- United States

- /

- Semiconductors

- /

- NasdaqGS:PI

A Look at Impinj’s (PI) Valuation Following Major Gen2X Technology Enhancements

Reviewed by Simply Wall St

Impinj (PI) revealed major upgrades to its Gen2X platform during the 2025 Gen2X Solutions Developers Conference. The latest enhancements aim to improve fraud prevention in tagging, enable faster inventory tracking, and promote stronger industry-wide adoption.

See our latest analysis for Impinj.

Impinj’s recent Gen2X rollout looks to be reigniting investor excitement, with the stock bouncing 3.81% higher in a day and gaining over 6% in the past week as the news broke. Still, the momentum has been volatile, highlighted by a sharp 1-month share price return of -34.88% and a year-to-date share price return of 4.65%. The latest developments come after a tough 12 months which saw a 1-year total shareholder return of -20.69%. Over the longer term, though, total shareholder returns remain impressive, up 25% over three years and a remarkable 267% across five years. This shows both the opportunities and risks that come with innovation leaders like Impinj.

If smart technology upgrades are on your radar, you might want to check out the promising companies in our See the full list for free..

But with shares still nearly 43% below average analyst price targets, and momentum swinging between sharp losses and solid gains, is Impinj a classic undervalued growth story, or are investors already pricing in its future potential?

Most Popular Narrative: 37.6% Undervalued

Impinj’s most popular narrative prices the company’s fair value at $246.25 per share, sharply above its last close of $153.57. This sizable gap hints at big expectations and an intriguing growth story that underpins the bulls’ case.

Expanding deployment of RFID solutions for food traceability and freshness, especially at the item level driven by pilots with major retailers, presents a multi-year growth opportunity. This trend is underpinned by regulatory and consumer demand for improved traceability and waste reduction, which is already leading to additional pilot programs and is expected to ramp into meaningful unit volumes in 2026 and beyond, supporting outsized future revenue growth.

Want to know what projections make this price target possible? This narrative hides ambitious revenue goals and a future margin leap, benchmarked against the world’s top chipmakers. Find out what makes this outlook so daring and whether the long-term math really adds up.

Result: Fair Value of $246.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing supply chain disruptions and heavy reliance on just a few key customers could easily challenge the company’s ambitious growth narrative.

Find out about the key risks to this Impinj narrative.

Another View: What About Market Multiples?

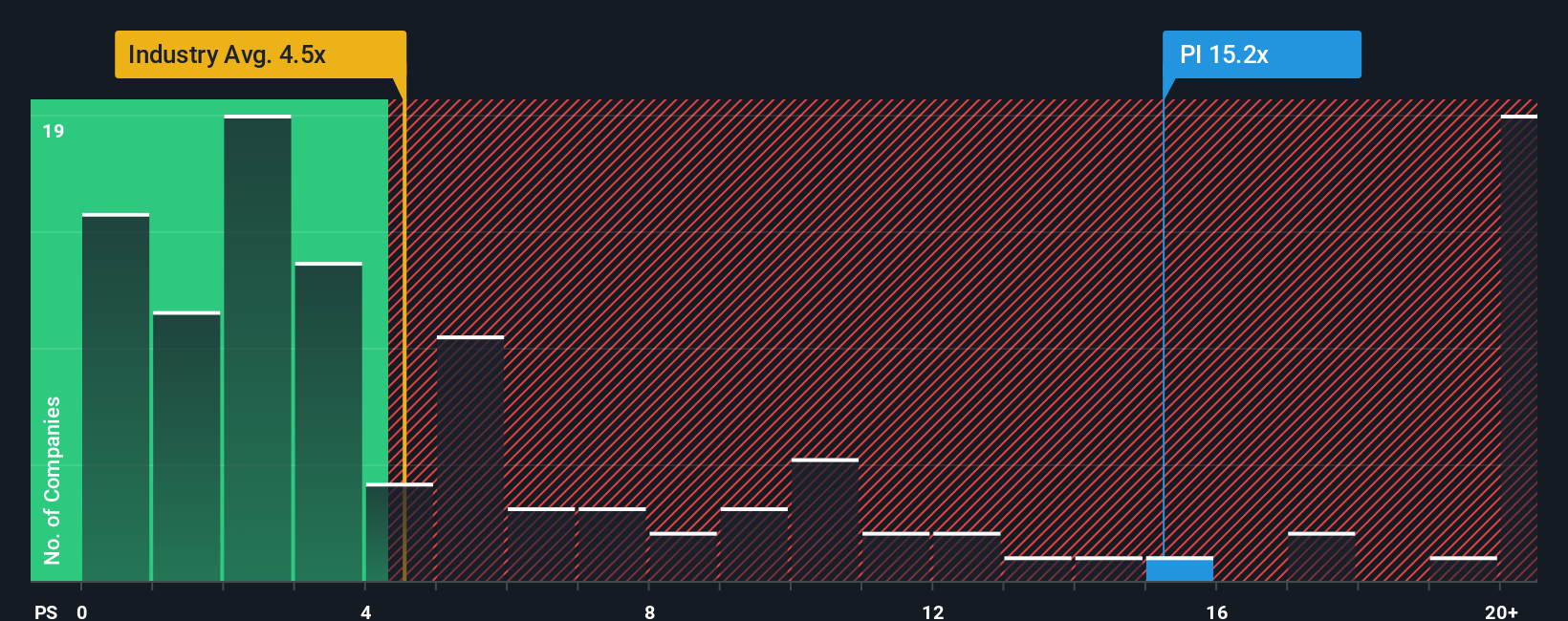

Looking through the lens of price-to-sales, Impinj trades at 12.9x, well above both the US Semiconductor industry average of 4.2x and its peer average of 5.7x. Even compared to the fair ratio of 7.6x, the premium is clear. Does this rich relative pricing signal hidden risk, or do the company’s prospects justify it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Impinj Narrative

If these perspectives do not quite match your own, why not dig into the data and build your own view in just a few minutes? Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Impinj.

Looking for More Compelling Investment Ideas?

Step up your investing game and don’t let standout opportunities pass you by. Simply Wall Street’s powerful Screeners unlock fresh ideas you might wish you saw sooner.

- Tap into exciting returns from companies with 3%+ yields and steady income streams through these 15 dividend stocks with yields > 3%.

- Get ahead in tomorrow’s tech landscape by targeting the innovators using artificial intelligence. Your next breakthrough pick could be among these 26 AI penny stocks.

- Secure your edge by spotting undervalued gems before the crowd with these 923 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PI

Impinj

Operates a cloud connectivity platform in the Americas, the Asia Pacific, Europe, the Middle East, and Africa.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives