- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

SolarEdge Technologies (SEDG): Evaluating Valuation Following New Partnerships and Expanded Market Momentum

Reviewed by Simply Wall St

If you have been considering SolarEdge Technologies (SEDG), the latest research update may prompt you to take a closer look. UBS highlighted SolarEdge’s strong ties with third-party partners and products tailored to the growing market for leased solar systems in the US. In addition, SolarEdge recently formed a strategic partnership with Schaeffler to deliver EV charging infrastructure across Europe and secured a significant contract to supply American-made solar technology for more than 500 rooftop projects. Together, these moves suggest a concentrated effort to expand the company’s reach and relevance this year.

These initiatives come at a time when the stock has rebounded following a challenging period, gaining 39% over the past year and nearly doubling in the past three months. This increase represents a change for a company that has faced weaker multiyear performance and ongoing industry challenges, including regulatory changes and shifting solar demand patterns. Currently, momentum seems to be building behind the business, and the market is responding.

This raises the question: Is this the right time to consider SolarEdge for long-term growth, or have recent gains already reflected its future potential?

Most Popular Narrative: 68% Overvalued

According to community narrative, SolarEdge Technologies is currently priced well above consensus fair value, with analysts expressing concern that market optimism has run ahead of business fundamentals.

"The rally in SolarEdge's stock appears to be pricing in robust future revenue growth driven by U.S. policy support (extension of manufacturing and storage credits). However, risks are rising as the elimination of the 25D residential solar tax credit is expected to cause a substantial drop in U.S. residential demand in 2026. This may only be partially offset by third-party owned (TPO) shifts, which could constrain topline growth."

Want to know what’s really fueling this expensive valuation? Several factors in the narrative include skyrocketing profit forecasts, significant policy bets, and a notably high earnings multiple. How do growth, margins, and share expansion all connect to that ambitious price target? Continue exploring to uncover the bold assumptions and major factors behind this eye-catching valuation.

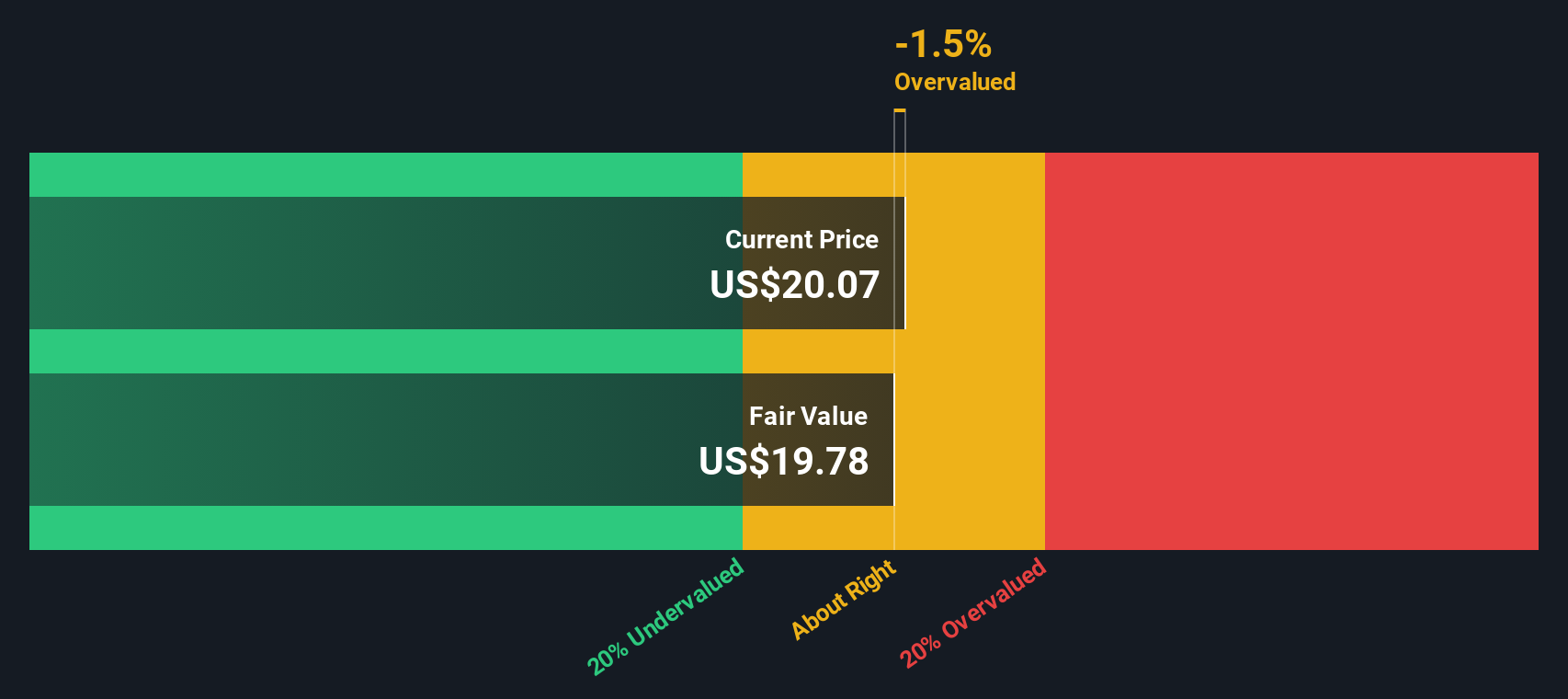

Result: Fair Value of $20.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, a major policy extension or a surge in battery storage adoption could spark upside and challenge current doubts about SolarEdge’s long-term potential.

Find out about the key risks to this SolarEdge Technologies narrative.Another View: Discounted Cash Flow Perspective

While market price targets suggest SolarEdge is expensive based on growth multiples, our DCF model presents an alternative perspective. It indicates the stock could actually be undervalued. Is the gap between these valuations an opportunity or a warning sign?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out SolarEdge Technologies for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own SolarEdge Technologies Narrative

Keep in mind, if this analysis doesn’t align with your perspective or you’d rather craft your own interpretation, you can generate a personalized narrative in just a few minutes by using Do it your way.

A great starting point for your SolarEdge Technologies research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Sharpen your portfolio strategy by tapping into fresh sets of high-potential stocks using powerful tools from Simply Wall Street. Don’t let unique opportunities slip by. Take your next step in investing with targeted ideas tailored for today’s market moves.

- Uncover growth under the radar by spotting undervalued stocks based on cash flows, which leads the way in undervalued innovation and proven cash generation.

- Capitalize on the future of technology by searching AI penny stocks, which power advances in artificial intelligence, automation, and new data insights.

- Fuel your income goals by zeroing in on dividend stocks with yields > 3%, with resilient yields and a history of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion