- United States

- /

- Semiconductors

- /

- NYSE:JKS

Will Trinity Energy’s EAGLE G6 Project and Recycling Pact Shift JinkoSolar's (JKS) Sustainability Narrative?

Reviewed by Sasha Jovanovic

- Trinity Energy announced it has partnered with JinkoSolar to supply around 1,000 EAGLE G6 solar modules for a Costco Warehouse in Richland, Washington, with the project participating in the EAGLE Preserve recycling program.

- This marks Washington State's first approved solar stewardship initiative, ensuring sustainable recycling for end-of-life modules at no cost to Costco or Trinity Energy.

- We'll explore how JinkoSolar's leadership in solar sustainability with EAGLE Preserve could influence its investment outlook and industry position.

The end of cancer? These 27 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

JinkoSolar Holding Investment Narrative Recap

For investors in JinkoSolar, the central belief is that global demand for efficient, sustainable solar solutions will continue to grow, and that the company’s focus on both product innovation and environmental stewardship positions it well for future gains. The recent EAGLE G6 module supply for Costco and Washington’s first approved solar recycling initiative demonstrates progress in sustainability, but has only a modest impact on near-term catalysts like improving shipment mix and profitability. The most pressing risk remains U.S. trade policy uncertainty, which continues to weigh on margins and overseas shipments.

Among recent announcements, JinkoSolar’s Memorandum of Understanding to supply 200 MW of Tiger Neo modules in Ireland aligns closely with the push into high-margin overseas markets, a key potential growth driver. Expanding beyond the U.S. and China, and focusing on regions pursuing aggressive renewable targets, continues to be integral to the company’s catalyst of market share growth through premium, high-power products.

However, despite these gains in sustainability, investors should be aware that when tariffs and policy shifts in the U.S. disrupt shipments and pressure pricing...

Read the full narrative on JinkoSolar Holding (it's free!)

JinkoSolar Holding's narrative projects CN¥124.9 billion revenue and CN¥382.9 million earnings by 2028. This requires 14.6% yearly revenue growth and an earnings increase of about CN¥2.3 billion from current earnings of CN¥-1.9 billion.

Uncover how JinkoSolar Holding's forecasts yield a $33.52 fair value, a 48% upside to its current price.

Exploring Other Perspectives

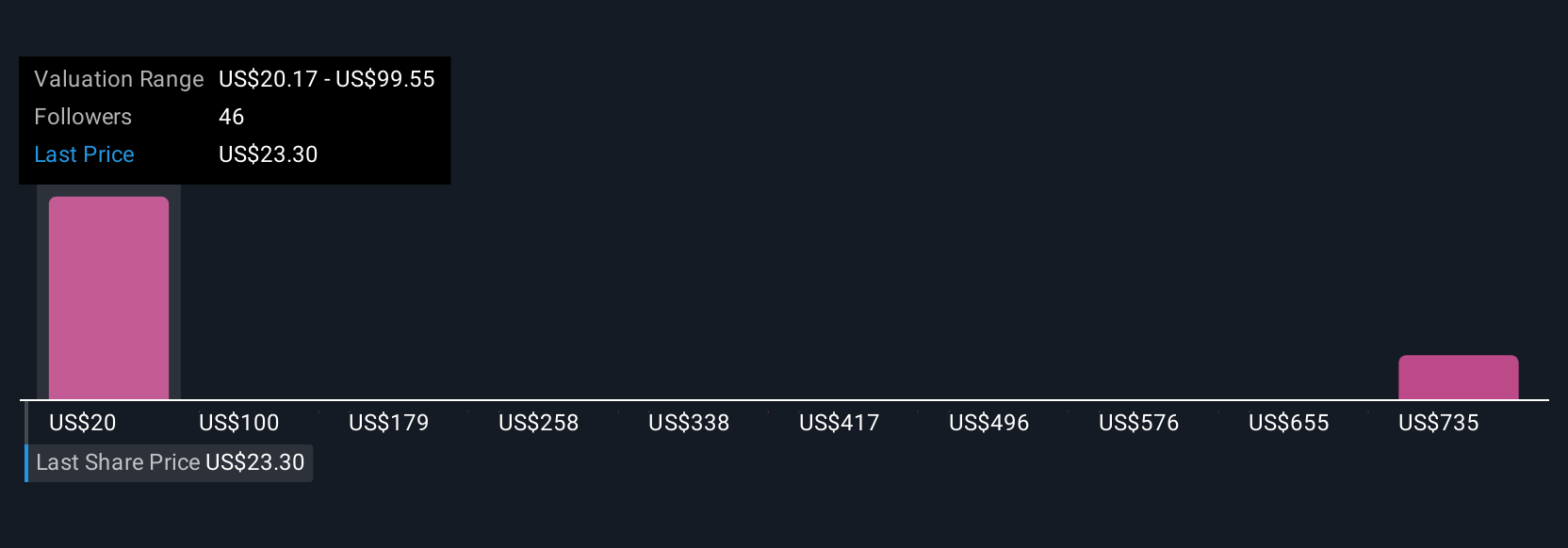

Four Simply Wall St Community members provided fair value estimates for JinkoSolar ranging from US$20.17 to US$175.31 per share, reflecting widely varied viewpoints. While many see opportunity in JinkoSolar’s supply chain optimizations and premium product focus, ongoing U.S. trade risks could shape future outcomes quite differently, so consider the full spectrum of perspectives when evaluating your next steps.

Explore 4 other fair value estimates on JinkoSolar Holding - why the stock might be worth 11% less than the current price!

Build Your Own JinkoSolar Holding Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your JinkoSolar Holding research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free JinkoSolar Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate JinkoSolar Holding's overall financial health at a glance.

Searching For A Fresh Perspective?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:JKS

JinkoSolar Holding

Engages in the design, development, production, and marketing of photovoltaic products.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives