- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge Technologies (SEDG): Evaluating Valuation Following Strategic AI Data Center Collaboration and Improving Earnings

Reviewed by Simply Wall St

SolarEdge Technologies (SEDG) is drawing fresh attention after announcing a collaboration with Infineon Technologies to advance its Solid-State Transformer platform for AI data centers. This move coincides with improving quarterly earnings results and narrowing losses.

See our latest analysis for SolarEdge Technologies.

SolarEdge Technologies’ recent momentum is hard to miss, with the share price up over 65% in the past three months and an impressive 187% return year-to-date, even as last year’s total return was still deeply negative. That powerful turnaround appears fueled by optimism around the company’s strategic AI data center push and sharply improving financials, hinting at renewed growth potential and perhaps a shift in how investors view risk versus opportunity here.

With technology’s changing landscape in mind, this is a great moment to explore other high-growth tech and AI stocks. See the full list for free.

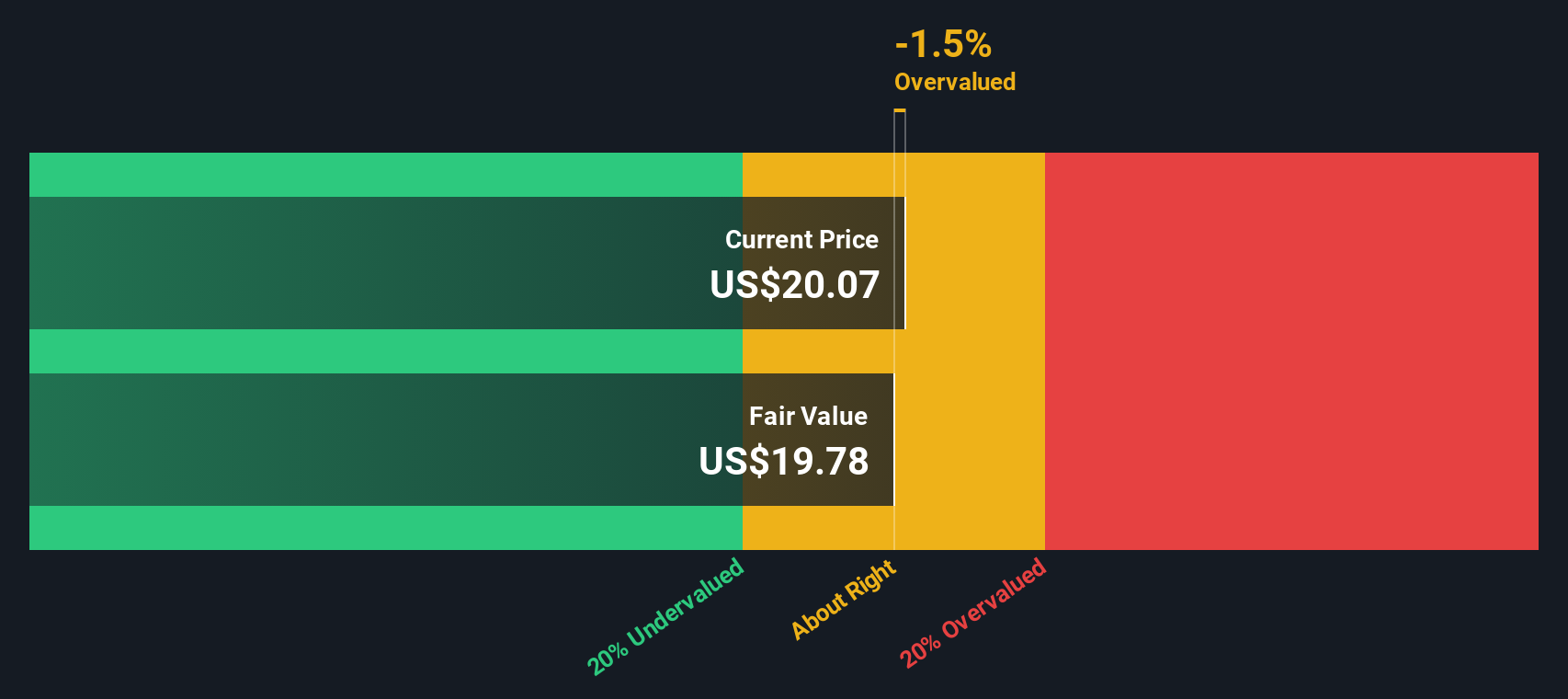

With shares rebounding sharply but the stock still trading below some analyst price targets, the key question is whether SolarEdge is now undervalued or if the market has already accounted for all that future growth. Is this a buying opportunity, or has investor optimism run ahead of fundamentals?

Most Popular Narrative: 40.6% Overvalued

SolarEdge’s fair value, according to the most widely followed narrative, is well below its recent closing price. This challenges the optimism behind its rebound. Let’s see what’s driving this sharp valuation disconnect.

The current valuation may overlook intensifying industry competition and hardware commoditization. Price and market share battles in both Europe and the U.S., including potential further pricing actions, could undermine net margins despite advances in new platforms and innovation.

Want to know what’s fueling this steep premium? This narrative hinges on a bold earnings turnaround, profit margin recovery, and faith that SolarEdge can buck industry headwinds. Find out which future trends and high-stakes assumptions create such a big gap between value and price.

Result: Fair Value of $30.23 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, supportive U.S. manufacturing legislation and faster battery storage adoption could strengthen margins and demand. This could potentially rewrite SolarEdge’s growth story.

Find out about the key risks to this SolarEdge Technologies narrative.

Another View: What Does the SWS DCF Model Say?

While the market’s price-to-sales approach suggests that SolarEdge may be above fair value, our SWS DCF model reaches a similar conclusion. The DCF currently estimates fair value at $38.30 per share, which is lower than the recent trading price. Could market optimism be overlooking underlying risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own SolarEdge Technologies Narrative

If the current story does not align with your perspective or you would rather investigate the numbers on your own, crafting your personalized take takes less than three minutes. Do it your way.

A great starting point for your SolarEdge Technologies research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock the power of smart investing by tapping into emerging trends you might be missing. Find unique opportunities that set your portfolio apart and stay ahead of the crowd.

- Capture tomorrow’s gains by checking out these 862 undervalued stocks based on cash flows, which have untapped potential based on cash flow fundamentals.

- Build growth momentum with these 32 healthcare AI stocks, shaping the intersection of artificial intelligence and next-generation healthcare breakthroughs.

- Boost your passive income with these 14 dividend stocks with yields > 3%, offering robust yields for steady returns in any market climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives