- United States

- /

- Semiconductors

- /

- NasdaqGS:SYNA

Synaptics (SYNA): Is the Recent Slide Creating an Undervalued Opportunity for Investors?

Reviewed by Simply Wall St

See our latest analysis for Synaptics.

This slide caps a stretch of cooling momentum for Synaptics, as the share price has retreated 27.44% year-to-date. This underscores a wider one-year total shareholder return of -17.51%. Despite earlier gains, the recent moves hint that investors are reassessing either growth prospects or new risks in the current environment.

If Synaptics’ ups and downs have you thinking about the market’s next opportunities, now’s an ideal time to broaden your search and discover fast growing stocks with high insider ownership.

With shares trading well below analyst targets and recent earnings showing declining profits, the central question is clear: is Synaptics undervalued, or is the market already factoring in all future prospects for growth?

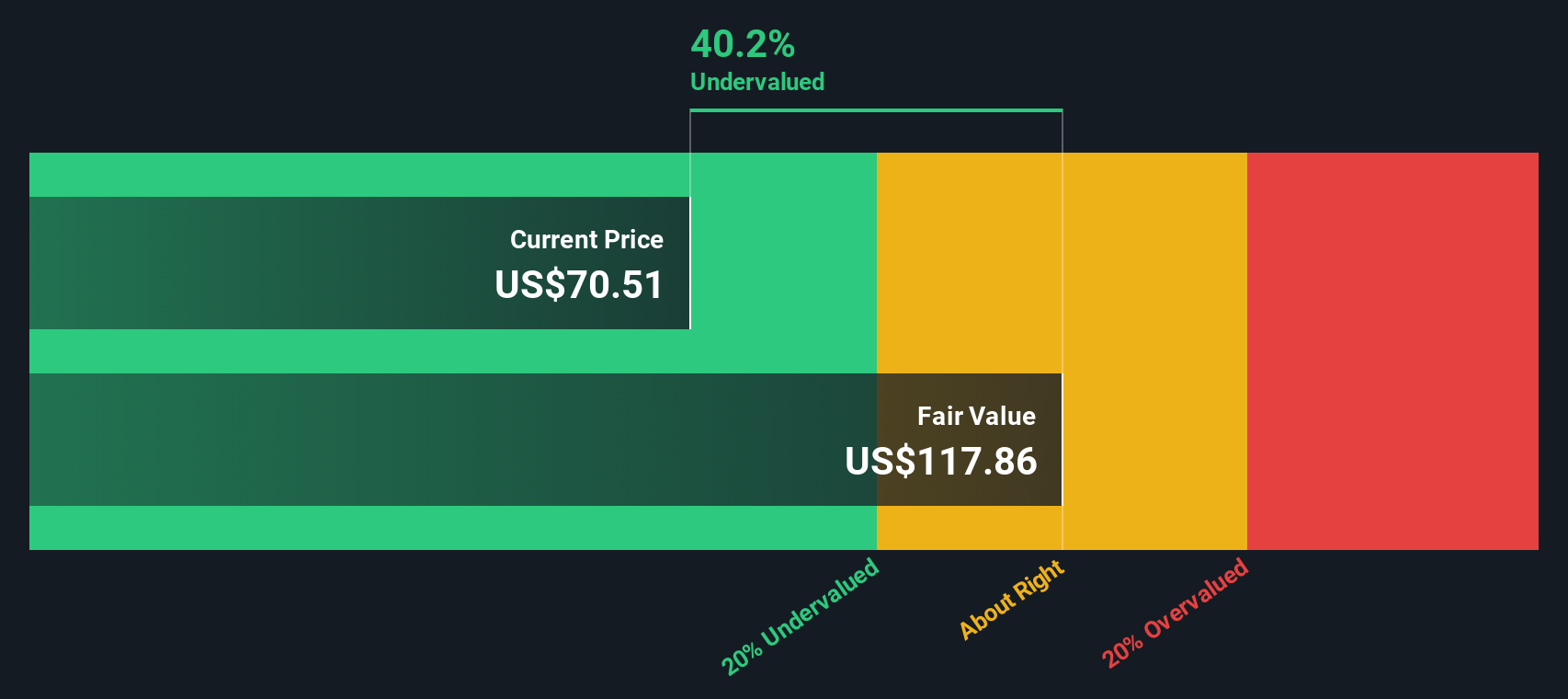

Most Popular Narrative: 27.2% Undervalued

With Synaptics last closing at $59.85 while the narrative’s fair value stands at $82.25, the current price is well below what analysts expect based on future earnings potential. This significant discount suggests some believe Synaptics has not fully priced in its next growth phase.

The company’s strategy to bundle highly integrated solutions combining wireless connectivity, low-power mixed-signal processing, and embedded AI/software content is expected to increase silicon content per device and drive higher gross margins as more revenue is captured per customer design win.

What’s powering this valuation? Behind the headline price are bold projections for Synaptics’s margins and revenue, mixed with ambitious assumptions on scaling next-gen product demand. If you want to uncover the financial forecasts and growth targets that pundits believe could ignite Synaptics’s value, the full narrative reveals what’s fueling this dramatic upside case.

Result: Fair Value of $82.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, uncertainty remains if execution falters or competitive pressures intensify. This could limit Synaptics's revenue growth and margin gains ahead.

Find out about the key risks to this Synaptics narrative.

Another View: Evaluating with the SWS DCF Model

While analyst consensus sees Synaptics as undervalued based on future growth assumptions, the SWS DCF model takes a more conservative stance. According to our DCF estimate, Synaptics is actually trading above its intrinsic fair value of $53.25, which suggests the current price may reflect more optimism than caution. Which story will the market eventually believe?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Synaptics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 904 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Synaptics Narrative

If you see Synaptics differently or want to dig deeper into the numbers, you can quickly craft your own perspective based on the data. Do it your way

A great starting point for your Synaptics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Missing these opportunities could mean leaving potential gains on the table. Steer your portfolio toward new growth by checking out these tailored stock ideas:

- Secure income today and long-term stability with these 18 dividend stocks with yields > 3% boasting yields above 3% from well-established companies.

- Tap into radical shifts in computing by accessing these 26 quantum computing stocks leading the charge in transformative quantum technology.

- Ride the wave of innovation with these 27 AI penny stocks positioned at the forefront of artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYNA

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives