- United States

- /

- Semiconductors

- /

- NasdaqGS:TER

Can Teradyne’s (TER) Dividend and Insider Sales Reveal Deeper Shifts in Management Strategy?

Reviewed by Sasha Jovanovic

- Earlier this week, Teradyne announced a quarterly cash dividend of US$0.12 per share payable on December 17, 2025, to shareholders of record as of November 24, 2025, while company insiders reported continued selling activity and the CEO executed a pre-arranged sale of 1,108 shares.

- Analyst sentiment shifted positively after Teradyne reported quarterly financial results exceeding expectations and raised guidance, with firms highlighting surging demand in AI chip testing and industrial automation as major growth drivers.

- We'll examine how Teradyne's stronger guidance and rising analyst confidence may influence the company's outlook and investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Teradyne Investment Narrative Recap

To be a Teradyne shareholder, you really have to believe in long-term demand for AI-enabled chip testing and the ongoing expansion in industrial automation, both supported by significant near-term guidance increases and rising analyst optimism. While the recent quarterly dividend affirmation and insider selling are newsworthy, neither event is likely to materially affect the primary short-term catalyst, increasing orders in AI chip testing, nor do they offset the biggest ongoing risk: foreign trade policy uncertainty that could unsettle demand across mobile and industrial sectors.

Among Teradyne's latest announcements, the company's raised quarterly guidance stands out. This reflects current momentum in high-growth areas, notably AI test and industrial automation, areas now in sharper focus as analysts cite them as key revenue drivers. The forward-looking commentary from management aligns with consensus that strength in these sectors has rapidly become the biggest tailwind.

By contrast, investors should also be aware of how persistent trade and tariff risks could unexpectedly affect Teradyne's revenues and future outlook if...

Read the full narrative on Teradyne (it's free!)

Teradyne's outlook anticipates $4.1 billion in revenue and $952.0 million in earnings by 2028. This projection is based on a 13.2% annual revenue growth rate and a roughly $482.8 million increase in earnings from the current $469.2 million.

Uncover how Teradyne's forecasts yield a $172.62 fair value, in line with its current price.

Exploring Other Perspectives

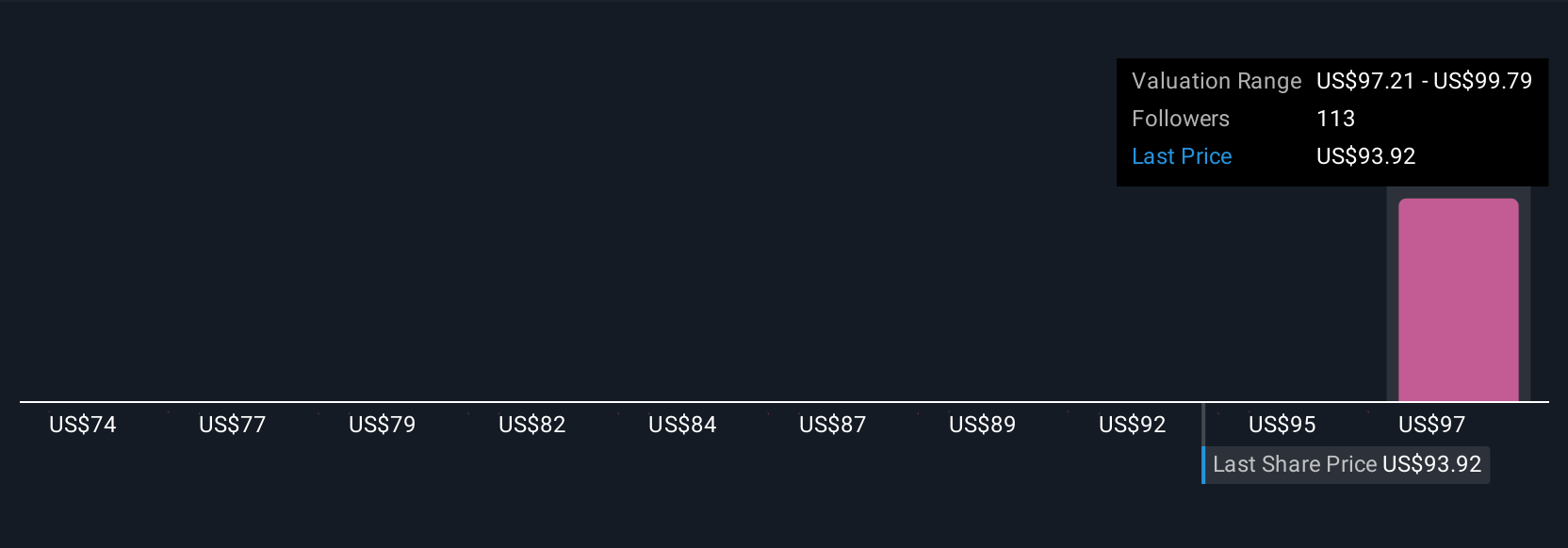

Eight different members of the Simply Wall St Community value Teradyne between US$74 and US$172, revealing a broad spectrum of opinions on the company's outlook. While expectations for AI-driven growth continue to gain traction, many readers will want to explore how variable demand and margin risks may impact these forecasts.

Explore 8 other fair value estimates on Teradyne - why the stock might be worth less than half the current price!

Build Your Own Teradyne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teradyne research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Teradyne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teradyne's overall financial health at a glance.

No Opportunity In Teradyne?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teradyne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TER

Teradyne

Designs, develops, manufactures, and sells automated test systems and robotics products in the United States, Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives