- United States

- /

- Semiconductors

- /

- NasdaqGS:POWI

How Investors Are Reacting To Power Integrations (POWI) Buybacks, Dividend Hikes and Downbeat Revenue Guidance

Reviewed by Sasha Jovanovic

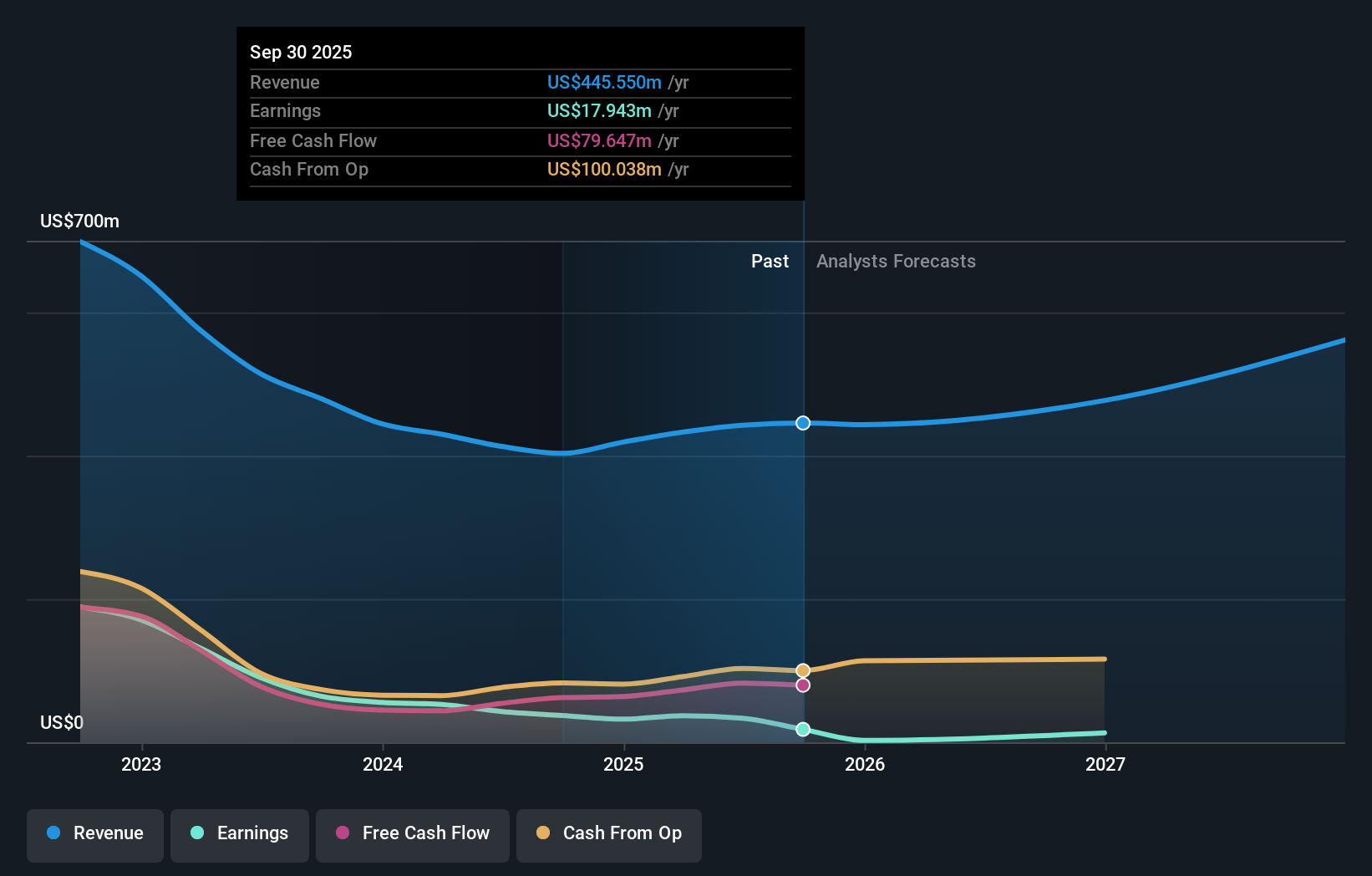

- Power Integrations announced past third-quarter earnings, issued revenue guidance of US$100 million to US$105 million for the fourth quarter of 2025, completed a US$50 million share buyback, and revealed increases to both its regular and future 2026 dividend payments.

- Notably, the company's combination of shareholder returns through buybacks and rising dividends comes alongside guidance suggesting a sequential sales decline and a recent quarterly net loss.

- We’ll now examine how the dividend increase and buyback completion influence the longer-term investment narrative for Power Integrations.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Power Integrations Investment Narrative Recap

To be a shareholder in Power Integrations right now, you need confidence in the company's ability to expand beyond its core appliances business and capitalize on emerging opportunities in automotive and AI data centers, despite near-term challenges. The latest earnings guidance for the fourth quarter implies weaker short-term sales and follows a net loss, signaling that the biggest catalyst, end-market recovery and design wins in new segments, remains intact, while trade and competitive pressures continue to weigh, though the announced news does not alter these core dynamics materially.

Among the recent announcements, the completed US$50 million share buyback stands out, as it underscores a commitment to shareholder returns during a period of cyclical headwinds and margin compression. While supportive, this action does not directly affect the key risk of ongoing exposure to tariffs or the need for significant new customer wins in fast-growing segments. In contrast, investors should be aware that ...

Read the full narrative on Power Integrations (it's free!)

Power Integrations' narrative projects $634.3 million revenue and $96.7 million earnings by 2028. This requires 12.8% yearly revenue growth and a $63.1 million earnings increase from $33.6 million currently.

Uncover how Power Integrations' forecasts yield a $53.20 fair value, a 54% upside to its current price.

Exploring Other Perspectives

Four distinct fair value estimates from the Simply Wall St Community range from US$27.96 to US$70 per share. These differing views land against analyst concerns about Power Integrations' reliance on trade-sensitive appliance sales, inviting you to explore what others are seeing in the company's future potential.

Explore 4 other fair value estimates on Power Integrations - why the stock might be worth 19% less than the current price!

Build Your Own Power Integrations Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Power Integrations research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Power Integrations research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Power Integrations' overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 16 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:POWI

Power Integrations

Designs, develops, manufactures, and markets analog and mixed-signal integrated circuits (ICs), and other electronic components and circuitry used in high-voltage power conversion.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives