- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

Will Analysts' Stable Outlook on TER Signal Resilience or Missed Momentum in Automation and AI?

Reviewed by Simply Wall St

- Teradyne announced its second-quarter earnings results after market close last Tuesday, with analysts expecting a 10.9% year-over-year revenue decline to US$650.5 million, reversing last year’s growth trend.

- While most peers in the semiconductor sector reported upbeat results, analysts on Teradyne mostly reaffirmed their estimates ahead of the release, highlighting industry uncertainty and a focus on stability over near-term gains.

- We’ll explore how anticipation of declining revenue shapes Teradyne’s broader investment narrative and outlook for growth in automation and AI.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Teradyne Investment Narrative Recap

To be a Teradyne shareholder, it helps to have conviction in the company’s long-term growth prospects in automation, AI-driven testing, and advanced robotics, even through sector swings and revenue headwinds. The latest expected Q2 revenue decline of 10.9% year-over-year has not materially changed Teradyne’s primary short-term catalysts, including its focus on new AI and semiconductor testing platforms, but it has heightened attention on risks like limited visibility beyond the quarter and ongoing geopolitical uncertainties that could impact demand or margins.

One recent development with direct relevance to these catalysts is Teradyne’s partnership with ficonTEC to deliver a high-volume wafer probe test cell for silicon photonics, announced in March. This move expands Teradyne’s capabilities in next-generation semiconductor testing, aligning with anticipated industry demand for AI accelerators and advanced chips, a key driver highlighted by analysts, even as near-term results reflect broader industry volatility.

Yet, despite new partnerships and product strength, the risk of unpredictable revenue and earnings projections, especially amid shifting global trade policies, is something every investor should watch, because while Teradyne’s long-term thesis is built on growth and innovation, uncertainty around ...

Read the full narrative on Teradyne (it's free!)

Teradyne's outlook projects $4.0 billion in revenue and $957.0 million in earnings by 2028. This requires an annual revenue growth rate of 11.4% and a $379.9 million increase in earnings from the current $577.1 million.

Uncover how Teradyne's forecasts yield a $96.69 fair value, a 6% upside to its current price.

Exploring Other Perspectives

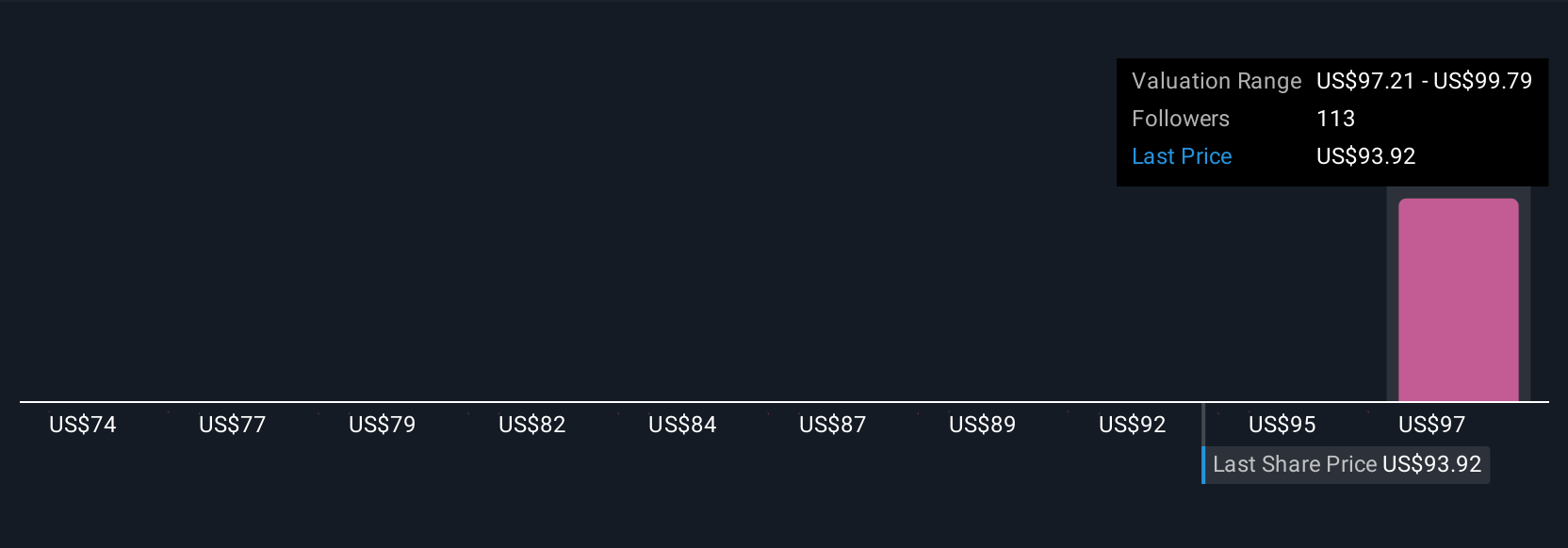

Four distinct fair value estimates from the Simply Wall St Community range between US$91.14 and US$96.90. With volatility ahead due to ongoing sector uncertainty, your view on Teradyne’s future may differ widely from others, explore how these differences might play a role in your own investment thinking.

Explore 4 other fair value estimates on Teradyne - why the stock might be worth just $91.14!

Build Your Own Teradyne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradyne research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Teradyne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradyne's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives