- United States

- /

- Semiconductors

- /

- NasdaqCM:QUIK

QuickLogic Corporation's (NASDAQ:QUIK) Shares Climb 49% But Its Business Is Yet to Catch Up

QuickLogic Corporation (NASDAQ:QUIK) shareholders have had their patience rewarded with a 49% share price jump in the last month. The annual gain comes to 278% following the latest surge, making investors sit up and take notice.

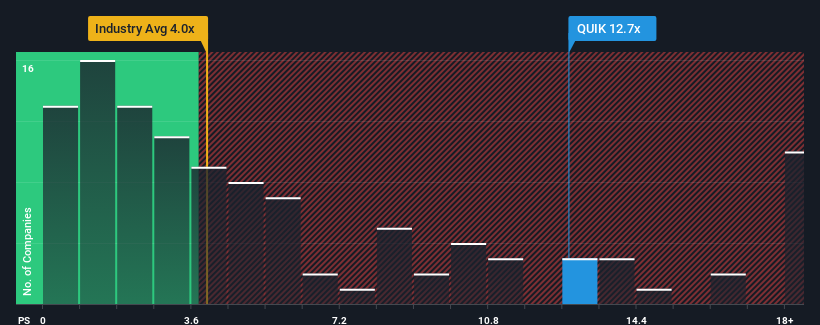

After such a large jump in price, QuickLogic may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 12.7x, when you consider almost half of the companies in the Semiconductor industry in the United States have P/S ratios under 4x and even P/S lower than 1.8x aren't out of the ordinary. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for QuickLogic

What Does QuickLogic's P/S Mean For Shareholders?

With revenue growth that's inferior to most other companies of late, QuickLogic has been relatively sluggish. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think QuickLogic's future stacks up against the industry? In that case, our free report is a great place to start.How Is QuickLogic's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like QuickLogic's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 31% last year. The strong recent performance means it was also able to grow revenue by 146% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 30% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 44%, which is noticeably more attractive.

In light of this, it's alarming that QuickLogic's P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Key Takeaway

The strong share price surge has lead to QuickLogic's P/S soaring as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that QuickLogic currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for QuickLogic that you should be aware of.

If you're unsure about the strength of QuickLogic's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if QuickLogic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:QUIK

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion