- United States

- /

- Semiconductors

- /

- NasdaqGS:SIMO

Assessing Silicon Motion (SIMO) Valuation as Analysts Project Another Quarter of Strong Earnings and Revenue Growth

Reviewed by Simply Wall St

Silicon Motion Technology (SIMO) is back on traders screens after fresh analyst commentary pointed to another quarter of strong year over year earnings and revenue growth, reinforcing a pattern of upside surprises.

See our latest analysis for Silicon Motion Technology.

The upbeat commentary comes as the share price has climbed to about $88.75, with a strong year to date share price return of 62.40% and a five year total shareholder return of 120.79%. This suggests momentum is rebuilding despite some recent volatility.

If this kind of renewed interest in semiconductors has your attention, it could be a good moment to scout other chip names through high growth tech and AI stocks.

With earnings forecast to jump nearly 44% and the share price still sitting well below consensus targets, is Silicon Motion quietly undervalued, or has the market already priced in the next leg of growth?

Most Popular Narrative Narrative: 22.1% Undervalued

With Silicon Motion Technology's fair value pinned at $114 against a last close of $88.75, the most followed narrative sees meaningful upside still on the table.

The company's accelerating innovation cycle including ongoing investment in next gen controllers (PCIe Gen 5/6, UFS 4.1/5.0), custom firmware, and advanced geometry products positions Silicon Motion for higher ASPs, gross margin expansion, and the ability to offset industry price erosion. Strategic partnerships with hyperscalers, automotive OEMs, and module makers, together with long term supply agreements, are enhancing gross margin visibility and laying the foundation for sustainable top line growth and the potential to achieve or exceed a $1 billion revenue run rate with significant operating margin improvement.

Curious how double digit top line growth, rising margins, and a richer future earnings multiple all combine into that fair value call? The full narrative unpacks the aggressive revenue ramp, the margin reset, and the valuation bridge that ties today’s price to tomorrow’s storage cycle.

Result: Fair Value of $114 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stretched valuations and fierce controller competition could quickly unwind that upside if memory demand stumbles or if key AI storage design wins slip.

Find out about the key risks to this Silicon Motion Technology narrative.

Another Angle on Valuation

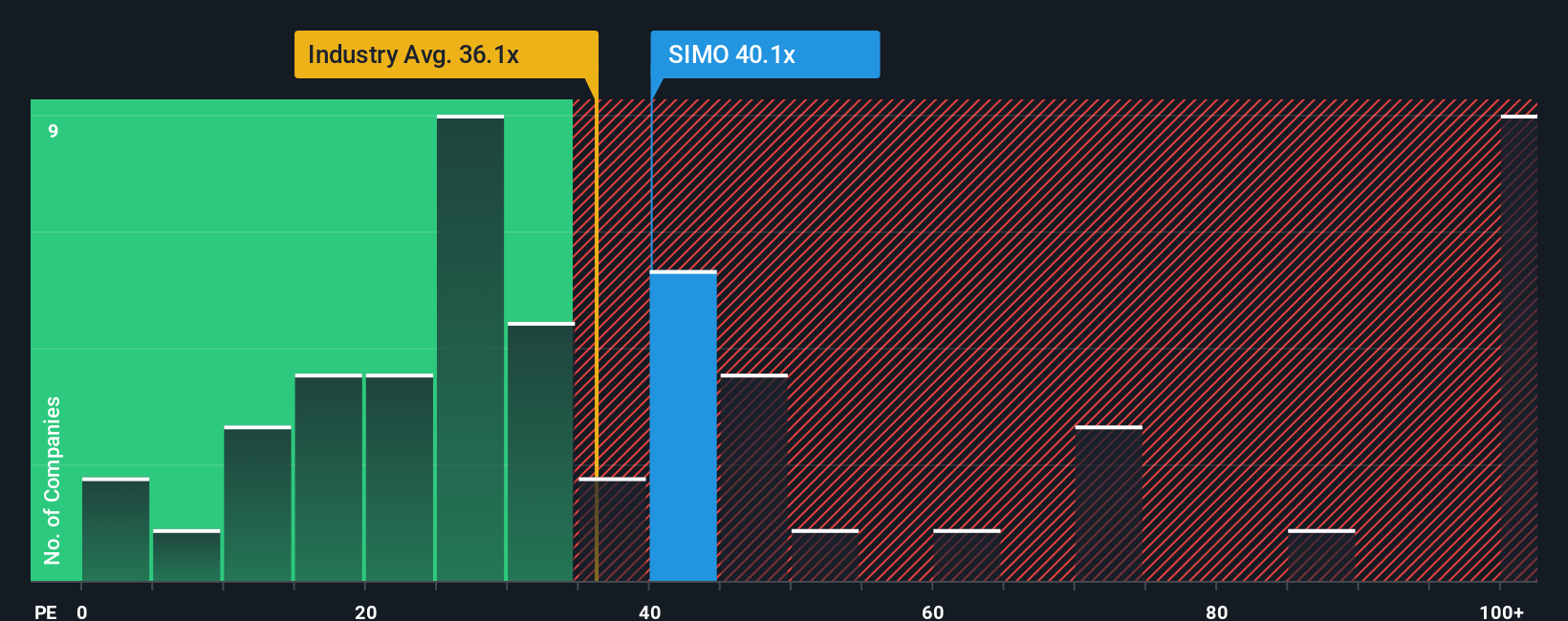

On simple earnings multiples, Silicon Motion looks punchy, trading at 31.3 times earnings versus a fair ratio of 28.5 times. It is cheaper than the US semiconductor average of 36.8 times and peers at 69.1 times, but that premium still leaves less room for error if growth cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Silicon Motion Technology Narrative

If you see the story differently or want to stress test the numbers yourself, build a custom view in minutes with Do it your way.

A great starting point for your Silicon Motion Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning a few focused stock lists on Simply Wall St, tailored to what you care about most.

- Target steady income by tracking companies in these 12 dividend stocks with yields > 3% that aim to reward shareholders with reliable cash returns.

- Capitalize on transformational tech shifts by checking out these 24 AI penny stocks shaping everything from automation to data intelligence.

- Position yourself for potential mispriced opportunities by reviewing these 914 undervalued stocks based on cash flows where the market may be underestimating future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SIMO

Silicon Motion Technology

Designs, develops, and markets NAND flash controllers for solid-state storage devices and related devices in Taiwan, the United States, Korea, China, Malaysia, Singapore, and internationally.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion