- United States

- /

- Semiconductors

- /

- NasdaqGS:SWKS

There's Reason For Concern Over Skyworks Solutions, Inc.'s (NASDAQ:SWKS) Massive 25% Price Jump

Those holding Skyworks Solutions, Inc. (NASDAQ:SWKS) shares would be relieved that the share price has rebounded 25% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 29% in the last twelve months.

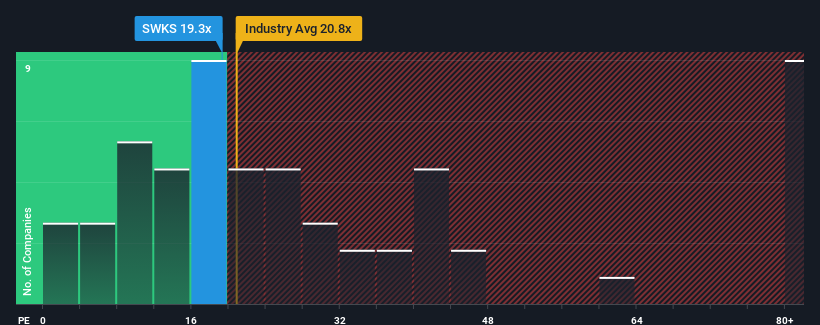

In spite of the firm bounce in price, there still wouldn't be many who think Skyworks Solutions' price-to-earnings (or "P/E") ratio of 19.3x is worth a mention when the median P/E in the United States is similar at about 17x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

We've discovered 2 warning signs about Skyworks Solutions. View them for free.While the market has experienced earnings growth lately, Skyworks Solutions' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Skyworks Solutions

How Is Skyworks Solutions' Growth Trending?

There's an inherent assumption that a company should be matching the market for P/E ratios like Skyworks Solutions' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 42% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 59% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 4.6% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the market is forecast to expand by 10% each year, which is noticeably more attractive.

In light of this, it's curious that Skyworks Solutions' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of earnings growth is likely to weigh down the shares eventually.

The Key Takeaway

Skyworks Solutions appears to be back in favour with a solid price jump getting its P/E back in line with most other companies. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Skyworks Solutions currently trades on a higher than expected P/E since its forecast growth is lower than the wider market. Right now we are uncomfortable with the P/E as the predicted future earnings aren't likely to support a more positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Skyworks Solutions has 2 warning signs we think you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SWKS

Skyworks Solutions

Develops, manufactures, and markets analog and mixed-signal semiconductor products and solutions in the United States, Taiwan, China, South Korea, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives