- United States

- /

- Semiconductors

- /

- NasdaqGS:SLAB

Silicon Labs (SLAB): Assessing Valuation as New Long-Range IoT Chip Targets Industrial Growth

Reviewed by Simply Wall St

If you follow Silicon Laboratories (SLAB), you probably spotted the company’s announcement this week about the FG23L wireless SoC landing later this month. It may not generate front-page buzz like a splashy acquisition, but for anyone watching the long-term push to dominate industrial IoT connectivity, the arrival of a cost-optimized, long-range chip is no small move. By positioning the FG23L as a tool for more affordable and secure large-scale deployments such as smart cities and industrial sensors, Silicon Labs is sending a clear message on where it sees the most exciting growth ahead.

This product launch comes amid an interesting stretch for Silicon Laboratories. The stock has seen steady gains, up roughly 21% over the past year and eking out a positive return so far this year even with a dip of nearly 3% over the past 3 months. It is clear momentum has cooled since earlier in the year, but upside drivers such as strong annual revenue growth and a newly sharpened focus on Sub-GHz markets keep the company squarely in analysts’ crosshairs. For investors, recent moves and the evolving competitive landscape are raising the stakes on whether the latest innovations will fuel the next leg of growth.

With that in mind, does this product push open the door for a bargain entry, or is the market already pricing in Silicon Labs’ bright IoT future?

Most Popular Narrative: 11.1% Undervalued

According to the most widely followed narrative, Silicon Laboratories' fair value is estimated to be 11.1% higher than its current share price. This suggests that the stock could be meaningfully undervalued if certain growth expectations are met.

The ongoing rollout of new, highly integrated, energy-efficient wireless platforms (Series 2 and Series 3) positions Silicon Labs to capture increased market share and supports higher average selling prices, which is likely to drive top-line growth and gross margin improvement. The growing adoption of battery-powered IoT and connected healthcare applications, enabled by the company's ultra-low-power wireless solutions, unlocks new, higher-value end markets and diversifies revenue streams. This supports improved earnings sustainability.

Curious why the fair value is set so high? One closely watched metric behind this target is tied to aggressive assumptions for revenue growth and future profitability. Just how optimistic are analysts about Silicon Labs' future earnings power and profit margins? The full narrative outlines bold financial projections that could change your view on what this company is really worth.

Result: Fair Value of $150.44 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition and industry-wide chip commoditization could challenge Silicon Labs’ ability to sustain higher margins and long-term revenue growth.

Find out about the key risks to this Silicon Laboratories narrative.Another View: Is the Stock Price Telling a Different Story?

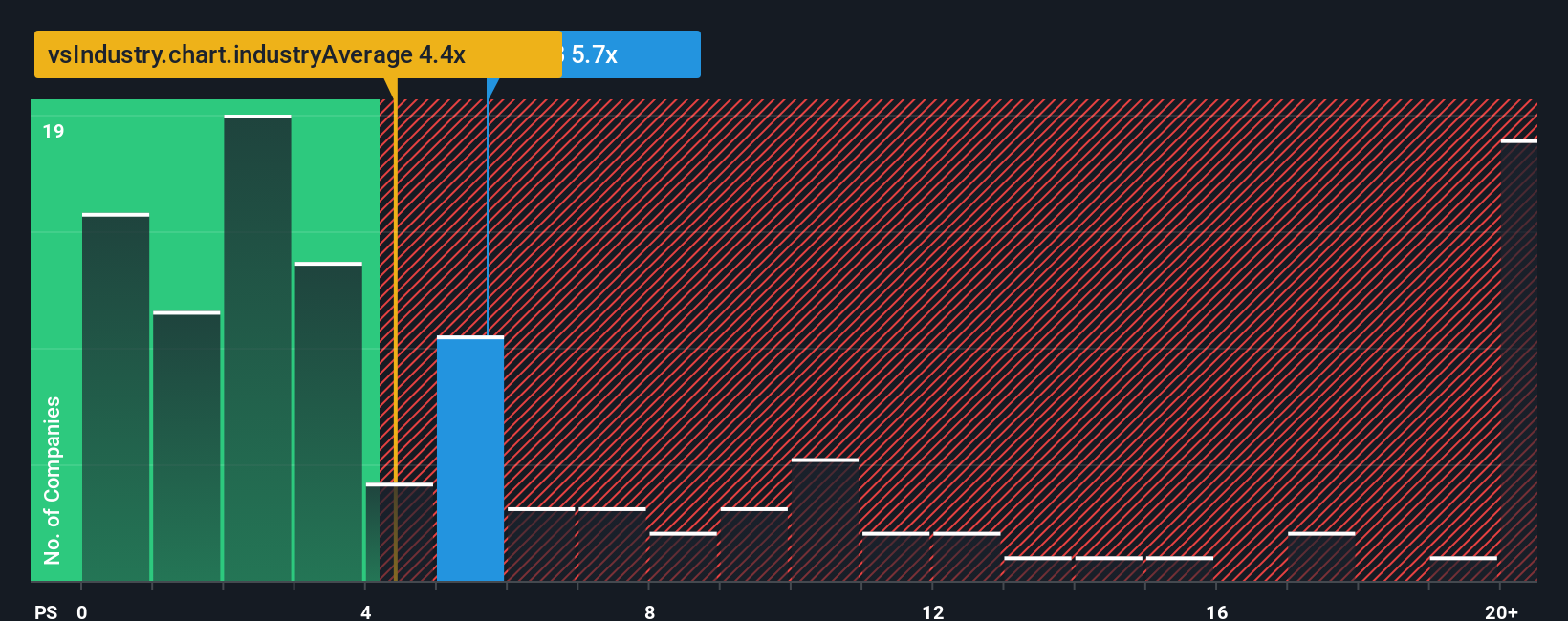

While analyst forecasts suggest Silicon Labs is undervalued, a look at price-to-sales versus the broader semiconductor industry paints a more expensive picture. Does this mean the growth narrative is already included, or is further upside possible?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Silicon Laboratories Narrative

If you have your own take or want to dig into the numbers yourself, you can craft a personal narrative in just a few minutes. Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Silicon Laboratories.

Looking for More Smart Investment Ideas?

Your next winning stock could be just a click away. Don't miss out on these unique opportunities curated for savvy investors seeking growth, innovation, or strong financial health.

- Find companies harnessing artificial intelligence to reshape core industries and unlock new value by checking out our AI penny stocks.

- Unearth hidden gems trading below their intrinsic value and see which names could be ready for a breakout with our undervalued stocks based on cash flows.

- Boost your income potential by spotting shares with robust dividends and yields above 3% using our dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLAB

Silicon Laboratories

A fabless semiconductor company, provides analog-intensive mixed-signal solutions in the United States, China, Taiwan, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives