The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in TOYO (NASDAQ:TOYO). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is TOYO Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's no surprise that some investors are more inclined to invest in profitable businesses. It is awe-striking that TOYO's EPS went from US$0.24 to US$0.99 in just one year. Even though that growth rate may not be repeated, that looks like a breakout improvement. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

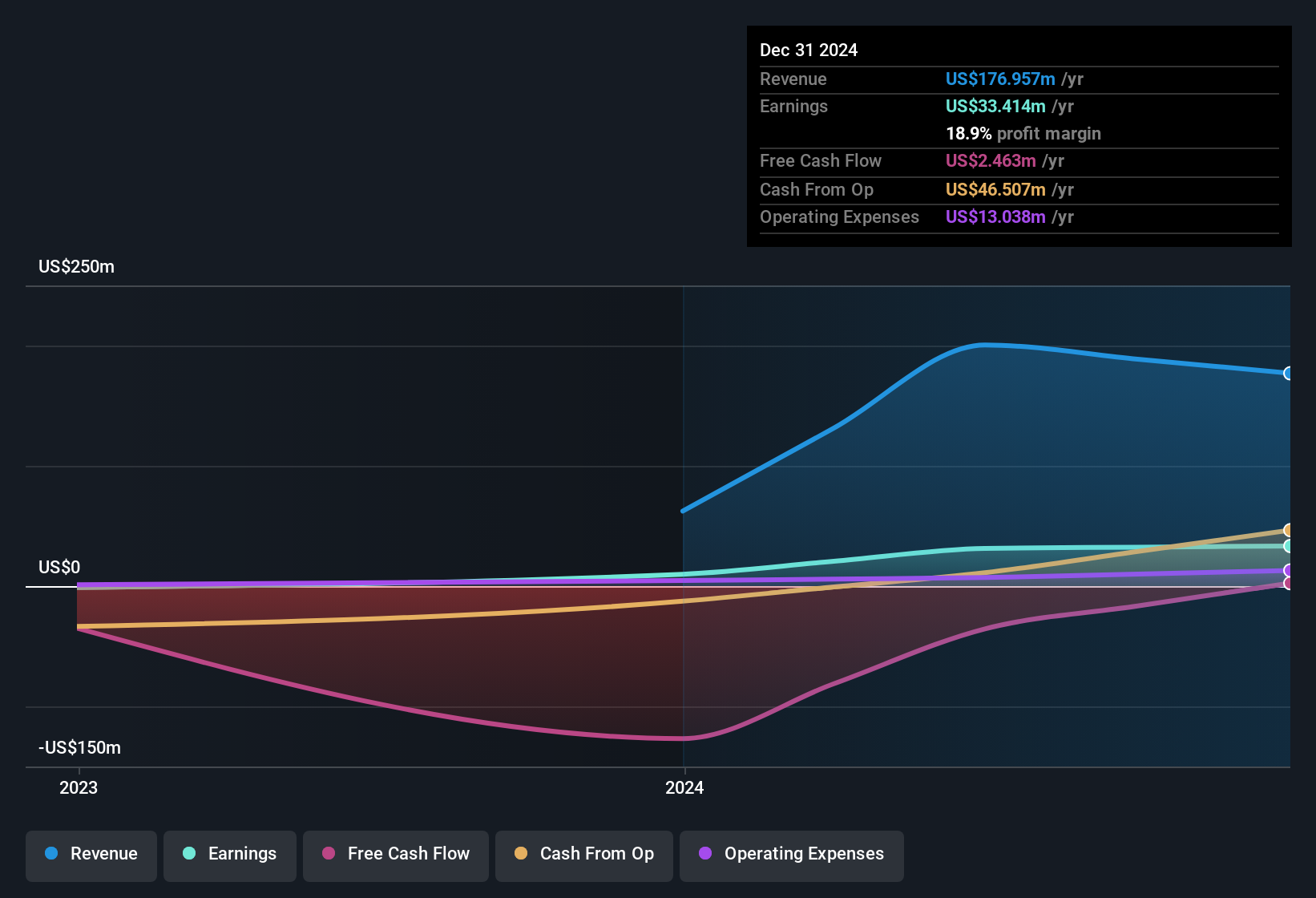

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the revenue front, TOYO has done well over the past year, growing revenue by 184% to US$177m but EBIT margin figures were less stellar, seeing a decline over the last 12 months. If EBIT margins are able to stay balanced and this revenue growth continues, then we should see brighter days ahead.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Check out our latest analysis for TOYO

Since TOYO is no giant, with a market capitalisation of US$177m, you should definitely check its cash and debt before getting too excited about its prospects.

Are TOYO Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. TOYO followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. To be specific, they have US$17m worth of shares. This considerable investment should help drive long-term value in the business. That amounts to 9.8% of the company, demonstrating a degree of high-level alignment with shareholders.

Should You Add TOYO To Your Watchlist?

TOYO's earnings have taken off in quite an impressive fashion. That sort of growth is nothing short of eye-catching, and the large investment held by insiders should certainly brighten the view of the company. The hope is, of course, that the strong growth marks a fundamental improvement in the business economics. So at the surface level, TOYO is worth putting on your watchlist; after all, shareholders do well when the market underestimates fast growing companies. We should say that we've discovered 3 warning signs for TOYO (2 don't sit too well with us!) that you should be aware of before investing here.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in the US with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if TOYO might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:TOYO

TOYO

Engages in the upstream production of wafer and silicon, midstream production of solar cell, downstream production of photovoltaic (PV) modules, and other stages of the solar power supply chain in Asia and the United States.

Moderate risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives