- United States

- /

- Semiconductors

- /

- NasdaqCM:PRSO

Peraso Inc. (NASDAQ:PRSO) Stock Catapults 59% Though Its Price And Business Still Lag The Industry

Peraso Inc. (NASDAQ:PRSO) shareholders are no doubt pleased to see that the share price has bounced 59% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 79% share price drop in the last twelve months.

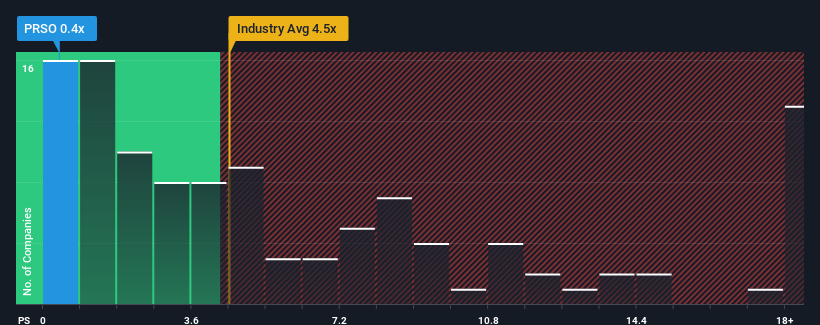

In spite of the firm bounce in price, Peraso may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 0.4x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios greater than 4.5x and even P/S higher than 10x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Peraso

What Does Peraso's Recent Performance Look Like?

Peraso hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It seems that many are expecting the poor revenue performance to persist, which has repressed the P/S ratio. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Peraso.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Peraso's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered a frustrating 19% decrease to the company's top line. Still, the latest three year period has seen an excellent 31% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 14% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 25% per annum, which is noticeably more attractive.

With this in consideration, its clear as to why Peraso's P/S is falling short industry peers. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

Shares in Peraso have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Peraso maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Plus, you should also learn about these 5 warning signs we've spotted with Peraso (including 4 which are significant).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:PRSO

Peraso

A fabless semiconductor company, develops, markets, and sells semiconductor devices and antenna modules in North America, Hong Kong, Taiwan, and internationally.

Undervalued with moderate risk.

Similar Companies

Market Insights

Community Narratives