- United States

- /

- Semiconductors

- /

- NasdaqGS:VECO

Veeco Instruments (VECO): Reassessing Valuation After Major Optical Communications Order and AI-Driven Demand Signals

Reviewed by Kshitija Bhandaru

Veeco Instruments (VECO) has just secured a substantial order from a top optical communications laser supplier for its Lumina metal organic chemical vapor deposition systems. These tools will drive production of indium phosphide lasers, which support data center growth fueled by AI applications.

See our latest analysis for Veeco Instruments.

Veeco’s string of wins in the optical communications space, including the recent expansion order and the launch of its Lumina+ platform with Rocket Lab, has fueled optimism about its outlook. That wave of positive momentum shows in the numbers: the 90-day share price return is a stellar 37%. However, recent gains have not fully erased the past year’s total return decline of 4%. Still, longer-term total shareholder returns remain robust, up 64% over three years and more than doubling over five.

If the sector’s accelerating innovation has you thinking bigger, it could be the right moment to discover See the full list for free.

With Veeco shares rebounding and new orders strengthening its growth story, investors now face a key question: is the stock trading at a bargain, or is the market already anticipating all the future upside?

Most Popular Narrative: Fairly Valued

The current fair value in the most widely followed narrative is just above the last close, suggesting the market has largely priced in analyst expectations. Here is the key catalyst highlighted in the narrative driving this view:

Current investor sentiment may be overestimating the sustained demand and revenue growth from advanced semiconductor manufacturing equipment. Macroeconomic uncertainty, reduced capital expenditure from major chipmakers, and the risk of global trade tensions, including potential recurring tariffs and regulatory barriers, particularly in China, could materially slow new orders and end-market growth. This could lead to more volatile top-line results in coming years.

This consensus puts big faith in accelerating top-line results. But what assumptions are truly baked into that number? Earnings, margins, and a future profit multiple that will raise some eyebrows come together here. Curious which hidden levers define this fair value? The full narrative breaks down the critical projections that could surprise even seasoned investors.

Result: Fair Value of $29.40 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected breakthroughs in AI adoption or accelerating demand in emerging markets could quickly shift Veeco's growth outlook and render current forecasts inaccurate.

Find out about the key risks to this Veeco Instruments narrative.

Another View: Looking Through a Different Lens

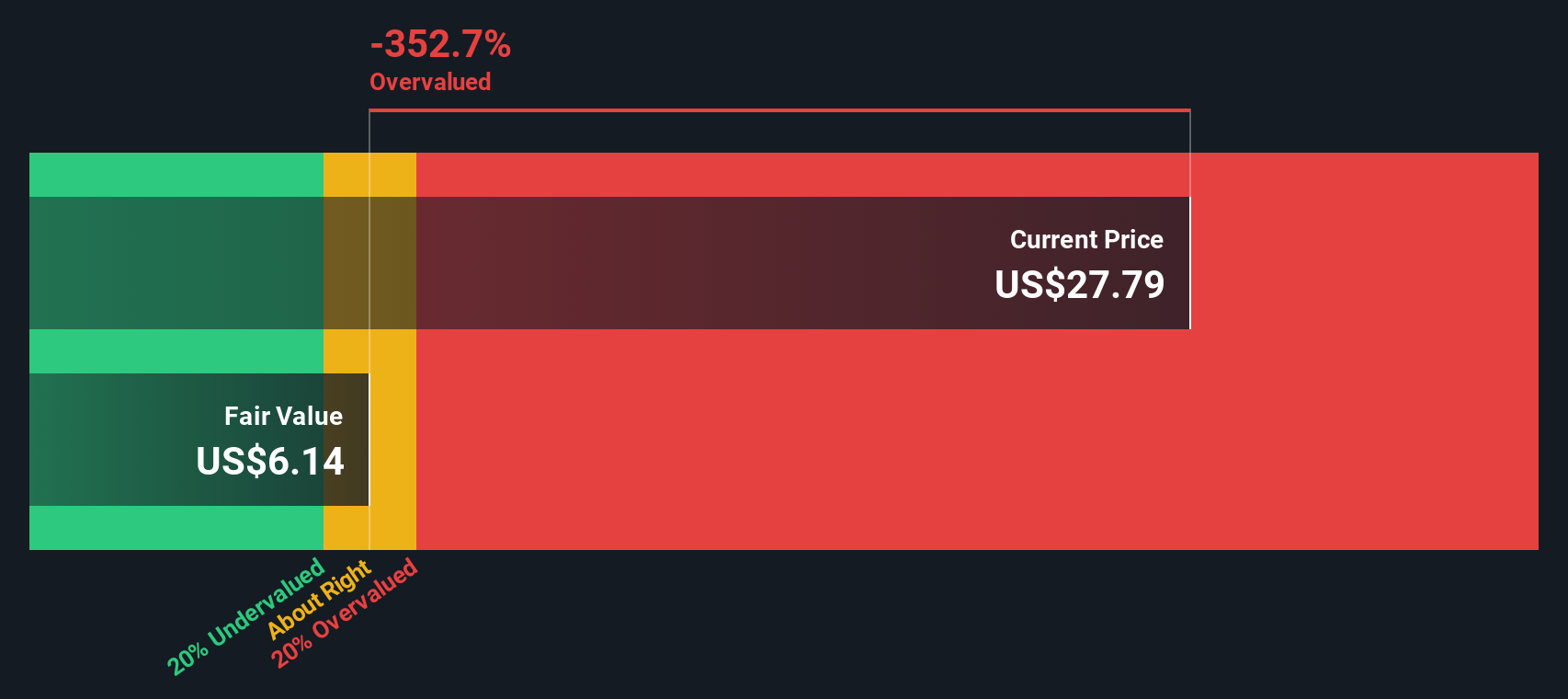

Our SWS DCF model estimates Veeco’s fair value at just $6.20, which is far below the recent share price. This method suggests the market might be too optimistic about future cash flows and margins. Is the market right to look past these risks, or could expectations be overly ambitious?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Veeco Instruments for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Veeco Instruments Narrative

If you see the story unfolding differently or want to dig deeper into the numbers yourself, you can craft your own take in just a few minutes. Do it your way

A great starting point for your Veeco Instruments research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Angles?

Expand your watchlist with high-potential ideas you might be overlooking. Act now to get ahead of shifting market trends and spot opportunities others will miss.

- Unlock steady income and long-term financial strength by checking out these 20 dividend stocks with yields > 3%, which features companies with attractive yields and robust track records.

- Seize the chance to invest early in game-changing startups by scanning these 3577 penny stocks with strong financials, combining strong financials with significant growth potential.

- Ride the next surge in digital innovation by reviewing these 79 cryptocurrency and blockchain stocks to see which businesses are leading with blockchain solutions and crypto strategies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VECO

Veeco Instruments

Develops, manufactures, sells, and supports semiconductor and thin film process equipment primarily to make electronic devices.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives