- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

Is Teradyne’s Recent 34% Rally Justified After Analyst Valuation Checks?

Reviewed by Bailey Pemberton

- Wondering if Teradyne is a real bargain or just getting swept up in the market buzz? You are in the right place for a clear look at what the numbers say about its true value.

- Teradyne’s stock has climbed an impressive 34.3% year-to-date, with a remarkable 66.5% gain over the last 12 months. However, it dipped 6.8% in the past week after a standout 20.5% jump during the past month.

- Recent headlines have highlighted industry-wide optimism around automation and semiconductor testing, which sent shares soaring through May. However, renewed concerns about tech sector valuations and shifting sentiment on interest rates led to some profit-taking in the latest week.

- Despite the excitement, Teradyne currently scores a 0 out of 6 on our valuation checklist, suggesting it is not undervalued against our usual benchmarks. We will break down why that is using several valuation approaches, and stick around until the end for a way to see the story from an even better angle.

Teradyne scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Teradyne Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by forecasting its future cash flows and discounting them back to today's value to reflect the time value of money. This approach helps investors determine what a business is truly worth, independent of current market sentiment.

For Teradyne, the most recent Free Cash Flow is $485.6 million. Based on analyst and in-house projections, annual free cash flow is expected to grow steadily, surpassing $1.2 billion by 2029. Analysts provide estimates for up to five years, after which projections are extrapolated. By 2035, cash flows could reach $1.76 billion.

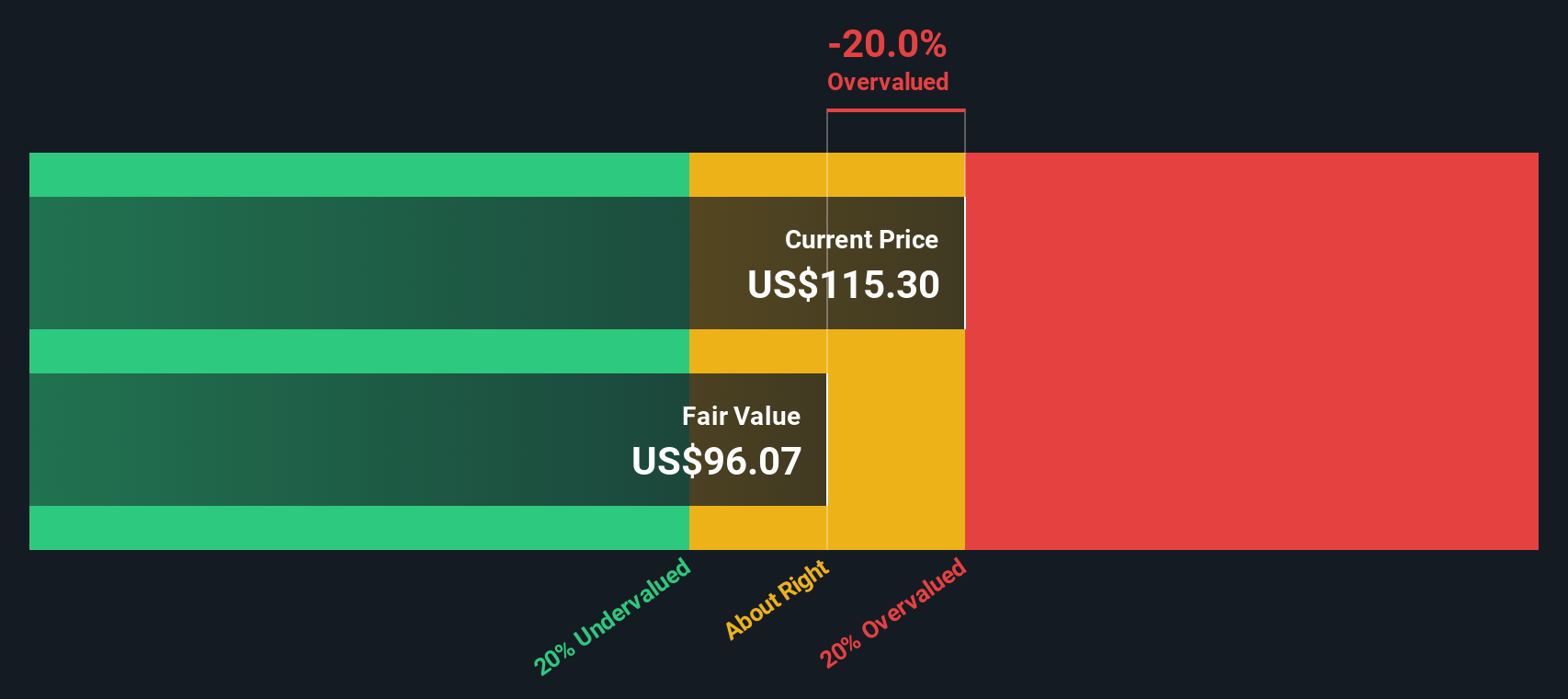

Using these forecasts, the DCF model calculates Teradyne's intrinsic value at $106.02 per share. Compared to its current market price, this intrinsic value suggests the stock is roughly 60.3% overvalued. This means investors are paying a significant premium over what the company's future cash generation appears to justify.

In summary, while Teradyne's growth prospects are promising, the DCF analysis indicates its shares are trading well above their calculated fair value right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Teradyne may be overvalued by 60.3%. Discover 879 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Teradyne Price vs Earnings

For companies like Teradyne that generate consistent profits, the Price-to-Earnings (PE) ratio is a widely used measure of valuation. The PE ratio helps investors gauge what they are paying today for each dollar of company earnings. This makes it especially useful for profitable businesses in established industries.

Typically, growth expectations and perceived risk play a significant role in determining what a “normal” or “fair” PE ratio should be. Higher growth prospects or more predictable earnings usually justify a premium multiple. Meanwhile, riskier or slower-growing companies tend to trade at lower multiples.

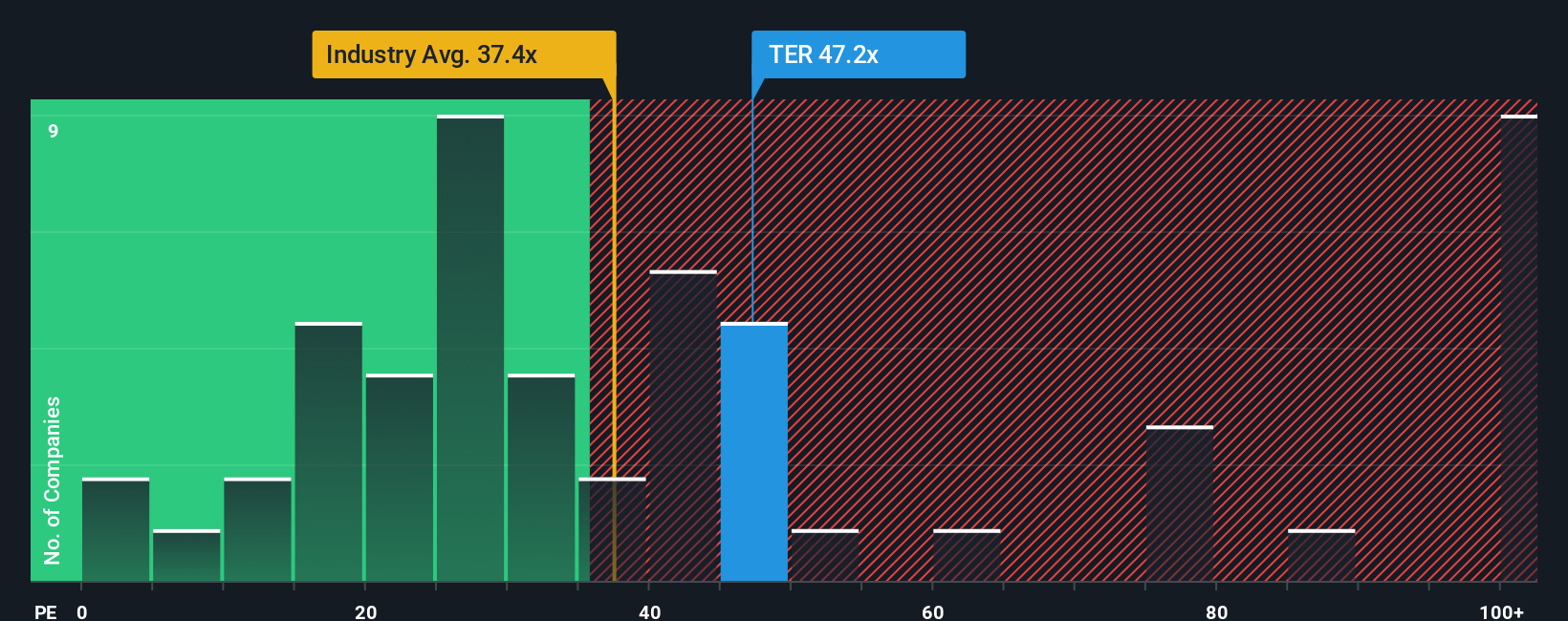

Currently, Teradyne trades at a PE ratio of 60.1x. This is considerably higher than both the semiconductor industry average of 34.0x and the average for its peers, which stands at 30.7x. On the surface, this premium might look steep.

However, Simply Wall St's proprietary "Fair Ratio" offers a more customized benchmark. At 37.9x, this Fair Ratio reflects factors unique to Teradyne, such as its earnings growth outlook, profit margins, size, industry specialty, and overall risk profile. Unlike a basic peer or industry comparison, this approach accounts for the company’s distinctive qualities and future potential.

Comparing the Fair Ratio and Teradyne’s actual PE, the stock trades well above what would be considered justified by its specific fundamentals and risks.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Teradyne Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives.

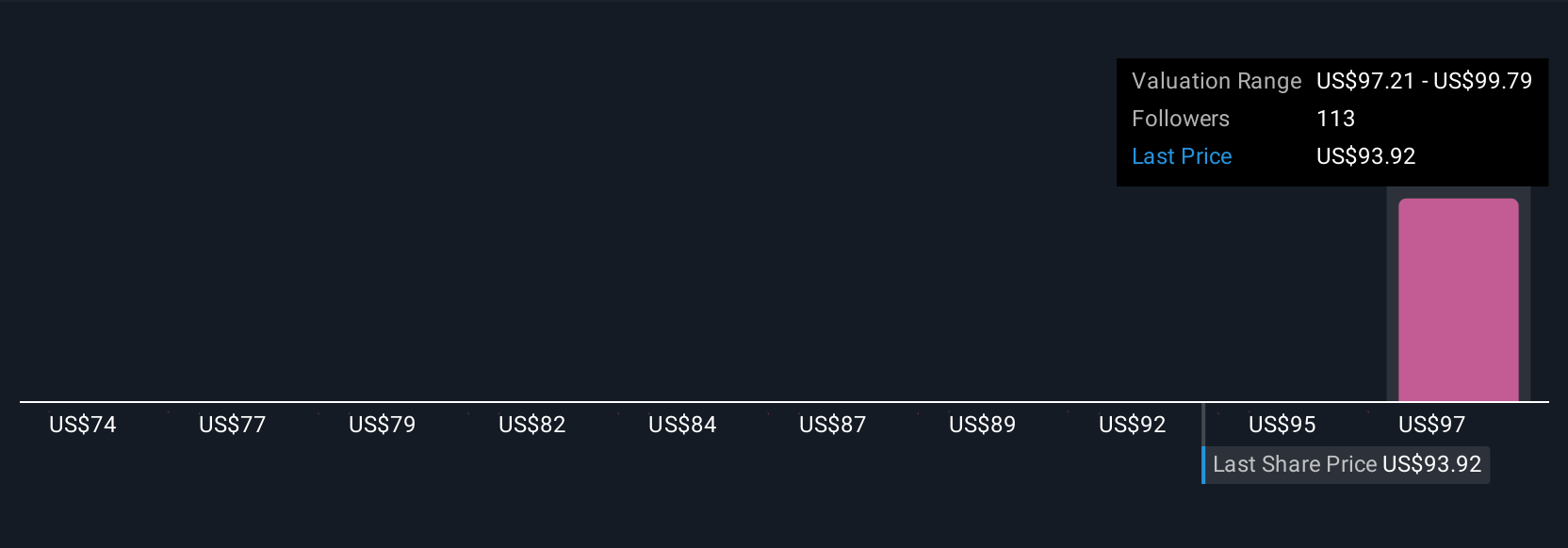

A Narrative is a simple, powerful story you create to explain your view of Teradyne, combining your own numbers and future assumptions about revenue, earnings, and margins to arrive at your personal estimate of fair value.

Unlike traditional ratios or checklists, Narratives link the business’s story with a financial forecast, helping you connect what you believe about a company’s future to what you think it’s actually worth today. This approach turns investing from a numbers game into a dynamic, personalized decision-making tool.

On Simply Wall St’s Community page, millions of investors use Narratives to track and share their reasoning, with updates flowing in automatically as new news or earnings reports shift the story and the underlying numbers. Narratives empower you to compare fair value to the current price instantly, guiding you on whether now is the right time to buy, hold, or sell based on your assumptions.

For example, some investors see Teradyne’s strategic moves in AI and robotics as a catalyst for rapid earnings growth and set bullish fair values above $130 per share, while others highlight macro risks and forecast prices as low as $85, showing that with Narratives, your decision always starts with your perspective.

Do you think there's more to the story for Teradyne? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives