- United States

- /

- Semiconductors

- /

- NasdaqCM:DVLT

The Summit Wireless Technologies (NASDAQ:WISA) Share Price Is Down 84% So Some Shareholders Are Rather Upset

Even the best investor on earth makes unsuccessful investments. But it's not unreasonable to try to avoid truly shocking capital losses. We wouldn't blame Summit Wireless Technologies, Inc. (NASDAQ:WISA) shareholders if they were still in shock after the stock dropped like a lead balloon, down 84% in just one year. That'd be a striking reminder about the importance of diversification. We wouldn't rush to judgement on Summit Wireless Technologies because we don't have a long term history to look at. Furthermore, it's down 29% in about a quarter. That's not much fun for holders.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for Summit Wireless Technologies

Given that Summit Wireless Technologies didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Summit Wireless Technologies grew its revenue by 24% over the last year. We think that is pretty nice growth. Unfortunately, the market wanted something better, given it sent the share price 84% lower during the year. It could be that the losses are too much for investors to handle without losing their nerve. It seems that the market has concerns about the future, because that share price action does not seem to reflect the revenue growth at all.

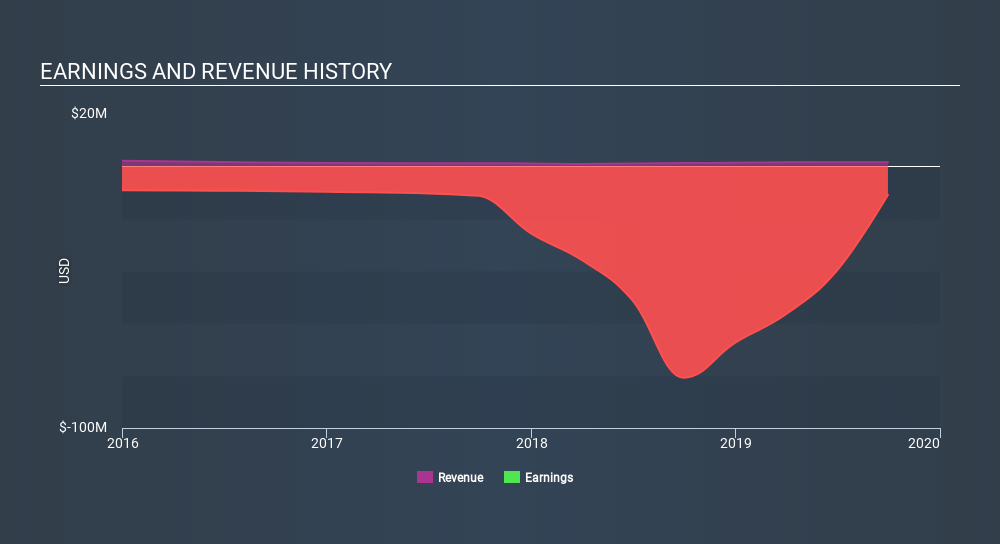

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

This free interactive report on Summit Wireless Technologies's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

While Summit Wireless Technologies shareholders are down 84% for the year, the market itself is up 20%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 29% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. It's always interesting to track share price performance over the longer term. But to understand Summit Wireless Technologies better, we need to consider many other factors. For example, we've discovered 6 warning signs for Summit Wireless Technologies (of which 2 are major) which any shareholder or potential investor should be aware of.

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqCM:DVLT

Datavault AI

A data sciences technology company, owns and operates data management platforms by supercomputing capabilities in the North America, Asia Pacific, Europe, and internationally.

Moderate with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives