- United States

- /

- Medical Equipment

- /

- NasdaqCM:IRIX

3 US Penny Stocks With Market Caps Under $50M To Watch

Reviewed by Simply Wall St

As the post-election rally loses steam, major U.S. indexes are showing mixed results, highlighting the ongoing volatility in the market. In such a climate, investors often seek out opportunities that offer both affordability and potential for growth. Penny stocks, though sometimes considered an outdated term, continue to attract attention due to their potential for significant returns when backed by strong financials. Here, we explore three penny stocks that exemplify this balance of financial strength and growth opportunity.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.81915 | $6.09M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.05B | ★★★★★★ |

| AsiaFIN Holdings (OTCPK:ASFH) | $1.50 | $81.55M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $161.52M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.40 | $125.19M | ★★★★★☆ |

| So-Young International (NasdaqGM:SY) | $1.25 | $72.53M | ★★★★☆☆ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.95 | $3.83M | ★★★★★★ |

| Flexible Solutions International (NYSEAM:FSI) | $4.22 | $54.16M | ★★★★★★ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.9278 | $87.69M | ★★★★★☆ |

Click here to see the full list of 738 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

IRIDEX (NasdaqCM:IRIX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IRIDEX Corporation is an ophthalmic medical technology company that offers laser systems, delivery devices, and consumable instruments for treating sight-threatening eye diseases, with a market cap of $23.46 million.

Operations: The company's revenue segment is entirely derived from its ophthalmology division, generating $49.7 million.

Market Cap: $23.46M

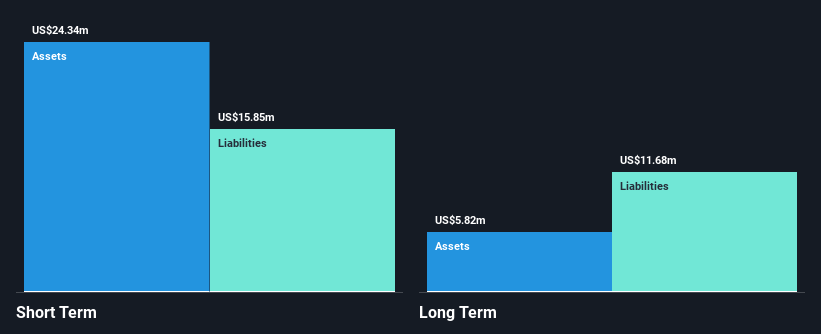

IRIDEX Corporation, with a market cap of US$23.46 million, is navigating challenges typical of penny stocks, including high volatility and recent shareholder dilution. The company remains unprofitable with a negative return on equity and increasing losses over the past five years at 2.3% annually. Recent earnings reports highlight declining sales—US$11.58 million in Q3 2024 compared to US$12.85 million a year ago—and growing net losses. Despite no debt and sufficient short-term assets to cover liabilities, IRIDEX's cash runway is limited to nine months without additional capital infusion, reflecting ongoing financial pressures amid leadership changes.

- Click here and access our complete financial health analysis report to understand the dynamics of IRIDEX.

- Understand IRIDEX's track record by examining our performance history report.

Pixelworks (NasdaqGM:PXLW)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Pixelworks, Inc. develops and markets semiconductor and software solutions for mobile, home and enterprise, and cinema markets across the United States, Japan, China, Taiwan, Korea, and Europe with a market cap of $39.59 million.

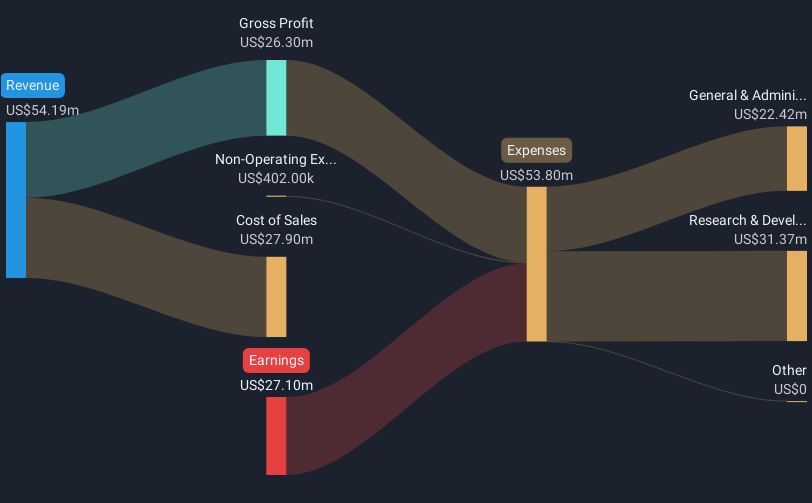

Operations: The company generates $60.70 million from its design, development, marketing, and sale of IC solutions.

Market Cap: $39.59M

Pixelworks, Inc. is facing typical penny stock challenges, including high volatility and recent shareholder dilution. The company reported a decline in Q3 2024 sales to US$9.53 million from US$16.03 million the previous year, with net losses widening to US$8.14 million. Despite sufficient short-term assets exceeding liabilities and being debt-free, Pixelworks struggles with profitability and negative return on equity (-51.77%). Additionally, it received a Nasdaq bid price deficiency notice due to its stock trading below $1 per share but continues efforts to regain compliance by March 2025 while maintaining a cash runway for over a year without new capital influxes.

- Click here to discover the nuances of Pixelworks with our detailed analytical financial health report.

- Assess Pixelworks' future earnings estimates with our detailed growth reports.

uCloudlink Group (NasdaqGM:UCL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: uCloudlink Group Inc. operates as a mobile data traffic sharing marketplace within the telecommunications industry and has a market cap of $42.37 million.

Operations: The company generates revenue of $86.08 million from its wireless communications services segment.

Market Cap: $42.37M

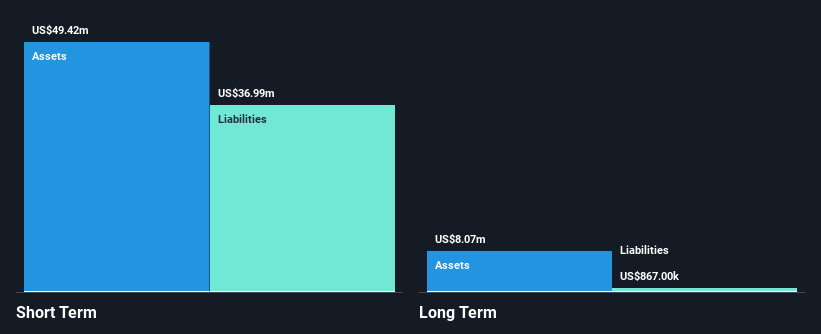

uCloudlink Group Inc. demonstrates promising characteristics for a penny stock, having achieved profitability with a net income of US$2.24 million in Q2 2024 compared to a net loss the previous year. The company maintains strong financial health, with short-term assets exceeding both short and long-term liabilities and cash surpassing total debt, which is well covered by operating cash flow. Despite an increased debt-to-equity ratio over five years, uCloudlink's return on equity is high at 22%, and its revenue guidance suggests growth between US$24 million and US$28 million for Q3 2024.

- Unlock comprehensive insights into our analysis of uCloudlink Group stock in this financial health report.

- Explore uCloudlink Group's analyst forecasts in our growth report.

Turning Ideas Into Actions

- Take a closer look at our US Penny Stocks list of 738 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:IRIX

IRIDEX

An ophthalmic medical technology company, provides therapeutic based laser systems, delivery devices, and consumable instrumentation to treat sight-threatening eye diseases in ophthalmology.

Flawless balance sheet slight.