- United States

- /

- Semiconductors

- /

- NasdaqGS:PI

Will Impinj's (PI) Office Expansion Reveal a New Chapter in Its Long-Term Growth Playbook?

Reviewed by Sasha Jovanovic

- In October 2025, Impinj extended its Seattle office lease to January 2038, adding 6,563 rentable square feet and securing rent abatements and a US$5 million tenant improvement allowance for expansion. This move supports the company's operational footprint as it pursues broader market opportunities in IoT and RFID solutions.

- An interesting aspect of this lease amendment is its focus on future scalability, reflecting Impinj's ongoing need for space to accommodate business growth and innovation initiatives.

- We’ll now explore how the lease expansion, signaling investment in long-term capacity, may alter Impinj’s investment narrative going forward.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Impinj Investment Narrative Recap

To be an Impinj shareholder, you have to believe in the long-term adoption of item-level RFID and IoT solutions across industries such as retail, logistics, and food, and in Impinj’s ability to translate these secular trends into sustained revenue growth and margin improvement. The recent Seattle lease expansion underlines management’s confidence in long-term opportunity, but is not material to the near-term catalyst, which remains the successful scale-up of new market pilots and continued endpoint IC adoption. The biggest risk continues to be customer concentration and the pace of new deployments.

Among recent updates, the third quarter 2025 earnings announcement stands out. Despite delivering better-than-expected results on both revenue and earnings, Impinj guided to lower sales in the upcoming quarter, reflecting softer demand visibility and maintaining the importance of new vertical and customer ramp-up as the major near-term performance catalyst.

By contrast, investors should be aware that revenue volatility could quickly resurface if pilots in new markets like food do not convert to broader rollouts...

Read the full narrative on Impinj (it's free!)

Impinj's narrative projects $630.4 million revenue and $91.2 million earnings by 2028. This requires 20.6% yearly revenue growth and a $90.6 million earnings increase from the current $633.0 thousand.

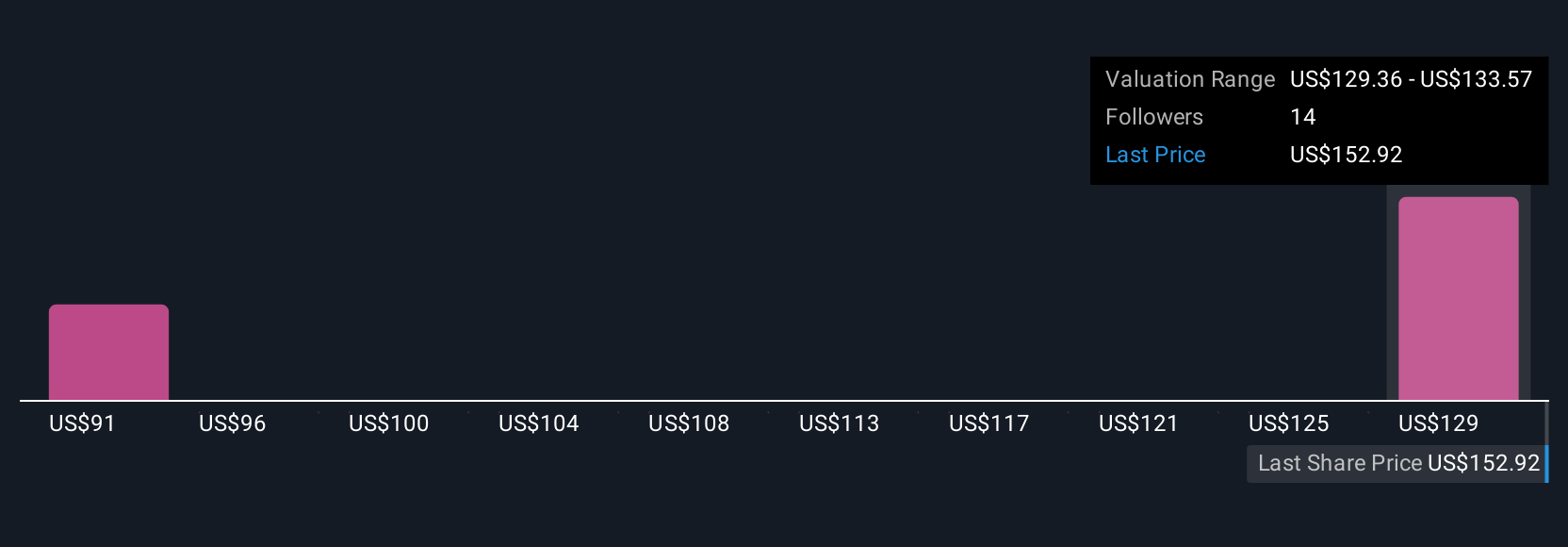

Uncover how Impinj's forecasts yield a $186.00 fair value, a 8% downside to its current price.

Exploring Other Perspectives

Simply Wall St Community members estimate Impinj’s fair value between US$181,435 and US$186 across 2 analyses. With customer concentration risk front of mind, see how peers see the company's path ahead.

Explore 2 other fair value estimates on Impinj - why the stock might be worth as much as $186.00!

Build Your Own Impinj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Impinj research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Impinj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Impinj's overall financial health at a glance.

Searching For A Fresh Perspective?

Our top stock finds are flying under the radar-for now. Get in early:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PI

Impinj

Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives