- United States

- /

- Semiconductors

- /

- NasdaqGS:PI

Revenues Not Telling The Story For Impinj, Inc. (NASDAQ:PI) After Shares Rise 27%

Impinj, Inc. (NASDAQ:PI) shares have continued their recent momentum with a 27% gain in the last month alone. Longer-term shareholders would be thankful for the recovery in the share price since it's now virtually flat for the year after the recent bounce.

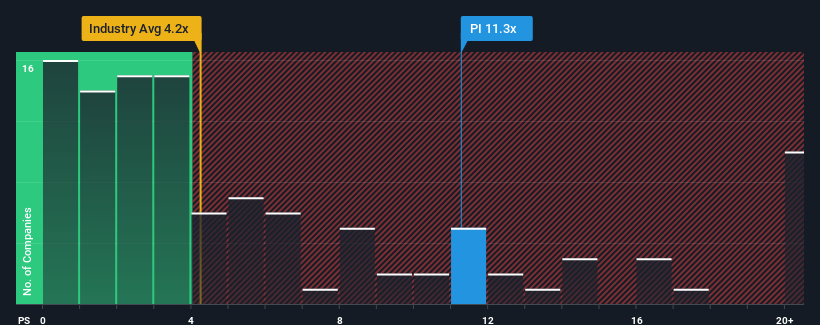

Following the firm bounce in price, Impinj may be sending very bearish signals at the moment with a price-to-sales (or "P/S") ratio of 11.3x, since almost half of all companies in the Semiconductor industry in the United States have P/S ratios under 4.2x and even P/S lower than 1.8x are not unusual. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Impinj

What Does Impinj's Recent Performance Look Like?

Recent times haven't been great for Impinj as its revenue has been rising slower than most other companies. One possibility is that the P/S ratio is high because investors think this lacklustre revenue performance will improve markedly. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Impinj's future stacks up against the industry? In that case, our free report is a great place to start.How Is Impinj's Revenue Growth Trending?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Impinj's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 19% last year. The latest three year period has also seen an excellent 121% overall rise in revenue, aided by its short-term performance. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 18% each year during the coming three years according to the eight analysts following the company. That's shaping up to be materially lower than the 27% each year growth forecast for the broader industry.

With this in consideration, we believe it doesn't make sense that Impinj's P/S is outpacing its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Key Takeaway

The strong share price surge has lead to Impinj's P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've concluded that Impinj currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

It is also worth noting that we have found 3 warning signs for Impinj (1 is a bit unpleasant!) that you need to take into consideration.

If you're unsure about the strength of Impinj's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PI

Impinj

Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives