- United States

- /

- Semiconductors

- /

- NasdaqCM:RGTI

Could Federal Interest in Rigetti Computing (RGTI) Reshape Its Strategic Role in Quantum Innovation?

Reviewed by Sasha Jovanovic

- In the past week, reports emerged that Rigetti Computing and other U.S. quantum computing firms are in discussions with the federal government regarding potential equity investments in exchange for federal funding as part of efforts to bolster critical technologies.

- This development highlights increasing government interest in quantum computing as a sector vital to national competitiveness and security, provoking widespread attention across technology and investment communities despite subsequent official denials of ongoing negotiations.

- We'll explore how prospective federal involvement could shape Rigetti Computing's investment narrative given the sector's rising importance to policymakers.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

What Is Rigetti Computing's Investment Narrative?

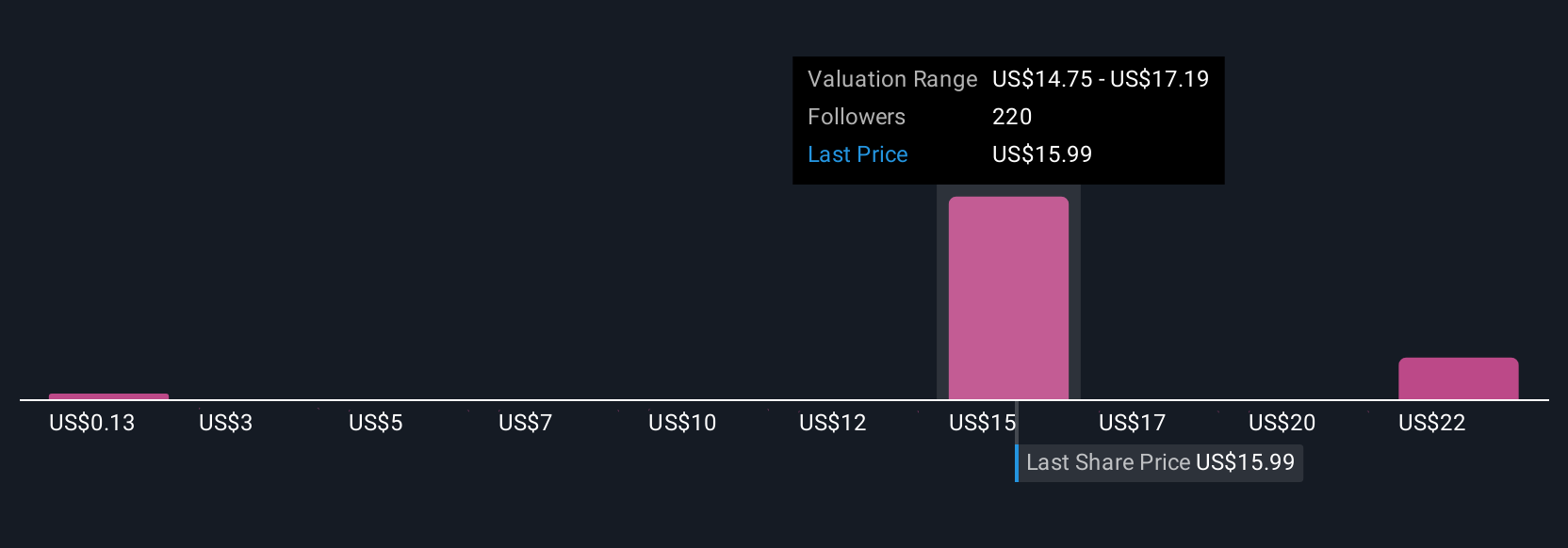

To be a Rigetti Computing shareholder, you need conviction in quantum technology's future, recognizing that real-world adoption could unlock meaningful revenue growth, yet profitability remains distant. The company's dazzling one-year total return and rapid revenue growth projections stand out, but these come with sharp risks: Rigetti remains deeply unprofitable, has a lofty valuation relative to peers, and recent equity dilution has been significant. The recent surge in share price after government funding rumors underscores how sensitive the stock is to headlines rather than fundamentals. While potential U.S. federal investment could validate quantum's importance and reduce Rigetti’s capital risk if it materializes, the official denials and subsequent share price retracement suggest limited change to immediate catalysts or risks. Near term, volatility, fierce industry competition, and regulatory uncertainty continue to be the factors to watch. On the other hand, competition from much larger tech giants is an ongoing risk investors shouldn't overlook.

Our valuation report unveils the possibility Rigetti Computing's shares may be trading at a premium.Exploring Other Perspectives

Explore 46 other fair value estimates on Rigetti Computing - why the stock might be worth less than half the current price!

Build Your Own Rigetti Computing Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Rigetti Computing research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Rigetti Computing research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Rigetti Computing's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGTI

Rigetti Computing

Through its subsidiaries, builds quantum computers and the superconducting quantum processors the United States, the United Kingdom, rest of Europe, Asia, and internationally.

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives