- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

QUALCOMM (NASDAQ:QCOM) Takes an Initiative to Keep the High Returns

As the global semiconductor shortage rages on, impacting multiple industries, companies like QUALCOMM(NASDAQ: QCOM) are under a spotlight as the broad market watches closely.

Beyond the latest acquisition, the company is pushing for new partnerships and exploring other possibilities to keep its solid returns ahead of the competition.

View our latest analysis for QUALCOMM

Acquisition and Diversification

Veoneer(NYSE: VNE) confirmed receiving an acquisition offer from Qualcomm. This "updated nonbinding "offer is at US$37 per share or US$4.6b in cash. Veoneer's management didn't give any further commentary except that the proposal is under review.

Meanwhile, Qualcomm is exploring stronger European partnerships. In addition to getting a deal to supply chips for a new Renault's EV, CEO Cristiano Amon is exploring partnerships with European-based chip foundries. This would certainly help increase the automotive market penetration, especially if the deal with Renault proves fruitful and the Veoneer acquisition goes through as planned.

In addition, it is a well-aligned strategy to move away from the Asian-based chip production that led to the current shortages.

Stock performance after the latest iPhone launch might be yet another reason for the diversification. The stock dipped over 9% in days after the iPhone 13 launch. While some of it indeed correlates with the latest broad market correction, it is evident that the market wasn't satisfied with the newest Apple phone.

Understanding Return On Capital Employed (ROCE)

To clarify, if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for QUALCOMM, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

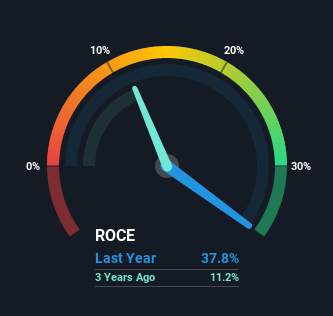

0.38 = US$10b ÷ (US$39b - US$11b) (Based on the trailing twelve months to June 2021).

Therefore, QUALCOMM has a ROCE of 38%.

In absolute terms, that's a great return, and it's even better than the Semiconductor industry average of 13%.

Above you can see how the current ROCE for QUALCOMM compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analyst's predictions in our free report on analyst forecasts for the company.

What Can We Tell From QUALCOMM's ROCE Trend?

We're pretty happy with how the ROCE has been trending at QUALCOMM. The data shows that returns on capital have increased by 166% over the trailing five years. The company is now earning US$0.4 per dollar of capital employed. Interestingly, the business may be becoming more efficient because it's applying 38% less capital than it was five years ago. A business that's shrinking its asset base like this isn't usually typical of a soon-to-be multi-bagger company.

On a side note, we noticed that the improvement in ROCE appears to be partly fueled by an increase in current liabilities. Effectively this means that suppliers or short-term creditors are now funding 30% of the business, which is more than it was five years ago. In particular, short-term liabilities now account for US$11.5b.

It's worth keeping an eye on this because as the percentage of current liabilities to total assets increases, some aspects of risk also increase.

Controlled Expansion

In a nutshell, we're pleased to see that QUALCOMM has been able to generate higher returns from less capital. And with the stock has performed exceptionally well over the last five years, investors are accounting for these patterns.

However, the latest efforts indicate that the company might be successfully expanding into new ventures. Success in those will likely keep the outstanding returns continue in the near future.

On a final note, we've found 1 warning sign for QUALCOMM that we think you should be aware of.

High returns are a vital ingredient to solid performance, so check out our free list of stocks earning high returns on equity with solid balance sheets.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion