- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

Will Qualcomm’s (QCOM) Saudi Arabia AI Move Redefine Its Long-Term Competitive Edge?

Reviewed by Sasha Jovanovic

- Qualcomm recently announced it will open a new engineering center in Saudi Arabia to support the deployment of AI servers utilizing its AI200 and AI250 accelerator chips and software.

- This initiative highlights Qualcomm’s ongoing transformation to diversify beyond smartphone chips and establish a stronger foothold in the growing AI data center market.

- We’ll explore how the Saudi Arabia engineering center launch could accelerate Qualcomm’s AI diversification goals and impact its investment case.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

QUALCOMM Investment Narrative Recap

To own Qualcomm shares, you need confidence in the company's ability to extend leadership beyond smartphones, especially into AI and data center markets. The Saudi engineering center is a visible move to support Qualcomm’s AI ambitions, but at this stage, it does not materially shift the most important near-term catalyst, premium-tier Android handset demand, or change the central risk, which is whether diversification pays off quickly enough to offset competition and cyclicality in mobile chip sales.

One recent announcement that directly ties into the Saudi AI initiative is Qualcomm's collaboration with HUMAIN to roll out advanced AI infrastructure in Saudi Arabia, leveraging the same AI200 and AI250 chips now being spotlighted. This keeps the spotlight on AI diversification as a potential longer-term growth engine, although the initial financial impact may be more incremental than transformative.

On the other hand, investors should know that legal and regulatory challenges remain ever-present, particularly concerning...

Read the full narrative on QUALCOMM (it's free!)

QUALCOMM's narrative projects $46.9 billion revenue and $12.2 billion earnings by 2028. This requires 2.7% yearly revenue growth and a $0.6 billion earnings increase from $11.6 billion currently.

Uncover how QUALCOMM's forecasts yield a $187.71 fair value, a 18% upside to its current price.

Exploring Other Perspectives

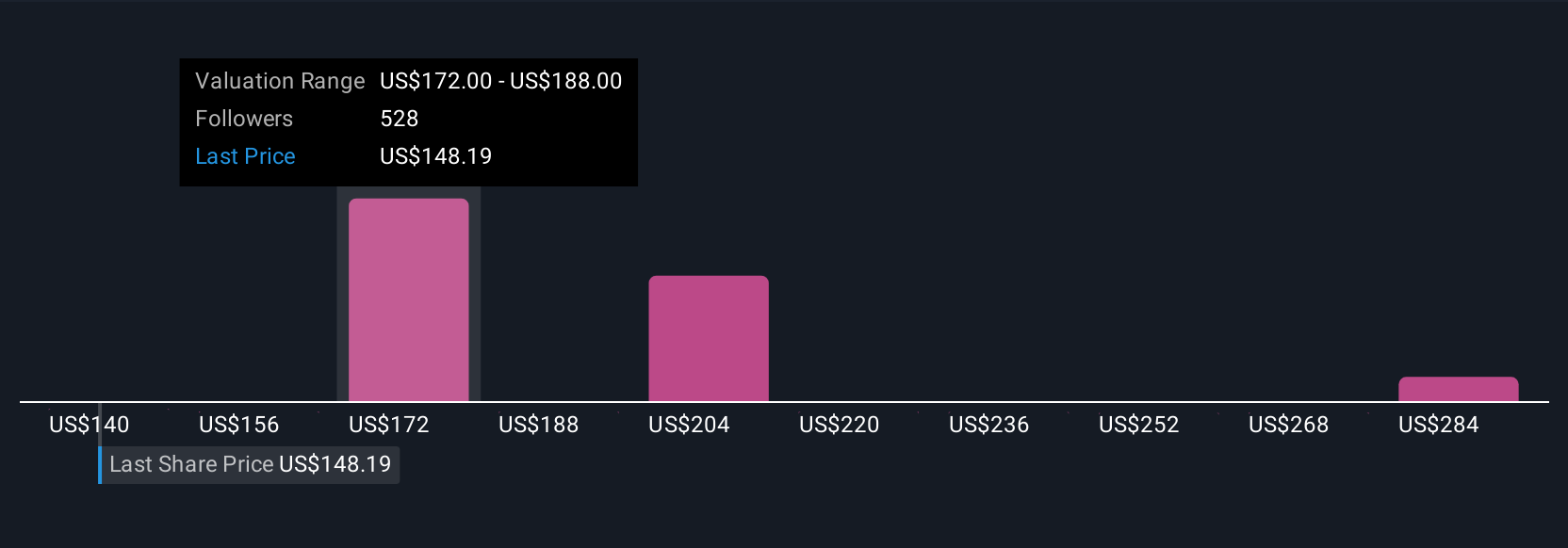

Thirty different fair value estimates from the Simply Wall St Community put QUALCOMM’s worth between US$141.66 and US$300 per share. As optimism about AI acceleration grows, many still debate how quickly diversification efforts can offset risks from changing smartphone demand.

Explore 30 other fair value estimates on QUALCOMM - why the stock might be worth 11% less than the current price!

Build Your Own QUALCOMM Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your QUALCOMM research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free QUALCOMM research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate QUALCOMM's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives