- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge Technologies (SEDG) Rides Early Demand for German Commercial Batteries Is a Broader European Shift Emerging?

Reviewed by Sasha Jovanovic

- SolarEdge Technologies recently completed its first commercial battery installations in Germany, with over 150 orders for its new CSS-OD storage system placed within weeks of launch, reflecting substantial demand in Europe's largest solar self-consumption market.

- This early adoption showcases the appeal of integrated PV and storage offerings among commercial and industrial customers as businesses seek greater energy independence and efficiency.

- We'll now examine how rapid commercial battery adoption in Germany could influence SolarEdge's overall investment narrative and growth outlook.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

SolarEdge Technologies Investment Narrative Recap

To own shares of SolarEdge Technologies, you need to believe in the accelerating shift toward integrated solar and battery solutions for commercial and industrial customers, especially in key European markets. The recent surge of commercial battery orders in Germany highlights promising early momentum but doesn’t materially change that the largest short-term catalyst remains continued channel normalization and inventory reduction, while the most substantial risk is still intense industry competition and hardware price pressure that could impact margins.

Of the company’s recent announcements, the virtual power plant (VPP) enrollment milestone across 16 U.S. states stands out as particularly relevant to the current German news. Both events reflect SolarEdge’s focus on expanding its integrated storage footprint, potentially supporting higher-margin revenue streams, though investors should watch closely to see if adoption rates meet heightened expectations.

However, despite clear interest in high-margin storage, investors should also consider...

Read the full narrative on SolarEdge Technologies (it's free!)

SolarEdge Technologies' outlook anticipates $1.6 billion in revenue and $11.8 million in earnings by 2028. This scenario requires annual revenue growth of 20.6% and a $1.71 billion increase in earnings from the current earnings of -$1.7 billion.

Uncover how SolarEdge Technologies' forecasts yield a $30.23 fair value, a 15% downside to its current price.

Exploring Other Perspectives

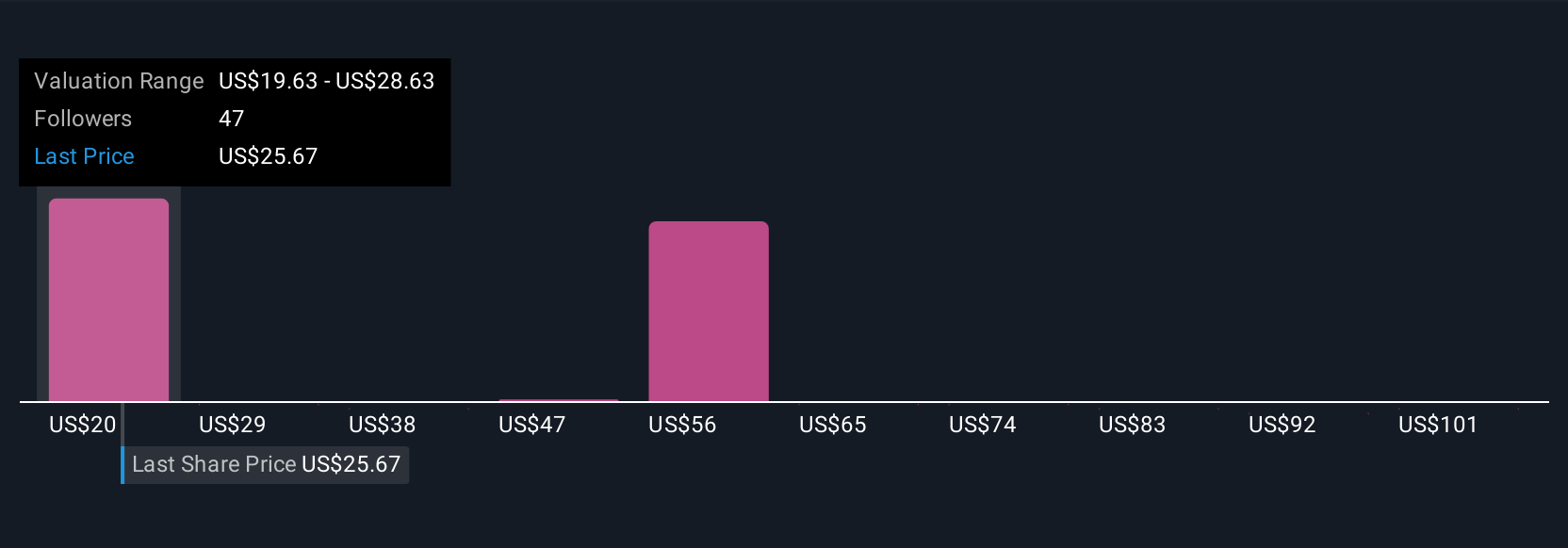

Sixteen members of the Simply Wall St Community estimate SolarEdge’s fair value ranges widely from US$30.23 to US$90.47 per share. With commercial storage adoption expanding, strong competition and potential hardware price pressure remain factors that could affect how quickly profits recover, so consider these differing viewpoints before making up your mind.

Explore 16 other fair value estimates on SolarEdge Technologies - why the stock might be worth 15% less than the current price!

Build Your Own SolarEdge Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SolarEdge Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SolarEdge Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SolarEdge Technologies' overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success