- United States

- /

- Semiconductors

- /

- NYSE:TSM

After 42.7% Stock Surge, Is TSMC Still Offering Upside in 2025?

Reviewed by Bailey Pemberton

- Curious if Taiwan Semiconductor Manufacturing could still be a value play, even with its market dominance? Let’s break down whether TSM is offering real upside or just hype in today’s market.

- The stock has surged 42.7% year-to-date and is up a remarkable 46.2% over the past year, showing both impressive momentum and increased investor attention.

- That excitement is fueled by fresh headlines about soaring global chip demand and new strategic partnerships. TSM is strengthening its position as the world’s top contract chipmaker. These tailwinds, along with geopolitical headlines about supply chains and advanced chip technology, have kept the spotlight firmly on TSM’s shares lately.

- According to our analysis, TSM scores a 3 out of 6 on our undervaluation checklist right now. Valuation techniques can tell us part of the story, but stick around for a perspective at the end that could change the way you think about what TSM is truly worth.

Approach 1: Taiwan Semiconductor Manufacturing Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model helps estimate a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s value. This approach is a popular analytical tool for understanding whether a stock is trading above or below its long-term fair value based on expected performance.

For Taiwan Semiconductor Manufacturing (TSMC), the current Free Cash Flow stands at approximately NT$802 Billion. Analysts foresee significant growth ahead, projecting Free Cash Flow numbers to surpass NT$1.3 Trillion in 2026 and reaching over NT$3.2 Trillion by 2035. It is worth noting that only five years of forecasts are from analysts, and the remainder are extrapolations. Such robust projections reflect the market’s optimism for TSMC’s growth trajectory as the global semiconductor industry expands.

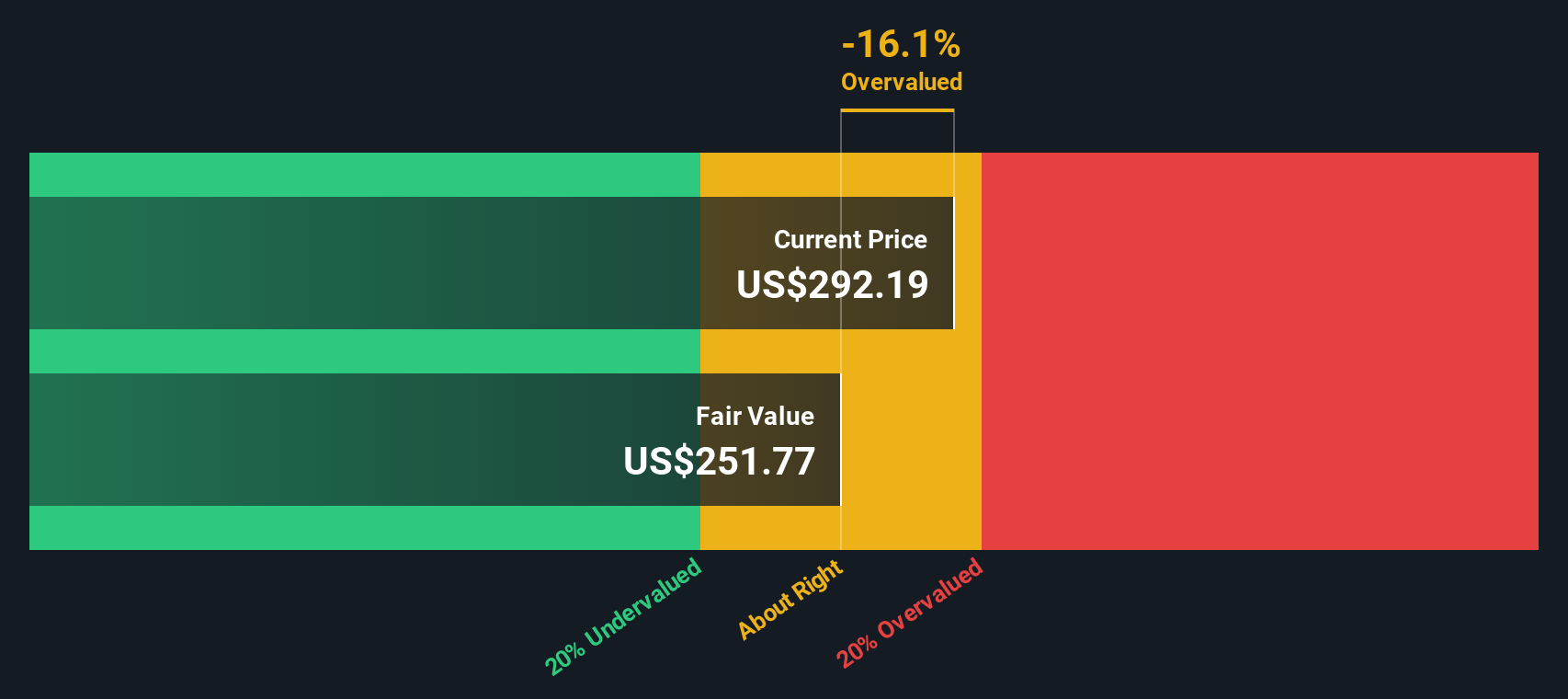

Applying the 2 Stage Free Cash Flow to Equity model, the estimated intrinsic value for TSMC is NT$223.03 per share. This figure indicates that the stock is approximately 29.0% overvalued compared to its current share price. While TSMC’s long-term cash flows are compelling, today’s stock price already seems to reflect even the rosiest future assumptions.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Taiwan Semiconductor Manufacturing may be overvalued by 29.0%. Discover 929 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Taiwan Semiconductor Manufacturing Price vs Earnings (PE)

For profitable companies like Taiwan Semiconductor Manufacturing (TSMC), the Price-to-Earnings (PE) ratio is a trusted metric to assess valuation. This multiple helps investors quickly gauge how much they are paying for each dollar of current earnings, which is a core indicator for established businesses generating steady profits.

The “right” PE ratio, however, is not a one-size-fits-all number. Higher growth prospects and lower risk often justify richer valuations, while slower-growing or riskier stocks typically command lower PE ratios. This is why context matters when comparing PE multiples across the industry or among peers.

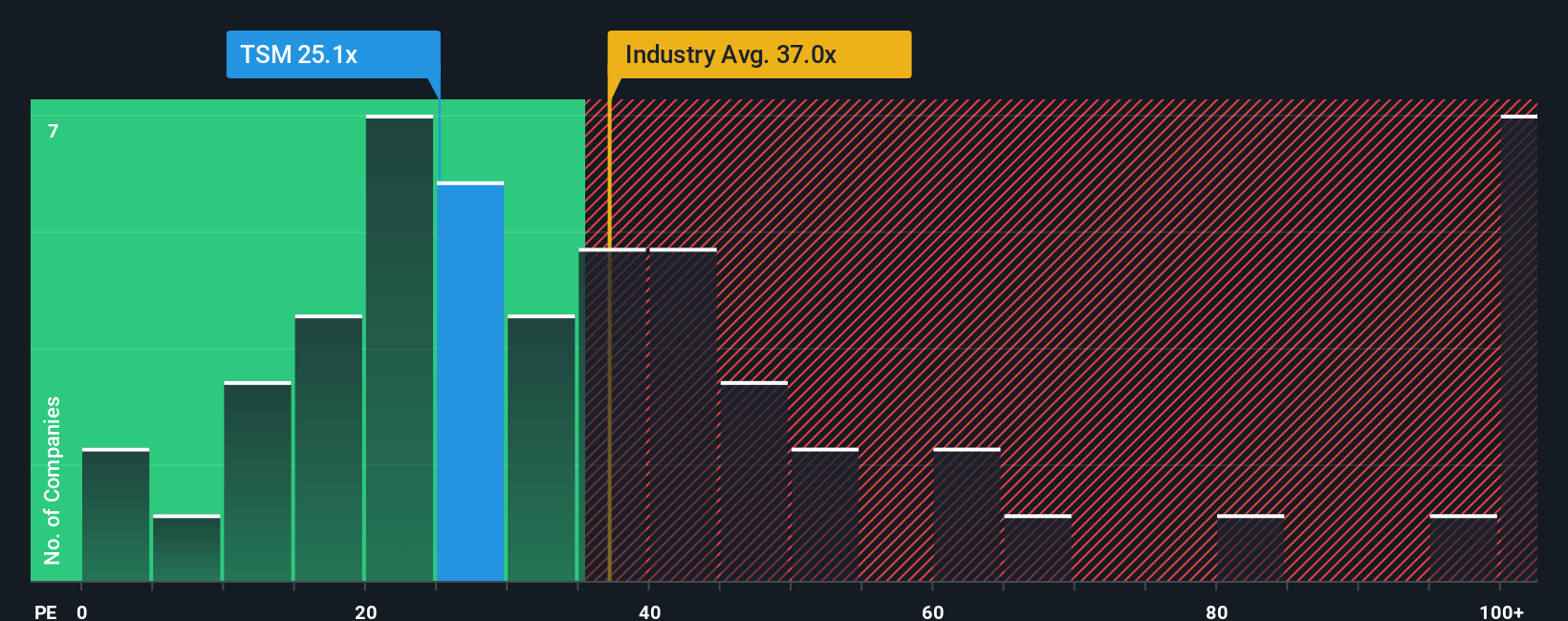

TSMC currently trades at a PE ratio of 23.26x. The Semiconductor industry average is much higher at about 35.69x, and direct peers in the space average an even steeper 68.81x. At first glance, TSMC appears to be attractively valued relative to these benchmarks.

Simply Wall St’s proprietary “Fair Ratio” tool refines this further by calculating a tailored benchmark based on the company’s own earnings growth, profit margins, industry landscape, market cap, and risk profile. For TSMC, the Fair PE Ratio is 37.61x, providing a more precise reference point than broad industry averages or peer group medians because it reflects TSMC’s unique characteristics.

With TSMC’s actual PE multiple sitting noticeably below its Fair Ratio, this suggests the company may be undervalued based on its underlying fundamentals and growth outlook.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1444 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Taiwan Semiconductor Manufacturing Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives—a powerful, yet approachable tool built to help investors turn financial data into actionable stories. A Narrative is simply your perspective or “story” about a company’s future, connecting your outlook on key drivers like revenue growth, margins, or risks to your own estimate of fair value.

This method links the bigger picture—how you see a company evolving—with hard numbers, letting you build a customized forecast and see what TSMC’s shares should be worth according to your view. Narratives are easy to create and compare inside the Simply Wall St Community, a place used by millions of investors to crowdsource and shape their investment thinking.

By framing the decision this way, you can decide whether to buy or sell based on the difference between your personal Fair Value and the current Price, and see how shifts in expected growth, profitability, or market sentiment change your thesis.

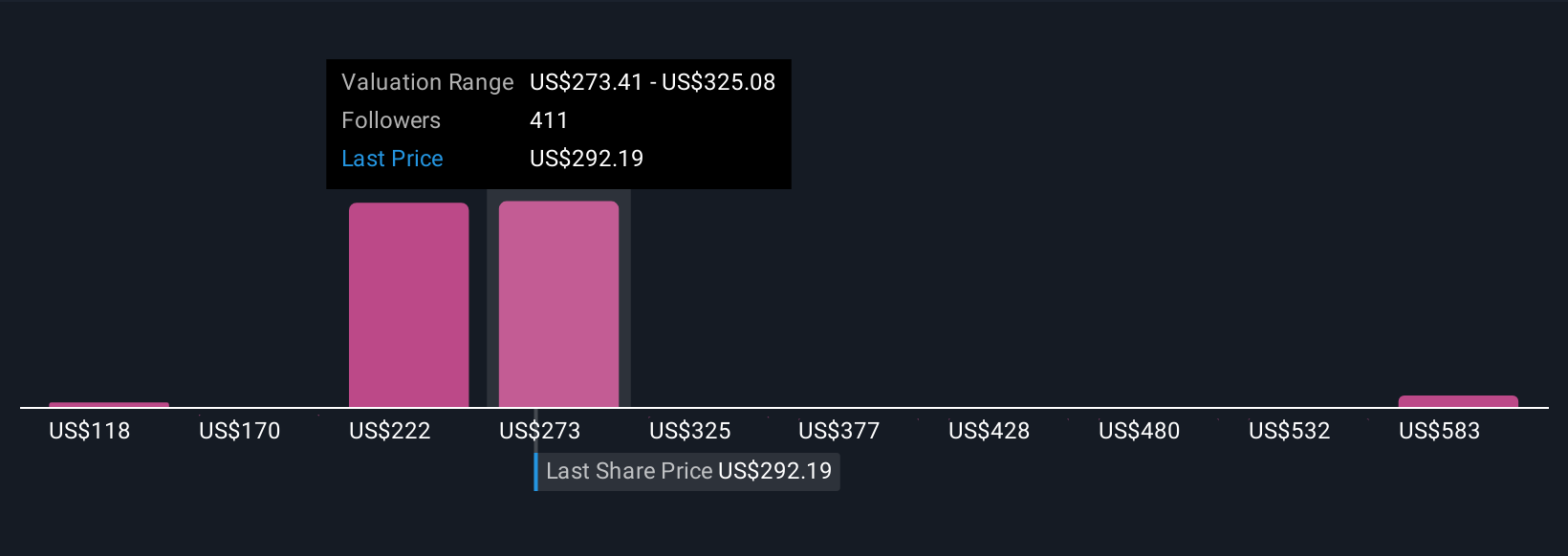

Importantly, Narratives stay dynamic—they automatically update when new information like earnings or news hits, so your analysis remains current. For example, one TSMC investor might assume robust AI-led demand and assign a higher Fair Value around $310, while a more cautious peer could focus on geopolitical risks and use a Fair Value nearer $118; both can instantly see if the stock aligns with their unique perspective and adjust as circumstances change.

For Taiwan Semiconductor Manufacturing, here are previews of two leading Taiwan Semiconductor Manufacturing Narratives:

- 🐂 Taiwan Semiconductor Manufacturing Bull Case

Fair Value: $310.00

Current Price is approximately 7.2% below the narrative fair value

Expected Revenue Growth Rate: 0%

- TSMC is the globally dominant chipmaker, supplying advanced semiconductors for tech giants like Apple and Nvidia. The company is leading at the frontier of 2 nm technology.

- AI and HPC demand is fueling record growth. Profitability, margins, and expansion into the US, Japan, and Germany reinforce the company’s foundation and moat.

- Key risks include geopolitics, margin pressures, and customer concentration. This narrative underscores TSMC as a central, low-risk way to participate in the “AI backbone.”

- 🐻 Taiwan Semiconductor Manufacturing Bear Case

Fair Value: $118.40

Current Price is approximately 143% above the narrative fair value

Expected Revenue Growth Rate: -23.21%

- TSMC is expected to remain the industry leader but faces meaningful risks from geopolitical tensions and heavy reliance on a handful of advanced hardware suppliers like ASML.

- Diversification of production outside Taiwan, such as in Japan, the US, and Europe, is progressing. However, meaningful mitigation of geopolitical risk may not be realized until after 2026.

- Organic growth and robust margins support current optimism, but this view sees TSMC as significantly overvalued at current prices with notable downside risk if industry cycles or geopolitical shocks occur.

Do you think there's more to the story for Taiwan Semiconductor Manufacturing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Taiwan Semiconductor Manufacturing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TSM

Taiwan Semiconductor Manufacturing

Manufactures, packages, tests, and sells integrated circuits and other semiconductor devices in Taiwan, China, Europe, the Middle East, Africa, Japan, the United States, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026