- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge Technologies (SEDG): Examining Valuation After Recent Share Price Strength

Reviewed by Simply Wall St

SolarEdge Technologies (SEDG) is making waves this week after posting a steady double-digit climb over the past month, drawing new attention from investors wondering if momentum is building. While there hasn't been a major headline setting off this move, some are now looking for clues in the price action itself, speculating that shifting sentiment around clean energy stocks or the broader tech sector might be playing a role. The stock’s resilience could be signaling a change in expectations, or it might just reflect market players taking new positions ahead of earnings or industry updates.

To put it in context, SolarEdge Technologies’ share price has rebounded about 19% over the past year, following a sharp drop that weighed on much of the solar and semiconductor industry. While that move helped recover some earlier losses, the stock is still well below its highs, with a three-year return sitting deep in negative territory. Recent weeks have brought a 21% gain, marking a clear reversal of recent momentum, even as industry news and company fundamentals remain mixed.

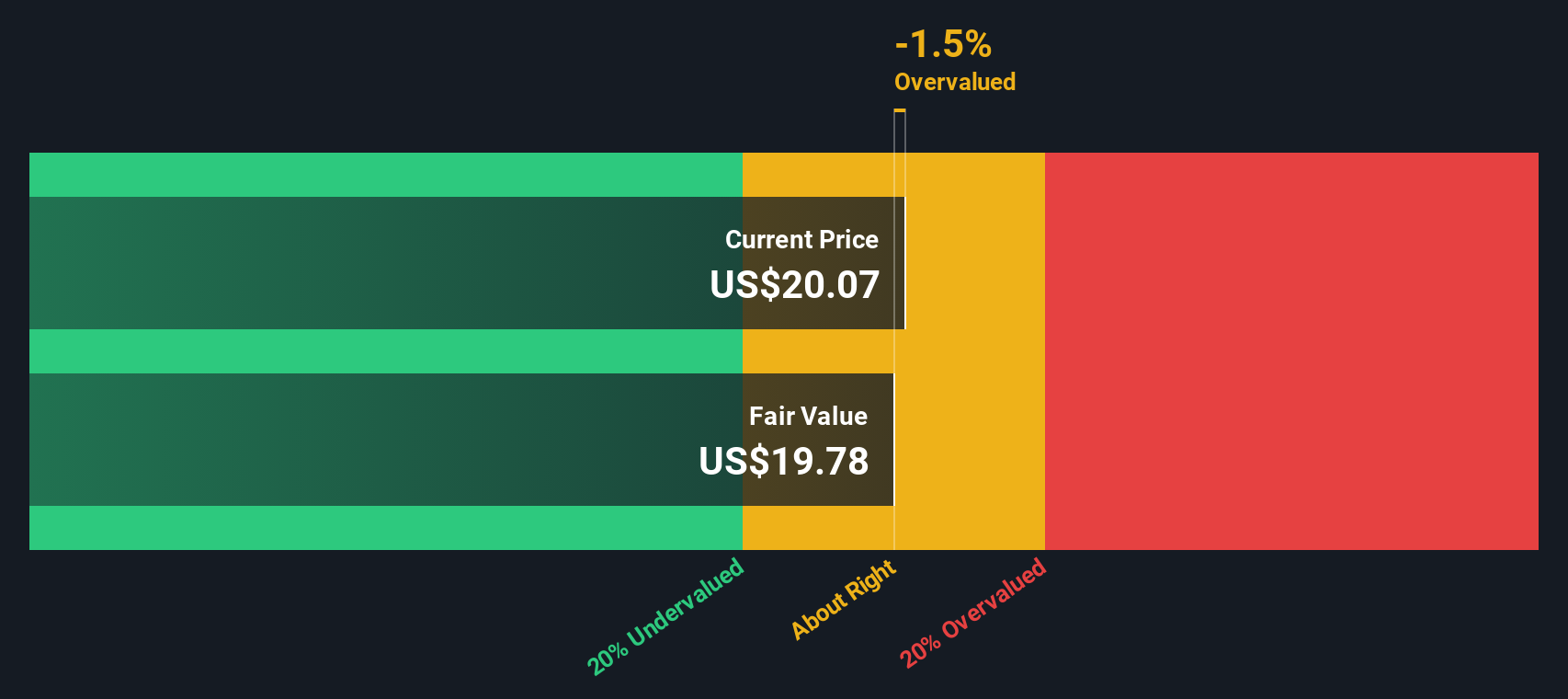

The question for investors now is whether there is genuine value left on the table, or if the market has already priced in all future growth for SolarEdge Technologies.

Most Popular Narrative: 63% Overvalued

According to community narrative, SolarEdge Technologies is currently considered significantly overvalued relative to its fair value estimate. Analysts expect the business outlook to improve, but believe the market is overly optimistic about future growth and profitability.

"The rally in SolarEdge's stock appears to be pricing in robust future revenue growth driven by U.S. policy support (extension of manufacturing and storage credits). However, risks are rising as the elimination of the 25D residential solar tax credit is expected to cause a substantial drop in U.S. residential demand in 2026. This decline may be only partially offset by shifts to third-party owned (TPO) models, potentially constraining topline growth."

Want to understand what’s driving SolarEdge’s high valuation? The answer may lie in bold projections, aggressive growth assumptions, and a profit turnaround that rivals even the most optimistic forecasts. Curious which numbers are making analysts so split? Explore the financial moves and market forces that could influence this consensus price target.

Result: Fair Value of $19.64 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing U.S. policy support and a surge in battery storage adoption could quickly change the outlook and bring renewed optimism for SolarEdge Technologies.

Find out about the key risks to this SolarEdge Technologies narrative.Another View: What Does the SWS DCF Model Say?

While most eyes are on industry price comparisons, the SWS DCF model offers a different perspective and points to deeper value in SolarEdge Technologies. Could market pessimism mean long-term opportunity, or is it a value trap?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SolarEdge Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SolarEdge Technologies Narrative

If you're not convinced by the market's current consensus or want to dig deeper into the numbers yourself, you can assemble your own perspective in just minutes. do it your way.

A great starting point for your SolarEdge Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Act now and give your portfolio an edge by checking out unique stock ideas beyond SolarEdge Technologies. With the Simply Wall Street Screener, you can spot trends before they become headlines and seize opportunities others might miss. Here are some standout picks this week:

- Uncover stable income streams by targeting dividend stocks with yields > 3%. These options could provide attractive, consistent yields for your holdings.

- Capitalize on breakthrough technologies with AI penny stocks, which are shaping the future of artificial intelligence and transforming industries at a rapid pace.

- Position yourself for the next big market shift by reviewing undervalued stocks based on cash flows. These choices may offer compelling growth potential based on solid cash flow analysis.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives