- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

Teradyne (TER) Is Up 14.5% After Q3 Earnings Beat and Upgraded Q4 Outlook – What's Changed

Reviewed by Sasha Jovanovic

- In the past week, Teradyne reported non-GAAP earnings of US$0.85 per share for the third quarter of 2025, exceeding analyst expectations, with revenues rising compared to last year.

- The company's higher-than-expected Q3 performance and robust Q4 guidance have prompted analysts to raise their estimates, reflecting a shift in investor confidence and outlook.

- We'll assess how Teradyne's improved Q4 guidance and strong earnings beat could impact the company's investment narrative moving forward.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Teradyne Investment Narrative Recap

Being a Teradyne shareholder today relies on the belief in ongoing demand for advanced semiconductor and robotics testing, as well as the company’s ability to capitalize on automation and AI themes. The latest earnings surprise and upbeat guidance reinforce near-term confidence, but geopolitical and trade policy uncertainty remain the most significant risks, these could quickly outweigh operational momentum if global conditions shift.

Among recent developments, Teradyne’s launch of the Titan HP SLT platform for AI and cloud customers stands out. Aligned with industry trends driving automation and AI compute, this product launch connects directly to the increasing short-term demand for more advanced test systems, the very catalyst underlying the strong Q4 outlook. But when considering the positive developments, investors should not overlook...

Read the full narrative on Teradyne (it's free!)

Teradyne's outlook anticipates $4.1 billion in revenue and $952.0 million in earnings by 2028. This is based on an assumed annual revenue growth rate of 13.2% and represents an earnings increase of $482.8 million from current earnings of $469.2 million.

Uncover how Teradyne's forecasts yield a $184.69 fair value, in line with its current price.

Exploring Other Perspectives

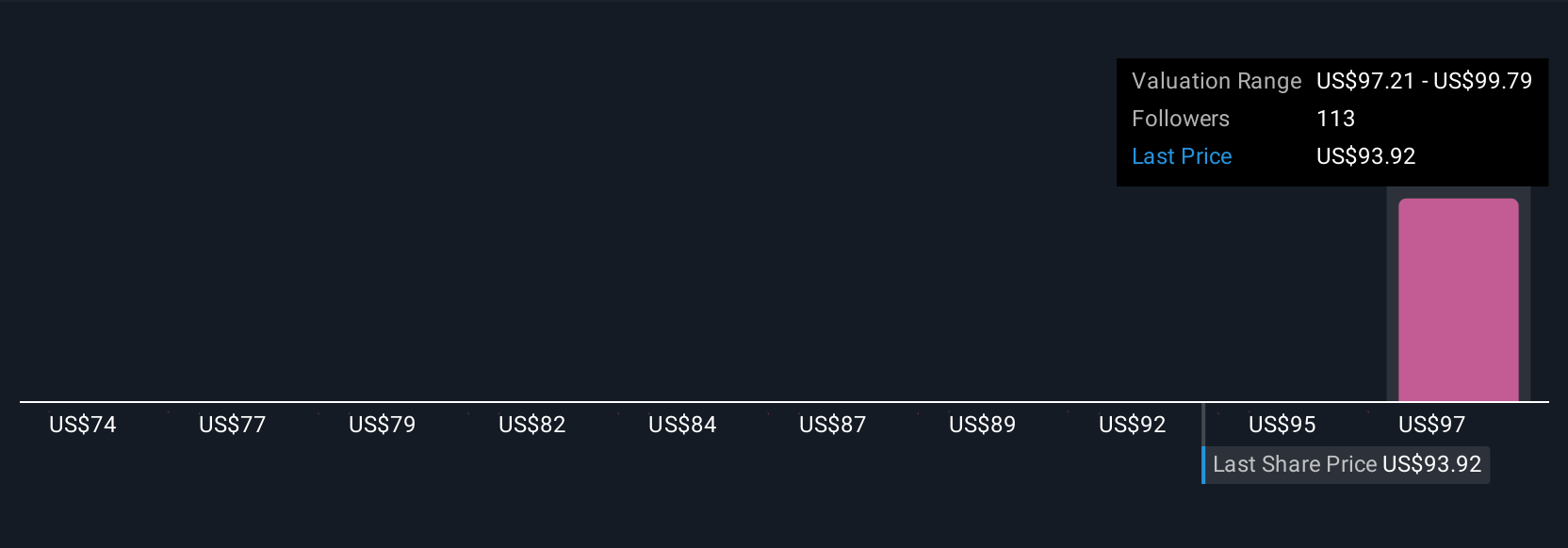

Private fair value estimates from 9 Simply Wall St Community members range from US$74 to US$184.69 per share. While many are optimistic about Teradyne’s automation focus, global trade policy risks could shift these outlooks, see how your view compares.

Explore 9 other fair value estimates on Teradyne - why the stock might be worth less than half the current price!

Build Your Own Teradyne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradyne research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Teradyne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradyne's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026