- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Rigetti Computing (RGTI) Slides 7.4 Percent After Widening Losses and Falling Revenue in Q3

Reviewed by Sasha Jovanovic

- Rigetti Computing recently reported third quarter 2025 earnings, revealing sales of US$1.95 million and a net loss of US$200.97 million, both worsening compared to the same period last year.

- While the company remains focused on research and development and is years from commercial scale, its mounting losses and declining revenue highlight the challenges facing quantum computing pure-play companies.

- We'll explore how Rigetti's sustained focus on R&D amid deepening losses shapes its investment narrative in the rapidly evolving quantum computing sector.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Rigetti Computing's Investment Narrative?

For those drawn to Rigetti Computing, the real belief centers on quantum computing’s long-term promise rather than short-term financials. The business is years from commercial scale and faces heightened risks after the recent quarterly report, which showed shrinking revenue and a much wider net loss of US$200.97 million. This result marks a significant deterioration compared to earlier quarters and may affect sentiment around Rigetti’s ability to monetize its technology pipeline in the near term. While big contract wins and product milestones create important future catalysts, the fresh earnings miss and deepening losses now put more pressure on management’s execution and raise questions about liquidity, cash burn, and the timeline to commercial traction. The latest news materially intensifies existing risks around dilution and volatility, while the most optimistic arguments for Rigetti now rest even more squarely on breakthroughs that remain some distance away. In contrast, dilution risk from equity offerings is something investors should keep a close eye on.

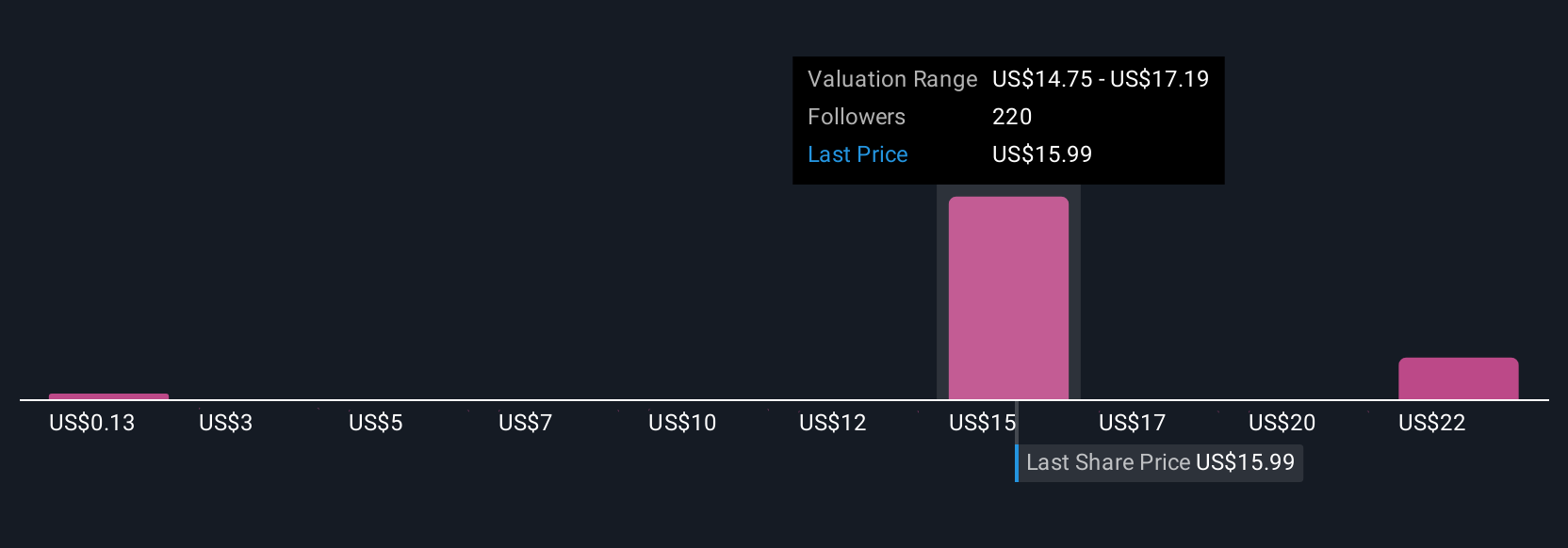

The valuation report we've compiled suggests that Rigetti Computing's current price could be inflated.Exploring Other Perspectives

Explore 49 other fair value estimates on Rigetti Computing - why the stock might be worth as much as 72% more than the current price!

Build Your Own Rigetti Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigetti Computing research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Rigetti Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigetti Computing's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives