- United States

- /

- Semiconductors

- /

- NasdaqGS:SEDG

Can SolarEdge (SEDG) Leverage Its Data Center Push to Reinvent Its Core Growth Story?

Reviewed by Sasha Jovanovic

- Earlier this month, Infineon Technologies and SolarEdge Technologies announced a collaboration to advance a high-efficiency solid-state transformer platform tailored for next-generation AI and hyperscale data centers, integrating advanced silicon carbide technology to target over 99% efficiency and sustainable power architectures.

- This marks an important step for SolarEdge Technologies as it aims to expand its core capabilities into the booming data center sector, leveraging its expertise in DC-coupled architecture and power electronics to address the surging global energy demand for AI infrastructure.

- We'll look at how SolarEdge's expansion into AI-driven data center power solutions could reshape its investment narrative and growth prospects.

The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

SolarEdge Technologies Investment Narrative Recap

To be a shareholder in SolarEdge Technologies, you need confidence in its ability to successfully expand beyond core solar products into high-efficiency power solutions for fast-growing sectors like AI data centers. The recent collaboration with Infineon showcases this ambition but does not materially alter the immediate catalyst, which remains tied to normalization of channel inventories and stabilization of gross margins amid ongoing market volatility. The biggest risk continues to center on whether competitive pressures and unpredictable policy shifts could hinder this margin recovery.

Of recent announcements, the milestone of enrolling over 500 MWh of residential battery storage in Virtual Power Plant (VPP) programs across 16 US states stands out. This underpins SolarEdge's efforts to unlock new revenue streams from distributed energy resources, complementing its move into higher-efficiency commercial and data center markets, yet operational execution and competitive positioning remain crucial for these growth levers.

By contrast, investors should be aware that ongoing risks related to margin recovery and potential supply chain disruptions could...

Read the full narrative on SolarEdge Technologies (it's free!)

SolarEdge Technologies' outlook anticipates $1.6 billion in revenue and $11.8 million in earnings by 2028. This scenario requires 20.6% annual revenue growth and an earnings increase of $1.7 billion from current earnings of -$1.7 billion.

Uncover how SolarEdge Technologies' forecasts yield a $30.23 fair value, a 24% downside to its current price.

Exploring Other Perspectives

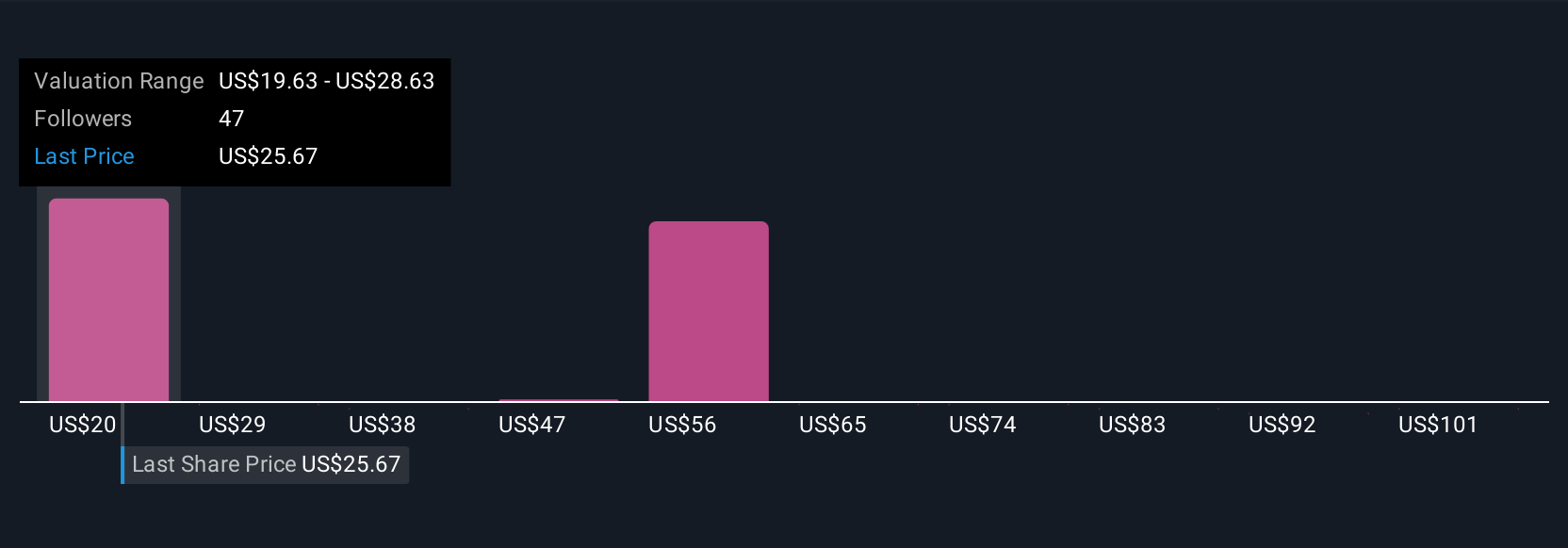

Sixteen members of the Simply Wall St Community valued SolarEdge from US$30.23 up to US$90.47 per share. As the company pivots towards AI data center power solutions, many investors are weighing the opportunities against risks of policy changes and margin pressure, review several opinions to see how views compare.

Explore 16 other fair value estimates on SolarEdge Technologies - why the stock might be worth over 2x more than the current price!

Build Your Own SolarEdge Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SolarEdge Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free SolarEdge Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SolarEdge Technologies' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEDG

SolarEdge Technologies

Designs, develops, manufactures, and sells direct current (DC) optimized inverter systems for solar photovoltaic (PV) installations in the United States, Germany, the Netherlands, Italy, rest of Europe, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives