- United States

- /

- Semiconductors

- /

- NYSE:NPTN

If You Had Bought NeoPhotonics (NYSE:NPTN) Stock A Year Ago, You Could Pocket A 34% Gain Today

It might be of some concern to shareholders to see the NeoPhotonics Corporation (NYSE:NPTN) share price down 23% in the last month. Looking on the brighter side, the stock is actually up over twelve months. But to be blunt its return of 34% fall short of what you could have got from an index fund (around 39%).

See our latest analysis for NeoPhotonics

NeoPhotonics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

NeoPhotonics grew its revenue by 4.0% last year. That's not a very high growth rate considering it doesn't make profits. Over that time the share price gained a very modest 34%. It might be worth thinking about how long it will take the company to turn a profit.

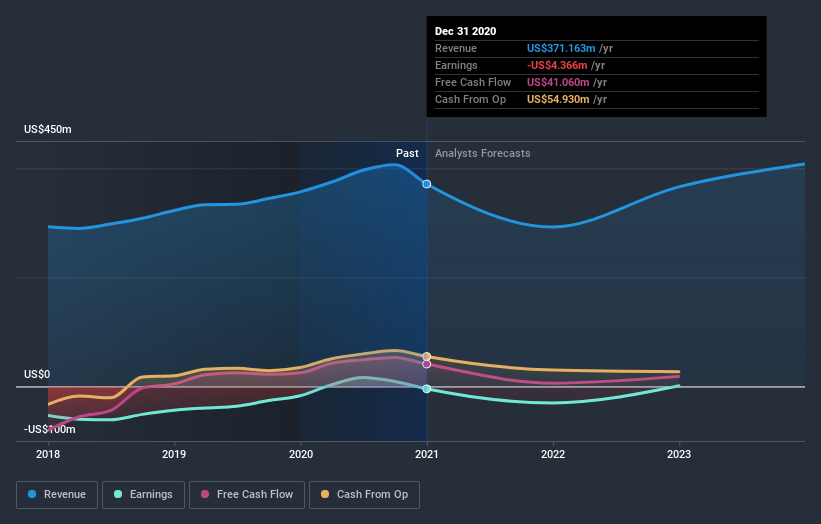

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

NeoPhotonics is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. If you are thinking of buying or selling NeoPhotonics stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

NeoPhotonics shareholders gained a total return of 34% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 5% endured over half a decade. It could well be that the business is stabilizing. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 3 warning signs for NeoPhotonics you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you decide to trade NeoPhotonics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if NeoPhotonics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NYSE:NPTN

NeoPhotonics

NeoPhotonics Corporation develops, manufactures, and sells optoelectronic products that transmit and receive high speed digital optical signals for cloud and hyperscale data center internet content provider and telecom networks.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives