at a noticeable discount to its intrinsic value based on earnings. This suggests that Taiwan Semiconductor Manufacturing may be undervalued on this metric.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1411 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Taiwan Semiconductor Manufacturing Narrative

Earlier we mentioned there is an even better way to understand what a stock is truly worth, so let’s introduce you to Narratives. A Narrative is your personalized investment story, where you bring together your assumptions about a company’s future, such as revenue growth rates, profit margins, risks, and outlook, and connect them directly to concrete financial forecasts and a fair value estimate.

This approach links the “why” of your viewpoint with the “how much” of the numbers, making it easier than ever for investors of all backgrounds to visualize and justify their valuation. Narratives are powered by millions of community insights on Simply Wall St’s platform, and you can easily create or explore them within the company’s Community page.

By comparing your Narrative’s Fair Value to the current market price, Narratives help you decide whether to buy, hold, or sell. In addition, they automatically update as new data or news emerges, keeping you in sync with fast-changing markets.

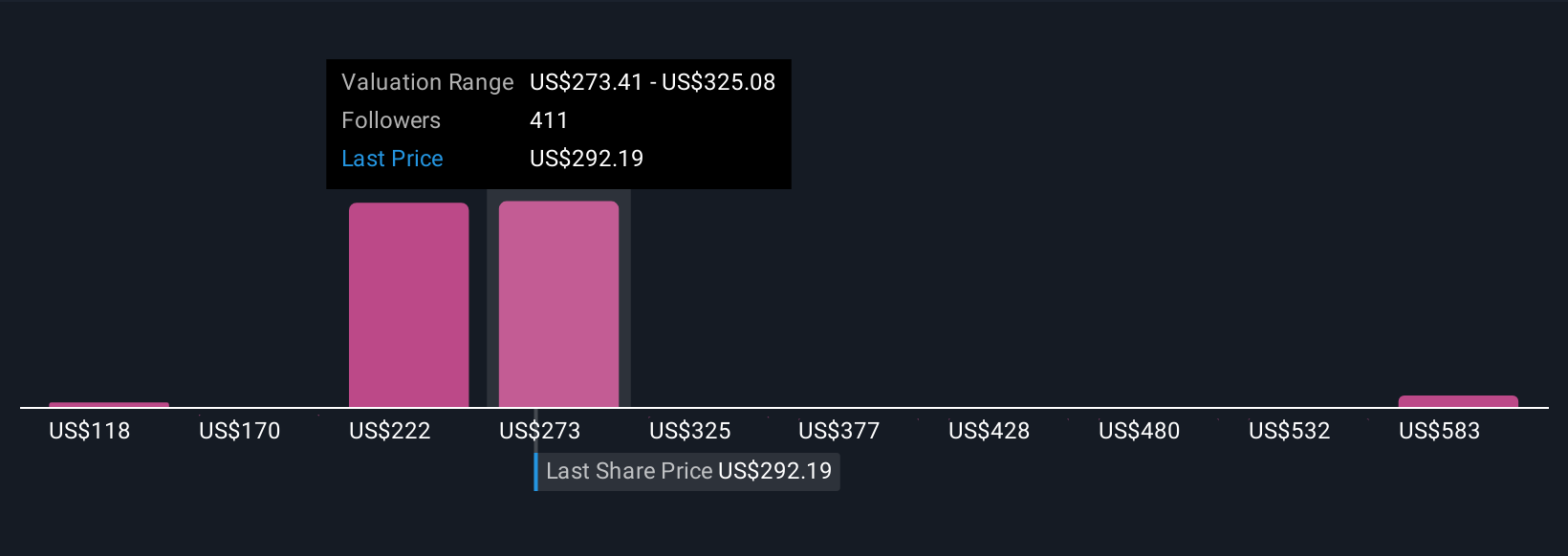

For Taiwan Semiconductor Manufacturing, for example, some users’ Narratives suggest a fair value as high as $310, reflecting bullish expectations on AI-driven growth. Others take a more cautious view and forecast a fair value near $118, focusing on potential geopolitical or margin risks.

For Taiwan Semiconductor Manufacturing, here are previews of two leading Taiwan Semiconductor Manufacturing Narratives:

🐂 Taiwan Semiconductor Manufacturing Bull Case

Fair Value: $310.00

Current price is approximately 5.2% below this fair value

Revenue Growth Rate: 0%

- TSMC is the backbone of advanced chip technology, holding around 50% global foundry market share and manufacturing for top tech brands like Apple, Nvidia, and Qualcomm.

- Financials are exceptionally strong, with high margins, surging revenues driven by AI and high-performance computing, and expansion plans including new fabs in multiple countries.

- Risks include trade and geopolitical tension, margin pressures from currency and overseas operations, but the business remains highly profitable and stable, supporting growth and shareholder returns.

🐻 Taiwan Semiconductor Manufacturing Bear Case

Fair Value: $118.40

Current price is approximately 148.5% above this fair value

Revenue Growth Rate: -23.21%

- Continued geopolitical stability is expected, allowing TSMC to lead the market with consistent revenue and earnings growth fueled by large repeat customers and R&D investment.

- TSMC’s healthy balance sheet can sustain expansion and dividends, but dependence on top customers and vital equipment suppliers such as ASML introduces concentration risks.

- Potential downsides include the threat of a major geopolitical event affecting Taiwan or supply chains, and valuation expansion appearing limited given risks and current multiples.

Do you think there's more to the story for Taiwan Semiconductor Manufacturing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSM

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives