- United States

- /

- Semiconductors

- /

- NasdaqCM:SKYT

Can SkyWater Technology's (SKYT) Delayed 10-Q Filing Reveal Deeper Challenges in Management Credibility?

Reviewed by Sasha Jovanovic

- On November 10, 2025, SkyWater Technology, Inc. announced that it would not be able to file its next 10-Q quarterly report by the deadline mandated by the SEC.

- This delay in regulatory filing often signals operational or financial complexities, which can heighten stakeholder scrutiny and raise questions about internal controls or business performance.

- We'll examine how the delayed 10-Q filing could impact SkyWater Technology's investment narrative amid heightened attention to transparency and risk.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

SkyWater Technology Investment Narrative Recap

To believe in SkyWater Technology as a shareholder, one must have conviction in its ability to turn recent acquisitions like Fab 25 and strategic partnerships into sustained revenue growth, while managing heavy capital requirements and exposure to government contract timing. The recent delay in filing its 10-Q does not appear to materially alter the company’s biggest near-term catalyst, growing demand tied to domestic chip supply, though it does highlight the ongoing risk of potential internal control or operational complexity disrupting investor confidence.

Of the recent announcements, the November 1, 2025, memorandum indicating $16 million in potential CHIPS for America funding for SkyWater’s Minnesota facility stands out as especially relevant. This initiative reinforces short-term optimism about the company’s positive cash inflows and supports its expansion ambitions, which is particularly impactful as investors weigh short-term catalysts versus risks linked to reporting delays and execution.

Yet, in contrast to the growth opportunities, investors should be mindful of ongoing gross margin compression and the integration hurdles with Fab 25 that...

Read the full narrative on SkyWater Technology (it's free!)

SkyWater Technology's outlook anticipates $804.6 million in revenue and $113.6 million in earnings by 2028. This is based on a yearly revenue growth rate of 40.6% and a $130.1 million increase in earnings from current earnings of -$16.5 million.

Uncover how SkyWater Technology's forecasts yield a $20.17 fair value, a 44% upside to its current price.

Exploring Other Perspectives

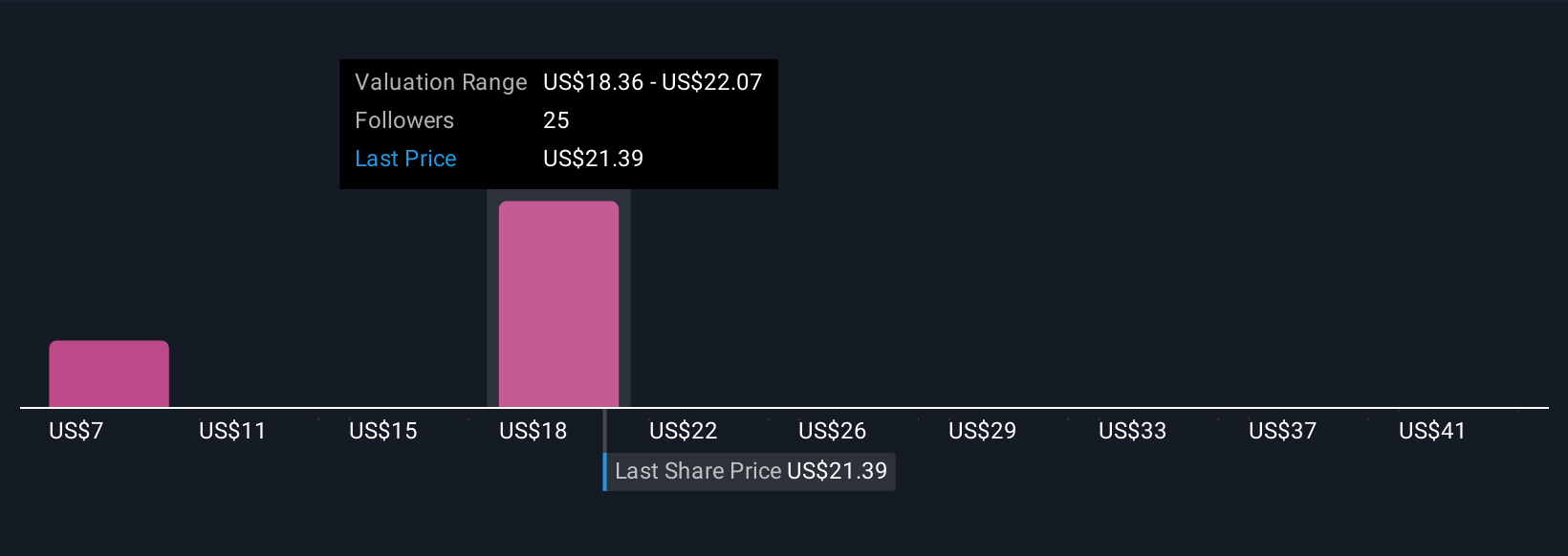

Simply Wall St Community members provided fair value estimates for SkyWater ranging from US$4.43 to US$44.30, with four distinct perspectives. While some focus on significant projected revenue growth, others highlight that margin pressure or delayed filings could introduce further variability in financial outcomes.

Explore 4 other fair value estimates on SkyWater Technology - why the stock might be worth less than half the current price!

Build Your Own SkyWater Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SkyWater Technology research is our analysis highlighting 4 key rewards and 5 important warning signs that could impact your investment decision.

- Our free SkyWater Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SkyWater Technology's overall financial health at a glance.

Searching For A Fresh Perspective?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SKYT

SkyWater Technology

Operates as a pure-play technology foundry that offers semiconductor development, manufacturing, and packaging services in the United States.

Moderate risk and fair value.

Similar Companies

Market Insights

Community Narratives