- United States

- /

- Semiconductors

- /

- NasdaqGS:SWKS

Can Skyworks (SWKS) Redefine Its Competitive Edge With New Programmable Clock Technologies?

Reviewed by Sasha Jovanovic

- Skyworks Solutions recently announced a new lineup of ultra-low jitter programmable clocks, leveraging DSPLL® and BAW technology to address demanding requirements in next-generation wireline, wireless, and data center timing applications.

- This product portfolio introduces programmable features and ultra-low jitter performance, empowering system designers to efficiently tailor solutions for a wide range of high-growth connectivity markets.

- We will examine how Skyworks Solutions’ advanced programmable clocks and next-gen timing technologies may shift its long-term investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Skyworks Solutions Investment Narrative Recap

To believe in Skyworks Solutions as a shareholder, you need to have confidence in its ability to diversify beyond its heavy reliance on a single major customer, currently about 63% of revenue, by capitalizing on next-generation wireless connectivity demand. While the recent launch of ultra-low jitter programmable clocks expands Skyworks’ offerings in data center and infrastructure markets, this announcement does not materially change the company’s biggest short-term catalyst, which remains the rising RF content in advanced smartphones, or the highest risk, which is customer concentration.

Among the most interesting recent announcements, Skyworks Solutions introduced an executive severance and change-in-control benefits plan. While not directly related to its product launches, this updated plan aims to provide leadership continuity and stability, which could help the company manage transitions as it pushes further into infrastructure, IoT, and automotive markets, key areas tied to future growth catalysts.

By contrast, investors should stay focused on how customer concentration continues to shape Skyworks’ earnings profile…

Read the full narrative on Skyworks Solutions (it's free!)

Skyworks Solutions is expected to reach $4.1 billion in revenue and $520.7 million in earnings by 2028. This outlook assumes 1.0% annual revenue growth and an increase in earnings of about $124.5 million from the current $396.2 million.

Uncover how Skyworks Solutions' forecasts yield a $83.63 fair value, a 34% upside to its current price.

Exploring Other Perspectives

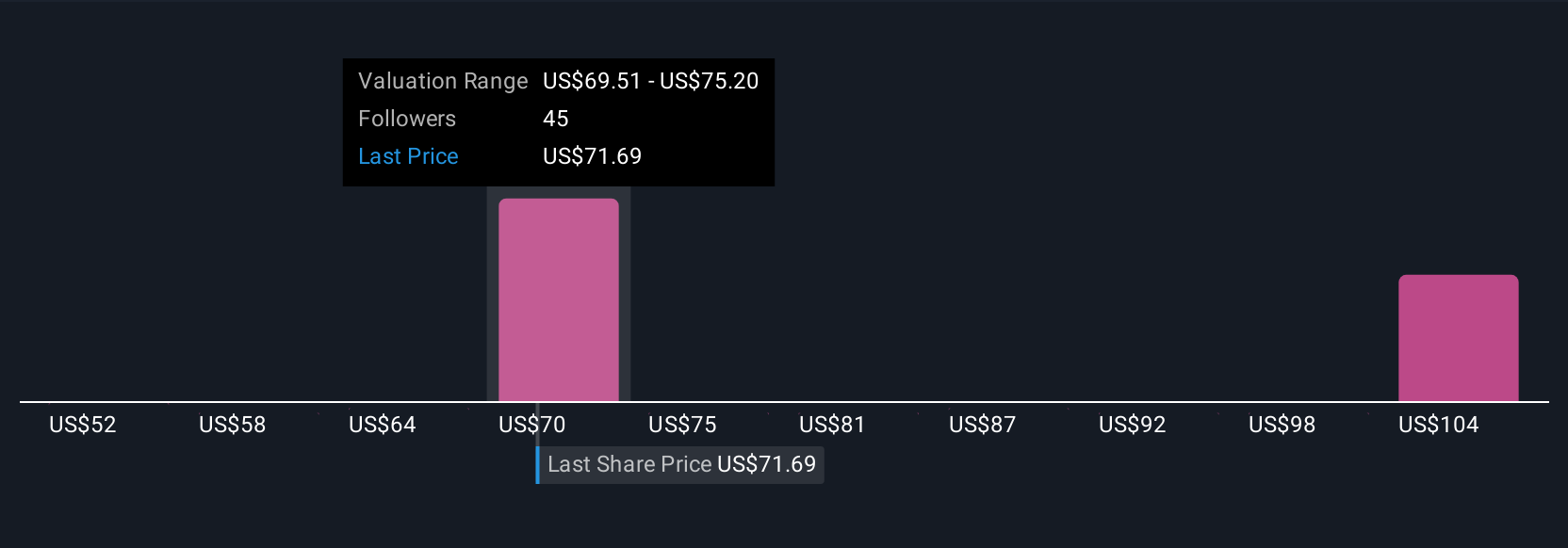

Fair value estimates from the Simply Wall St Community range from US$58 to US$88.52, reflecting four distinct viewpoints. With customer concentration still dominating revenue, consider how different opinions might affect your outlook on Skyworks’ next chapter.

Explore 4 other fair value estimates on Skyworks Solutions - why the stock might be worth 7% less than the current price!

Build Your Own Skyworks Solutions Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Skyworks Solutions research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Skyworks Solutions research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Skyworks Solutions' overall financial health at a glance.

Curious About Other Options?

Our top stock finds are flying under the radar-for now. Get in early:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SWKS

Skyworks Solutions

Develops, manufactures, and markets analog and mixed-signal semiconductor products and solutions in the United States, Taiwan, China, South Korea, Europe, the Middle East, Africa, and the Asia Pacific.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives