- United States

- /

- Semiconductors

- /

- NasdaqGM:SITM

Could SiTime’s (SITM) Board Appointment Hint at a New Strategic Focus in Tech Leadership?

Reviewed by Sasha Jovanovic

- On October 16, 2025, SiTime Corporation announced that Tom Yiu resigned as a director and was succeeded by Ganesh Moorthy, a highly experienced executive with leadership backgrounds at Microchip Technology and Ralliant Corporation.

- Moorthy’s appointment brings deep industry expertise to SiTime’s board, signaling an increased focus on executive leadership within the semiconductor and technology sectors.

- We’ll assess how Ganesh Moorthy’s board appointment could influence SiTime’s investment narrative and its positioning in fast-evolving markets.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

SiTime Investment Narrative Recap

To be a shareholder in SiTime, you have to believe in the company’s ability to stay ahead in precision timing for AI-driven data centers and next-generation infrastructure. The recent appointment of Ganesh Moorthy to the board, while significant for governance, does not materially alter the immediate risk of heavy customer concentration within AI data center demand or change the near-term catalyst tied to upcoming earnings and new product adoption.

The recent launch of SiTime’s Titan Platform, a next-generation MEMS resonator family aimed at expanding into wearables and IoT, closely aligns with the company’s core catalyst: broader end-market access and greater dollar content per device. While this innovation addresses diversification goals and expands future growth opportunities, customer concentration risk in the CED segment remains the company’s most pressing vulnerability in the short term.

By contrast, investors should be aware that any slowdown or strategic shift among hyperscaler customers could...

Read the full narrative on SiTime (it's free!)

SiTime's outlook projects $600.4 million in revenue and $15.9 million in earnings by 2028. This is based on a forecasted annual revenue growth rate of 32.9% and an earnings increase of $98.1 million from current earnings of -$82.2 million.

Uncover how SiTime's forecasts yield a $285.00 fair value, a 3% upside to its current price.

Exploring Other Perspectives

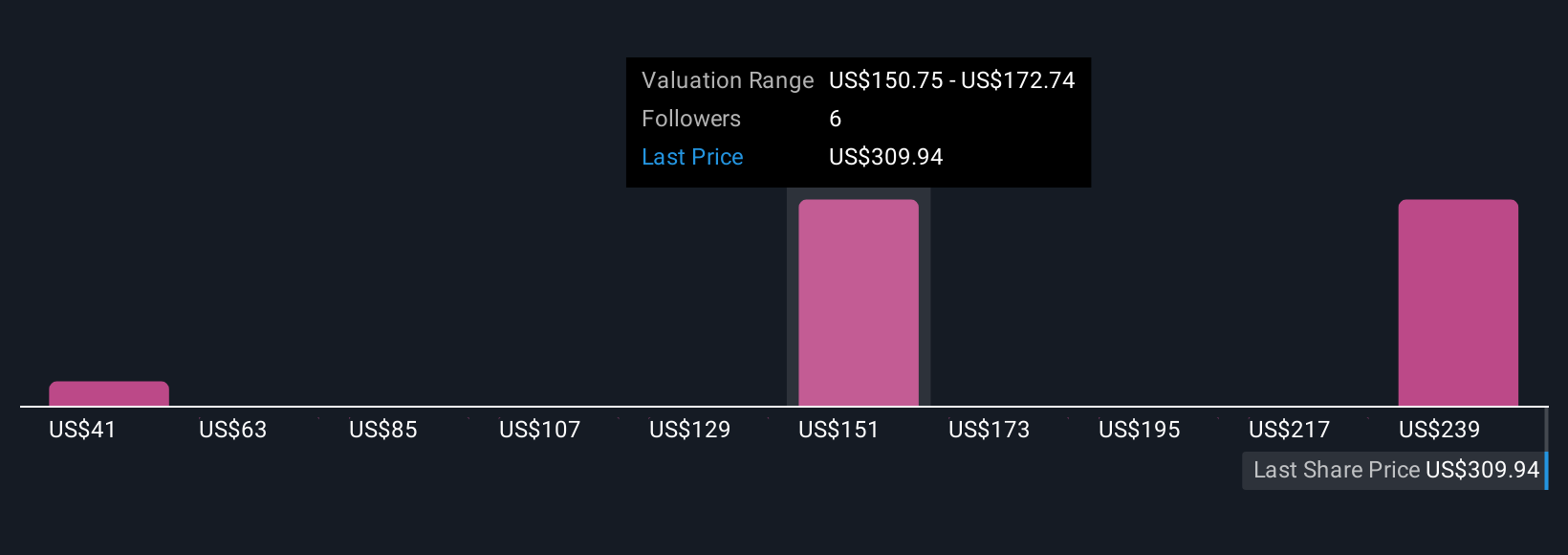

Three fair value estimates from the Simply Wall St Community range widely from US$40.78 to US$285 per share. Given ongoing reliance on a concentrated customer base, you may find that the risks and opportunities highlighted by different users offer valuable context as you explore more perspectives.

Explore 3 other fair value estimates on SiTime - why the stock might be worth as much as $285.00!

Build Your Own SiTime Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SiTime research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free SiTime research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SiTime's overall financial health at a glance.

Interested In Other Possibilities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SITM

SiTime

Designs, develops, and sells silicon timing systems solutions in Taiwan, Hong Kong, the United States, Singapore, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives