- United States

- /

- Semiconductors

- /

- NasdaqGS:SMTC

Semtech (SMTC) Valuation: Is There Still Upside After Recent Share Price Gains?

Reviewed by Simply Wall St

See our latest analysis for Semtech.

Semtech’s 1-year total shareholder return of 38% stands out among semiconductor peers and reflects real momentum that has accelerated further in the last 90 days with a 37% share price gain. Despite a small recent dip, investors clearly see growth potential building here.

If semiconductors’ latest surge has you thinking about what’s next, consider discovering See the full list for free.

But with Semtech trading just below analyst price targets and recent gains already factored in, the real question for investors is whether there is more upside ahead or if the market has already priced in future growth.

Most Popular Narrative: 2.7% Undervalued

At $69.89, Semtech’s share price sits just below what the most-followed narrative considers fair value, pointing to only modest upside potential. The narrative behind this figure leans heavily on growth in AI data centers and IoT, setting expectations high for the years ahead.

Rapid proliferation of IoT devices and smart infrastructure continues to expand Semtech's addressable market. Its leadership in LoRa technology and enhanced dual-band chips is unlocking new applications in industrial, smart city, asset tracking, drone delivery, and environmental monitoring, underpinning sustained long-term revenue growth and recurring higher-margin IP/licensing streams.

Curious what’s behind this bullish stance? The fair value hinges on bold forecasts for both bottom-line growth and expanding margins, driven by long-term bets on emerging technology. The true drivers might surprise you. Find out which metrics carry the most weight in shaping this outlook.

Result: Fair Value of $71.86 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, margin pressure from shifting product mix and challenges with integrating recent acquisitions could quickly dampen Semtech’s momentum if not addressed.

Find out about the key risks to this Semtech narrative.

Another View: DCF Model Tells a Different Story

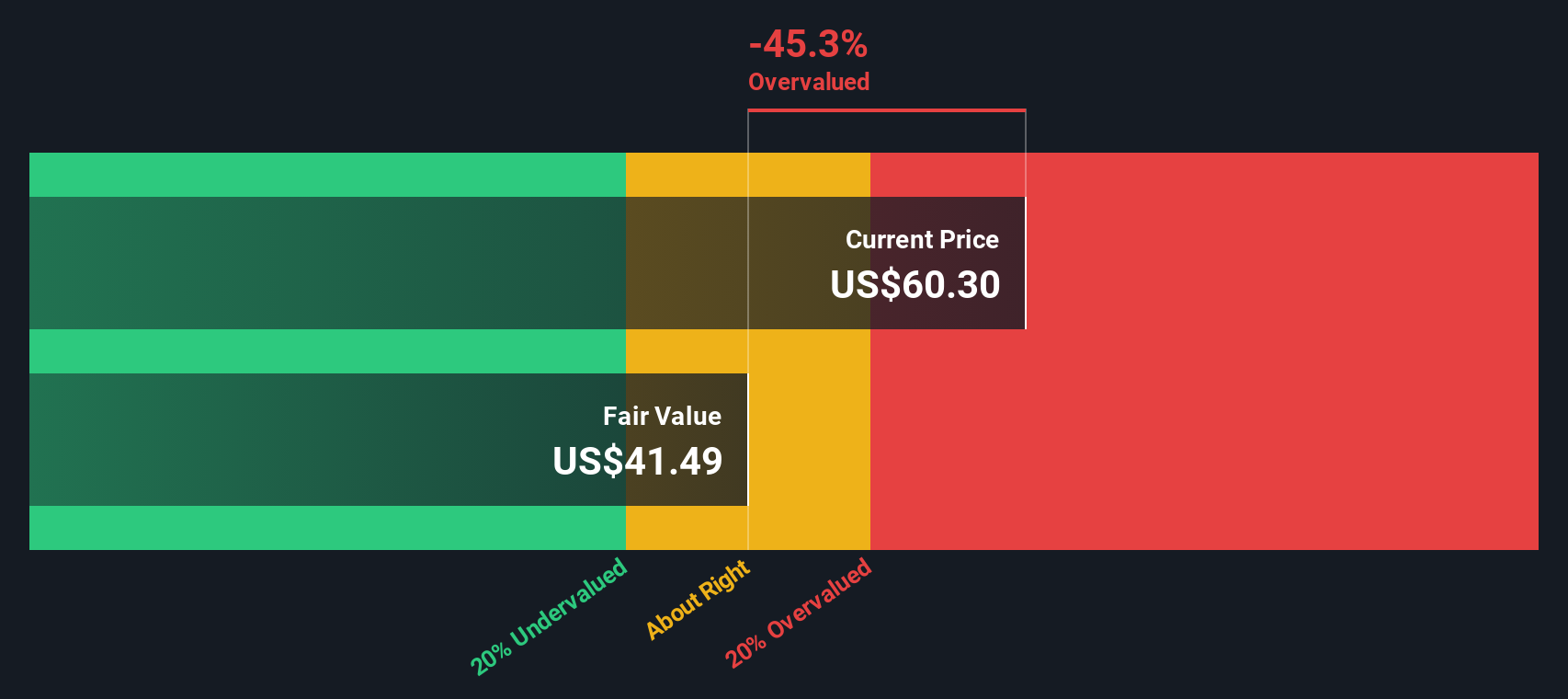

While multiples suggest Semtech is only modestly undervalued, our SWS DCF model points to a much lower fair value of $39.26. This implies the current share price may be running ahead of the stock’s fundamentals. Which outlook best captures the real risks and upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Semtech for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 853 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Semtech Narrative

If you see the story differently or want a hands-on look at the numbers, it takes just a few minutes to create your own perspective and shape the data your way. Do it your way.

A great starting point for your Semtech research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t wait for opportunity to come to you. Find your next big investment by tapping into these powerful screener tools every smart investor should know about:

- Unlock strong returns with reliable income by checking out these 18 dividend stocks with yields > 3%, which offers yields above 3% and robust payout histories.

- Catch the next tech wave early as you scan these 25 AI penny stocks, featuring companies pioneering artificial intelligence breakthroughs in dynamic, fast-moving markets.

- Spot exceptional value plays by scanning these 853 undervalued stocks based on cash flows, focusing on stocks priced below their intrinsic cash flow value and positioned for a breakout.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SMTC

Semtech

Provides semiconductor, Internet of Things systems, and cloud connectivity service solutions in the Asia- Pacific, North America, and Europe.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives